Interest Markups and Markdowns

Instructions

You can mark down credit and short proceeds credit interest, and mark up debit interest. Markups and markdowns are entered as %. To specify the interest markups and markdowns, follow the steps below.

- Click Menu in the top left corner > Administration & Tools > Fees & Invoicing > Fees

- The display selector will open on the right side.

- To sort the list by any column heading, click the arrow next to that heading.

- Select an account you'd like to charge a markup to.

- Select a Client Fee Template if you wish to use one.

-

Select the Fee Strategy from the drop-down menu

-

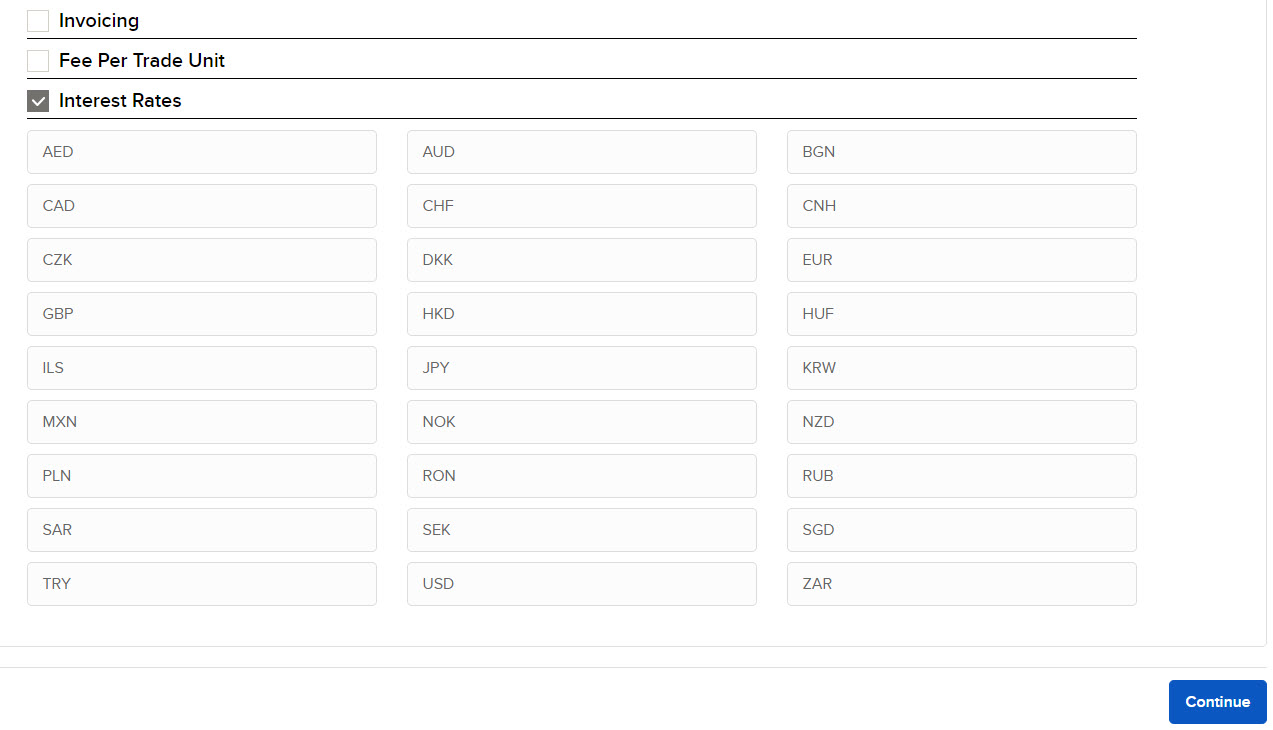

Select the Interest Rates check box and the currency on which you are looking to charge an interest markup / markdown.

-

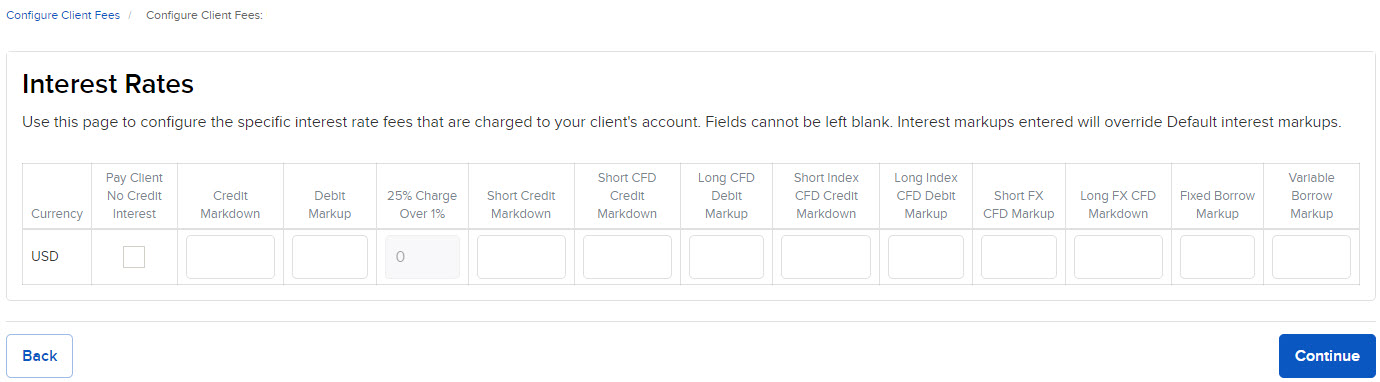

Specify the interest rate fees you are looking to charge. For more information on this, click here.

-

Press Continue to review, then Save.

You can charge markups as a variable or fixed percentage of the IBKR borrow rate, and the system will apply the rate that results in the larger total amount.

-

Variable borrow fee markup -is a variable percentage of IBKR's borrow rate. The total cost to your client is calculated as follows:

-

Borrow Rate (1 + Variable Markup Percentage)

-

The range of acceptable values that you can enter is 0 - 25%.

-

-

Fixed borrow fee markup is a fixed percentage of IBKR's borrow rate. The total cost to your client is calculated as follows:

-

Borrow Rate + Fixed Markup Percentage

-

The range of acceptable values that you can enter is 0 - 1%.

-

Example

Symbol ABC Borrow Rate = 35%

Variable Borrow Markup = 20%

Fixed Borrow Markup = 1%

Calculating the total cost to your client, we have:

-

Variable Markup:

-

35% (1+20%) = 42% total cost to your client

or

-

0.35 (1.2) = 0.42

-

-

Fixed Markup:

-

35% + 1% = 36%

or

-

0.35 + 0.01 = 0.36

-

Our system applies the larger total amount which, in this example, would be the 42% Variable Borrow Markup including both our borrow rate and your borrow markup.

Note: Interest markups and markdowns are rounded to two decimals.

Learn more about Interest Markups and Markdowns at IBKR Campus.