Required Minimum Distribution Calculator

Instructions

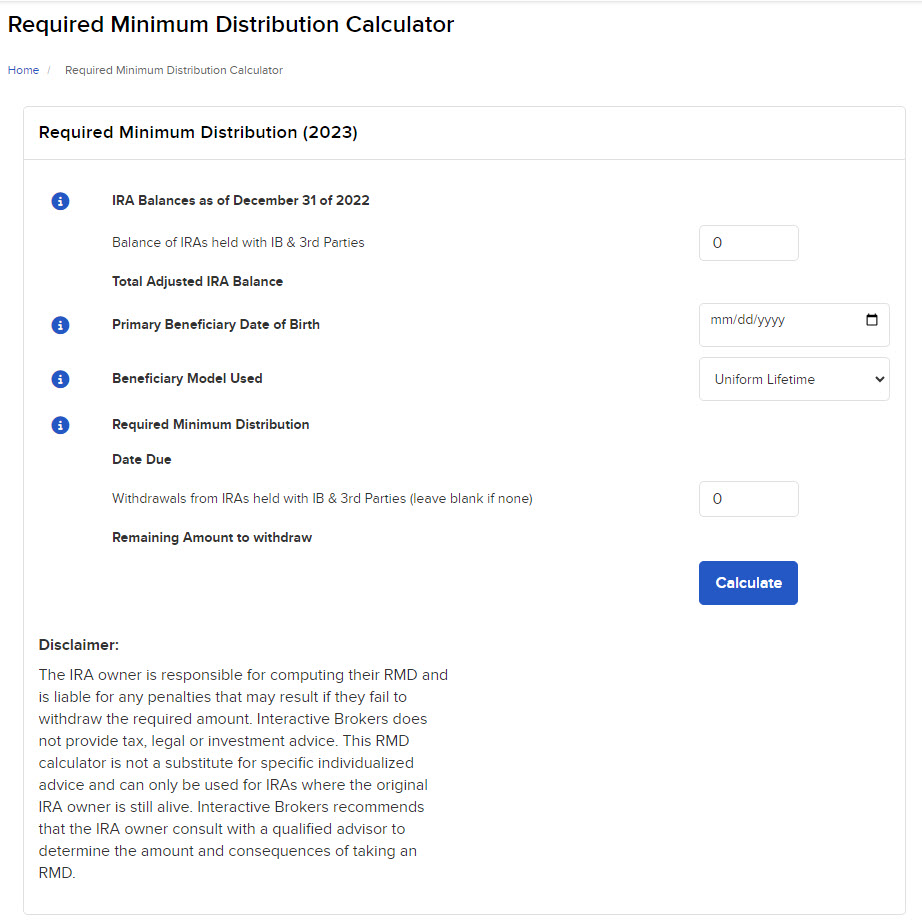

Clients now have the ability to calculate the Required Minimum Distribution (RMD) for all RMD-applicable Individual Retirement Accounts (IRA). The calculator will show the total amount withdrawn to date and the amount awaiting withdrawal.

Note: The RMD calculator is only available for Traditional IRA, Rollover IRA, SEP IRA, advisor master accounts, and broker master accounts.

-

Click Menu in the top left corner > Administration & Tools > Required Minimum Distribution Calculator.

IRA Balance

The RMD is based on your IRA balances from the immediately preceding calendar year, including rollover deposits. You can aggregate the RMDs of all your IRAs and either withdraw the full amount from one or divide it among several (note, however, that certain types of retirement accounts do not allow aggregation).

Date Of Birth

You are due for an RMD on or before December 31st of the current year if you turned 70 and a half in 2019 or before, or turned 72 in 2019 or before.

Note: The RMD age changed from 70½ to 72 in 2019, when the Secure Act passed. If you turned 70½ before 2020, you may be subject to RMDs. For 2020 and after, you may be subject to RMDs beginning at age 72.

Beneficiary Model

One of three tables is used to calculate your RMD as required by the Internal Revenue Service. The Uniform Lifetime Model is used for all unmarried IRA owners, married owners whose spouses are not more than 10 years younger, and married owners whose spouses are not the sole beneficiaries of the IRA owner.

Required Minimum Distribution (RMD)

The RMD is determined by dividing the fair market value of the IRA by a factor derived from the Uniform Lifetime beneficiary model. You may withdraw more than your RMD.