Tax Optimizer

Instructions

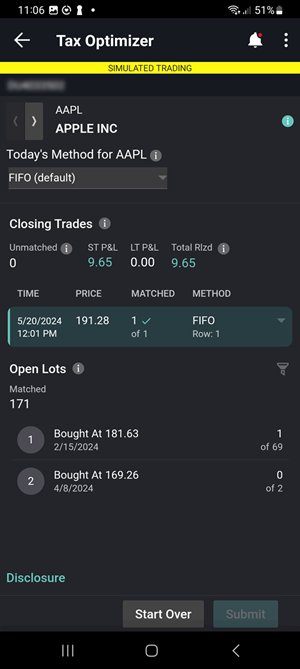

Change your trades' cost basis directly in IBKR Mobile using the built-in Tax Optimizer tool. You can try up to seven different automated matching methods and see potential profit and loss using your selected method(s), broken out by long-term and short-term gain or loss.

To open Tax Optimizer

-

Tap the Account menu icon (three lines) on the top left corner of the app and select Transactions

-

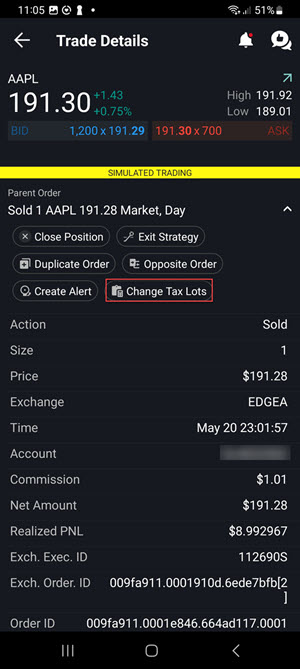

Tap a closing trade to view Trade Details.

-

Tap Change Tax Lots.

Apply matching methods to all closing trades or just a single closing trade:

- Choose to apply a matching method across all Closing Trades using the Method for All drop-down at the top of the tool.

- You can apply a method to a single closing trade using the Method drop-down from the selected trade line.

- Manually match a specific open lot to the selected closing trade by selecting Spec. Lot (Specific Lot) from the trade's Method drop down and then matching it to the selected open lot .

You can apply a new Method for All but this value reverts to the default when you log out. To change the default Method for All, log into Client Portal and from the menu select Reporting. From the Reports menu select Tax Documents. On the right hand side under Tax Optimizer, select your Account Match Method from the drop-down and press Save Changes.

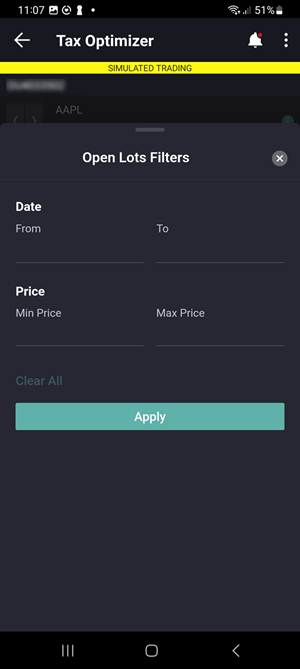

Filter Open Lots by date or price by tapping the funnel icon in the Open Lots section.

Available Tax Lot Matching Methods:

- Specific Lot: Manually match closing trades to open lots.

- FIFO (First In, First Out): Sales are paired with the earliest purchases sequentially. This method is always used for futures and options on futures.

- LIFO (Last In, First Out): Each sale is paired with the most recent possible purchase.

- Max LT Gain (Maximize Long-Term Gain)

- Max LT Loss (Maximize Long-Term Loss)

- Max ST Gain (Maximize Short-Term Gain)

- Max ST Loss (Maximize Short-Term Loss)

- High Price (Highest Price): Seeks to maximize losses while minimizing gains.

For more information about Tax Lot Matching Methods, visit the User Guide or FAQs.

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.