Internalization

Instructions

IBKR may now internalize certain customer stock orders (or portions of those orders). “Internalization” is when a broker or its affiliate acts as the counter-party to a customer’s order. IBKR is making this change to improve execution quality (i.e., increase price improvement) and/or reduce customer execution costs without reducing execution quality.

In addition, please note that IBKR must provide “best execution” for every customer order regardless of whether it internalizes the order or executes it as the customer’s agent. IBKR therefore will only internalize an order if it determines that internalization offers the best available execution. If it does not, IBKR will execute the order with a third-party on an agency basis, as it has done so in the past.

If you do not want your orders to be eligible for execution via IBKR’s internalization process, you may opt out by taking the steps outlined below.

-

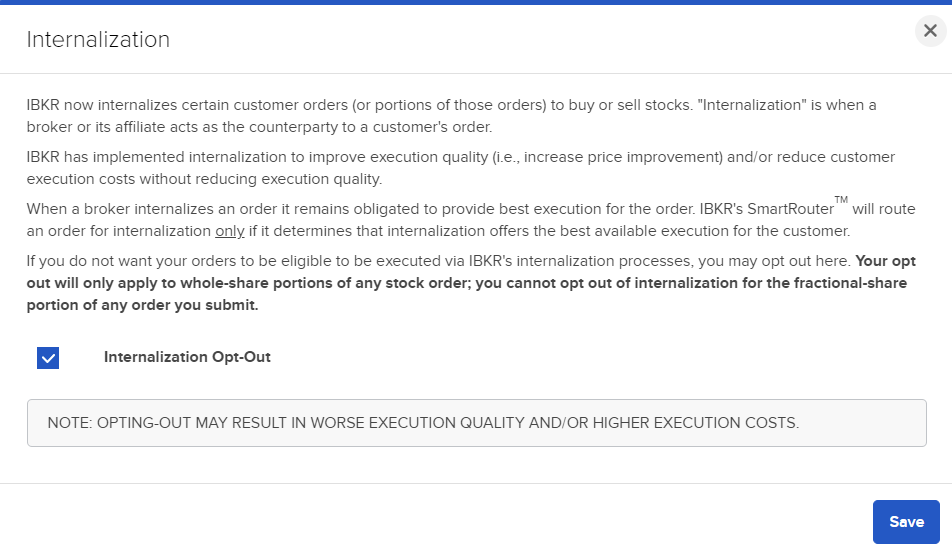

Click the User menu (head and shoulders icon in the top right corner) > Settings > Trading > Internalization

-

Select the Internalization Opt-Out check box

-

Select Save

Your opt out will only apply to whole-share portions of any stock order; you cannot opt out of internalization for the fractional-share portion of any order you submit. Please be aware that opting out may result in worse execution quality and/or higher execution costs.