Client Service Programs

Instructions

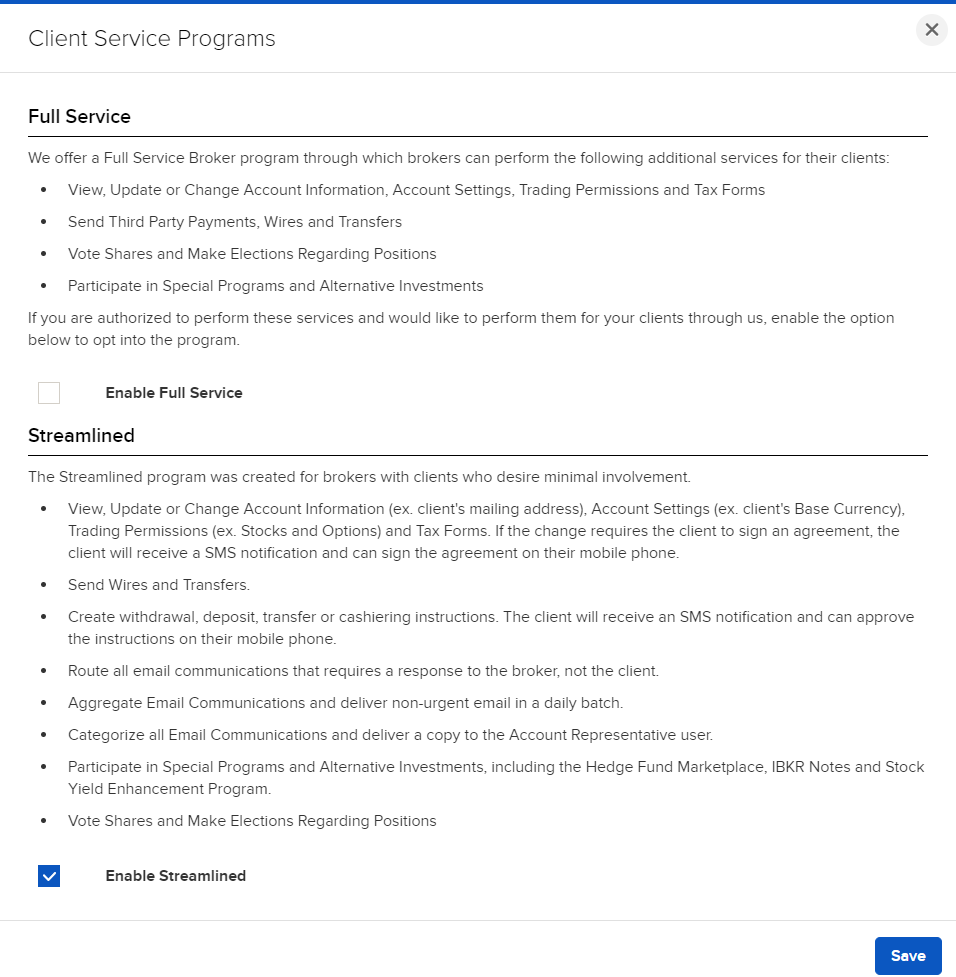

Brokers can opt into these programs to modify additional settings in the client account.

Brokers who are eligible for this feature are IBLLC-US from risk ranking countries having a value of 3 or 4.

Here is a list of all of the tasks that a broker can be authorized to perform in a client's account. The list is organized by category just as on the actual authorization form.

Authorization to Update or Change Account Information, Account Settings, Trading Permissions and Tax Forms:

- Change Account Info (Name & Address, Email, Phone Number, Legal Residence, Mailing address, Personal Info, Employment Info, Financial Information, Regulatory Information, Trading objectives,

- Change trading permissions and products

- Change account settings (Base Currency, Account Type)

- View and change account forms and tax forms.

- W8/W9 functions

- Change Investor Category (QIB, Accredited Investor, etc)

- Statement/Confirm Delivery Settings

- Trading Configuration

- Market Data

- Market Data Subscriber Status

- Alert Notification

- Paper Trading Account

Authorization to Provide Banking and Transfer Instructions:

- Create Deposit Notification

- Submit Position Transfers

- Make Internal Transfers

- Provide Settlement Instructions

Authorization to Send Third Party Payments and Wires:

- Transmit payments or assets from the client account to third parties including wire transfers, ACH transfers and other transfers of funds or assets.

- Place limits on this authority by specifying a maximum amount and time period in months. For example, no more than $5,000 per 3 month period.

Authorization to Vote Shares and Make Elections Regarding Positions (does not affect Account Management):

- Corporate Actions should be sent to the broker not the client.

- Proxy delivery and voting will be done by the broker not the client.

Authorization for Special Programs and Alternative Investments:

- Hedge Fund Capital Introduction Program Agreement.

- Enroll or un-enroll in the Stock Yield Enhancement Program.

The Streamlined Client service program was created for Brokers with clients who desire minimal involvement. Upon joining, you will have the capability to perform additional tasks on your client's behalf and the client can confirm your actions. When a Broker enrolls in the Streamlined program all of the Broker’s clients will receive an email notification outlining the clearing agreement with IBKR.

Funding Instructions:

-

Create funding institutions (Wire, Check, SEPA) for a client in Portal.

-

From the Home page, click the Menu button in the top left corner and select Contacts.

-

Click the i Info icon next to a contact. The Contact Information page opens.

-

Click the Transfer & Pay tab> Transfer Funds > Make a Withdrawal > Eligible Method.

-

Enter the required information and select Save Bank Information.

-

-

Upon submitting this information, the client will receive an SMS containing a link and informing them that changes have been submitted. The link will launch Client Portal.

-

The client logs into Client Portal and the funding instructions are displayed and they will be asked to either approve or decline.

-

Once the client approves or declines the broker receives an SMS informing of the client's decision.

Trading Permissions:

-

Submit Trading Permission changes for your clients.

-

From the Home page, click the Menu button in the top left corner and select Contacts.

-

Click the i Info icon next to a contact. The Contact Information page opens.

-

Under Configuration select Trading Experience & Permissions and select the asset row you want to add and complete the sequence that follows.

-

Change Account Type:

-

Modify MIFID: only applicable to IB-UK & IB-IE clients

-

Enroll Client in Non-US Dividend Tax Relief

-

Change a client's account type (Cash, Margin, Portfolio Margin).

-

From the Home page, click the Menu button in the top left corner and select Contacts.

-

Click the i Info icon next to a contact. The Contact Information page opens.

-

Under Configuration select Account Type.

-

-

Upon submitting this information, the client will receive an SMS containing a link and informing them that changes have been submitted. The link will launch Client Portal.

-

The client logs into Client Portal and the funding instructions are displayed and they will be asked to either approve or decline.

-

Once the client approves or declines the broker receives an SMS informing of the client's decision.

Send messages to your Client Accounts:

- View messages by Category: Action Needed, To Advisor, or To Client.

- Filter messages by: Representative, Category, Account, or Date

Click here for more information on Sub Account Messages

There are no third party payment authorizations in the Streamlined process.

To grant and view additional broker authorizations

-

The broker will Click the User menu (head and shoulders icon in the top right corner) > Settings > Account Configuration > Client Service Programs.

-

In the Full Service dialog box, check Enable Full Service or Enable Streamlined and then click Save.

- Read through the Service Broker Agreement. Sign your name and then click Save.

To make changes for a client, you may take the steps outlined below.

-

Click Menu in the top left corner > Contacts

-

Select the Client Account

-

Click the gear or pencil icon on the section where you need to make changes.

In order for a Broker to make changes for a client, they must have the Account Information User Access Right selected. More information on UAR can be found here.