Retirement Planner - Institutions

Instructions

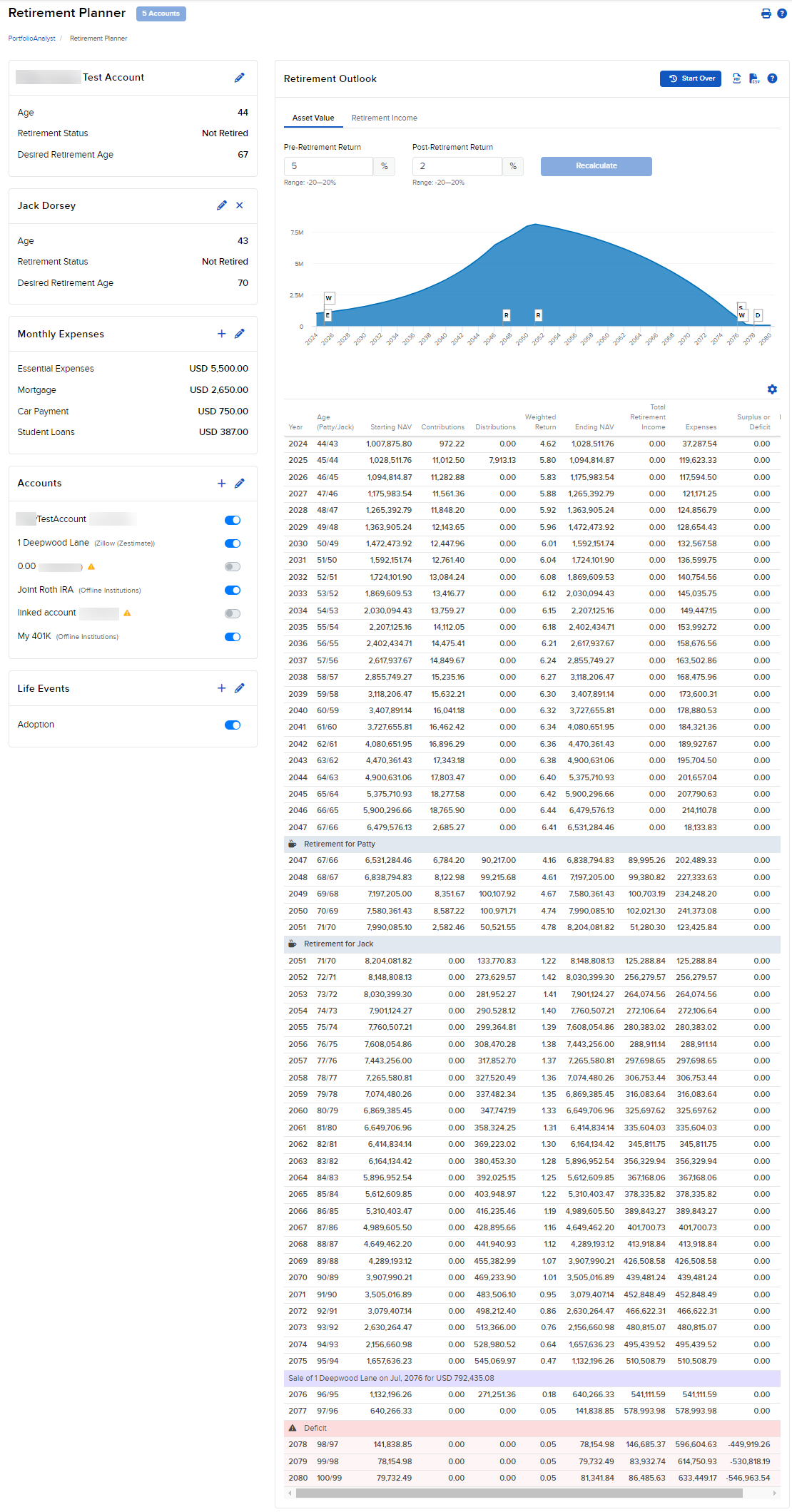

The Retirement Planner is a tool that may be used to get a better understanding of your client's Retirement Outlook. The tool takes into consideration your client's personal retirement preferences, current and future employment expectations, any potential additional monthly retirement income sources, your client's current monthly expenses, and general market performance assumptions. Based on this information and the accounts you have chosen to include, the Retirement Planner will generate your Retirement Outlook to help you plan for your client's future.

This tool utilizes user data when generating a Retirement Outlook. User data may be prefilled from existing user/account information or manually entered by you within the various sections throughout the page. Some prefilled user data may be changed and in doing so may impact the Retirement Outlook.

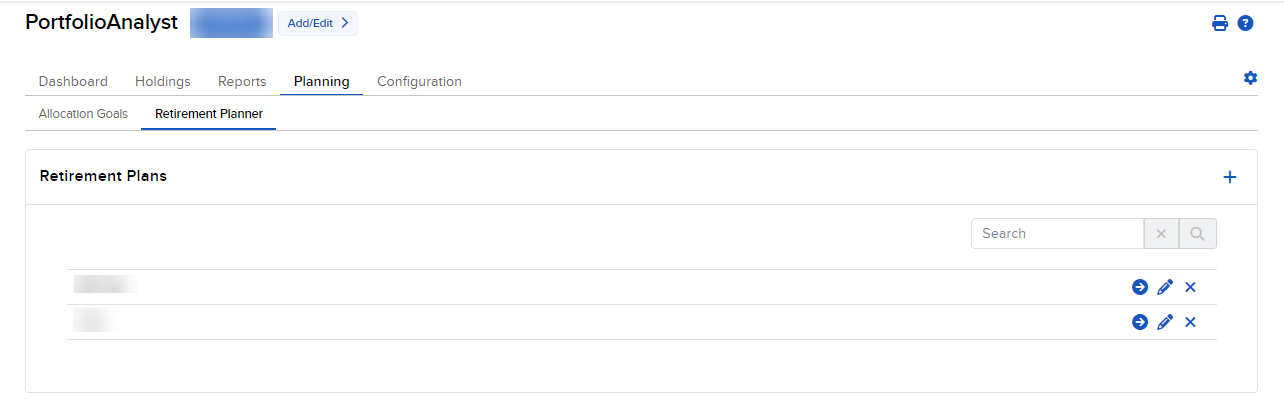

Note: Master users may create multiple retirement plans for their clients. Use the search bar in the top right corner of the page to search for a client's retirement plan.

To navigate to this tool, please take the steps outlined below.

-

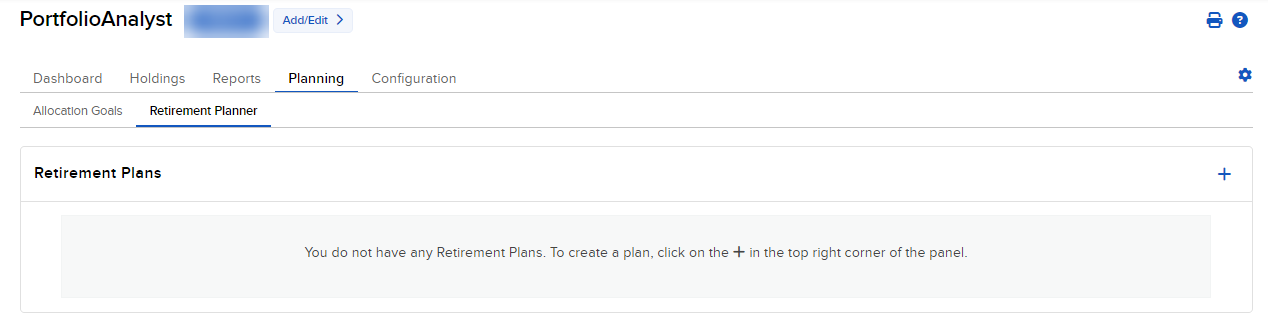

Select the Planning tab at the top of the PortfolioAnalyst page.

-

Select Retirement Planner.

-

Select the + icon in the top right corner.

-

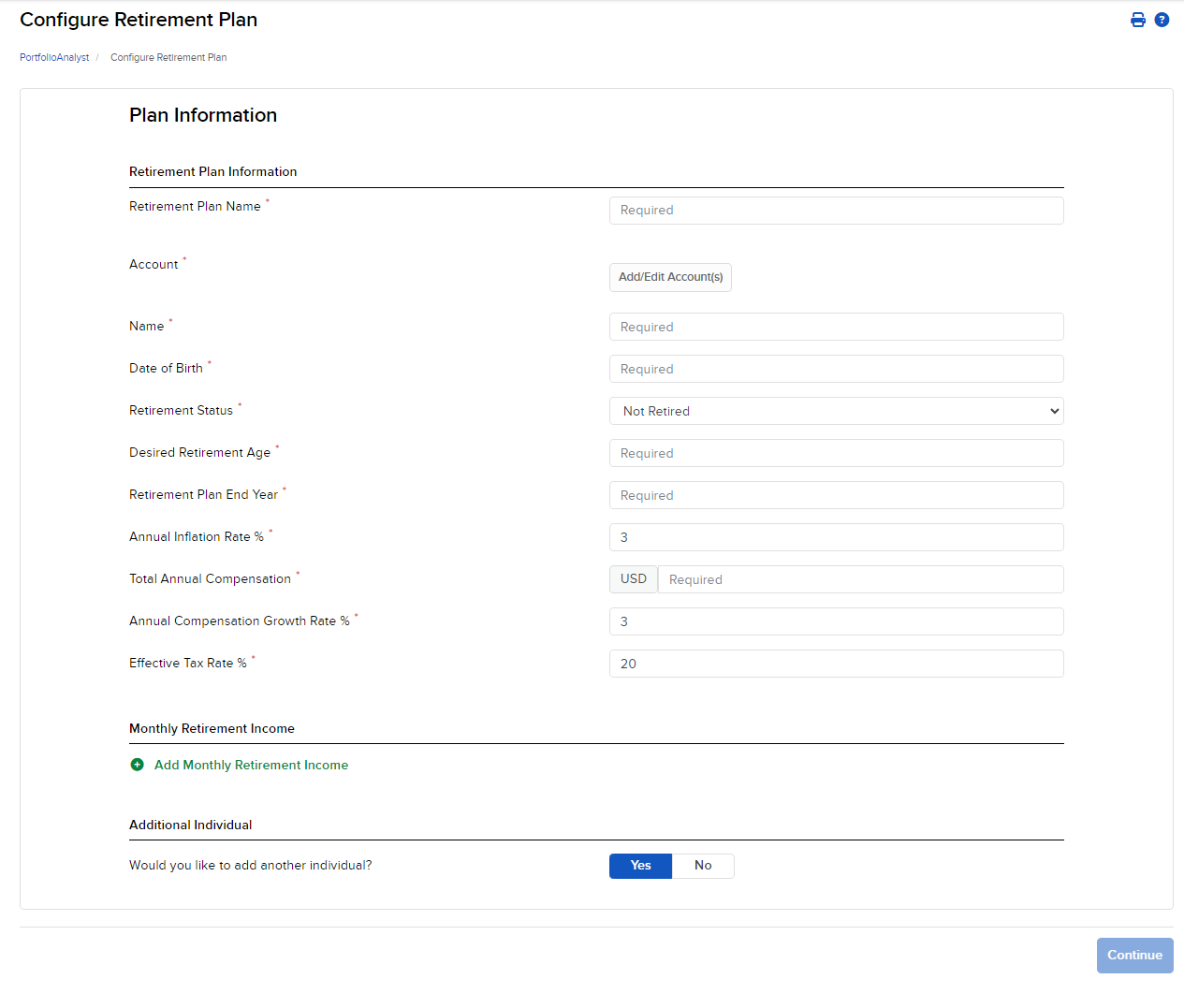

Enter the Retirement Plan Information. Select the client account by clicking the Add/Edit Account(s) button.

-

Add the Monthly Retirement Income that your client may receive by selecting the + Add Monthly Retirement Income button.

-

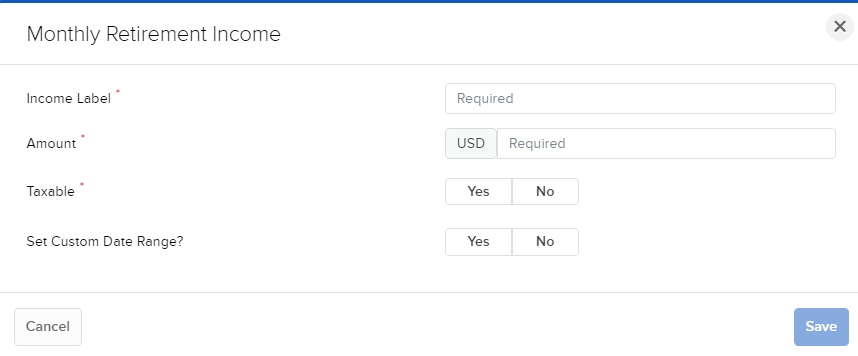

Enter the required Monthly Retirement Income information and press Save.

-

If you would like to add an another individual in this retirement plan, please select Yes to the right of "Would you like to add another individual?"

-

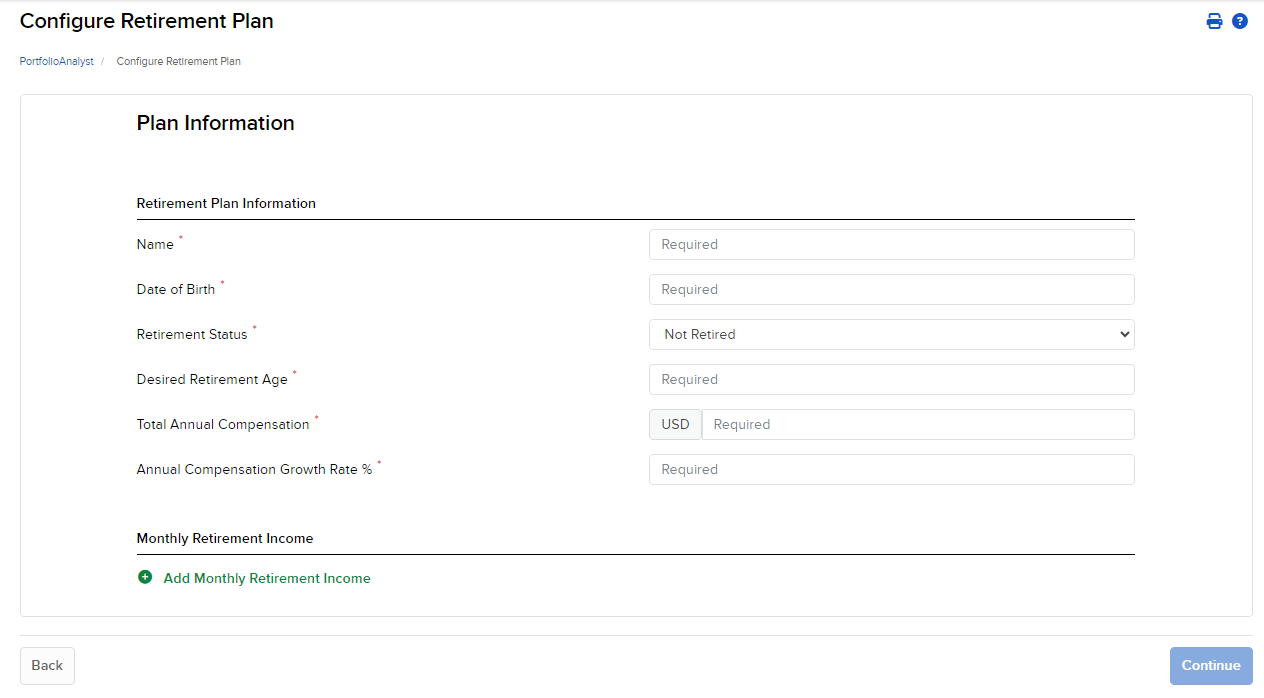

Enter the additional individuals information and press Continue.

-

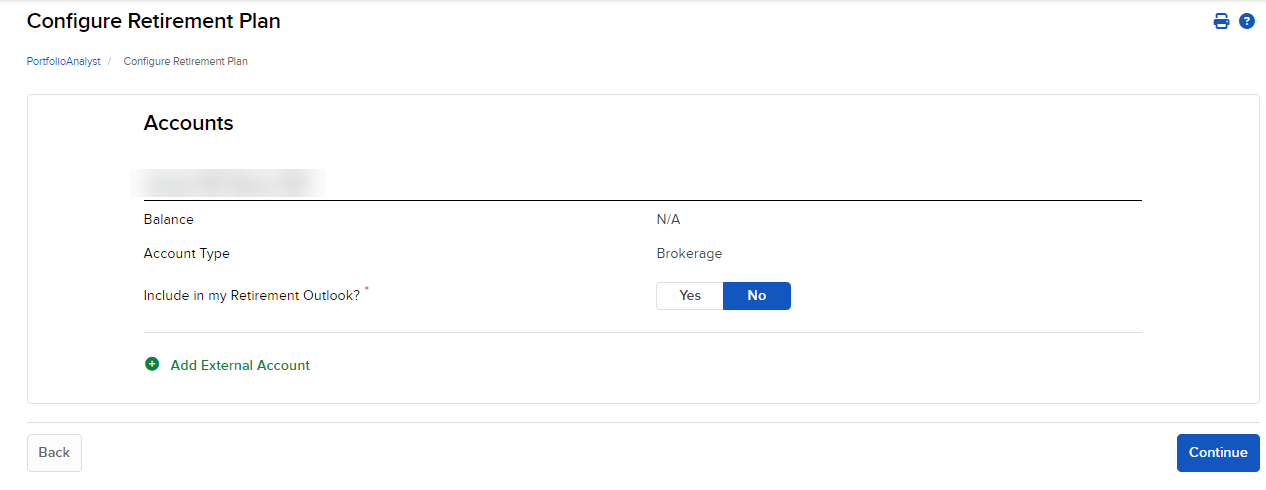

The Accounts page will populate. Select Yes or No to include the client's brokerage account in their Retirement Outlook. If you would like to add an external account, select Add External Account.

-

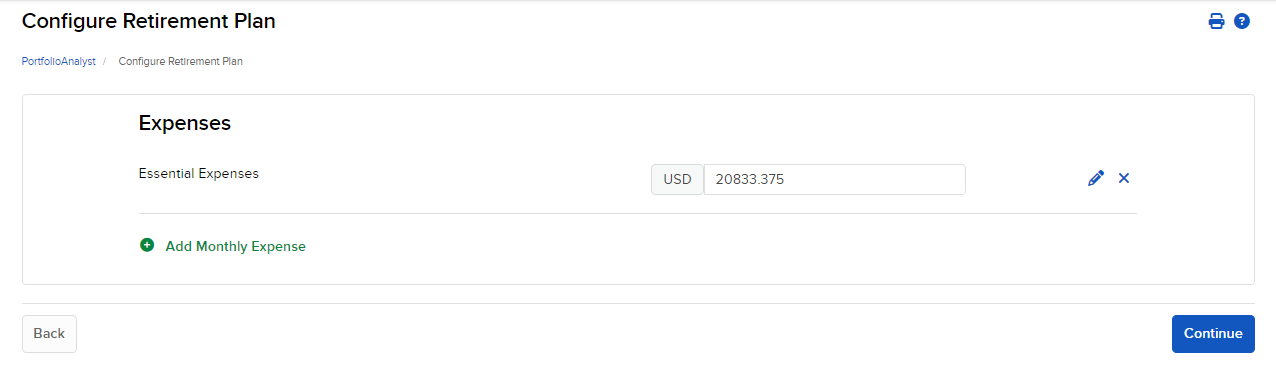

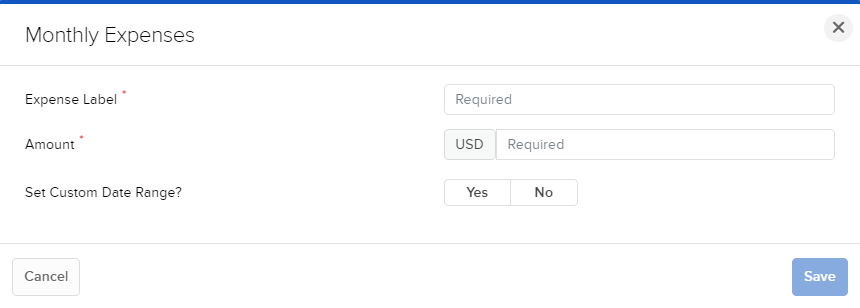

The Expenses screen will populate. Click Add Monthly Expense to add any additional monthly expenses you may have.

-

Enter the required information and press Save.

-

Press Continue.

-

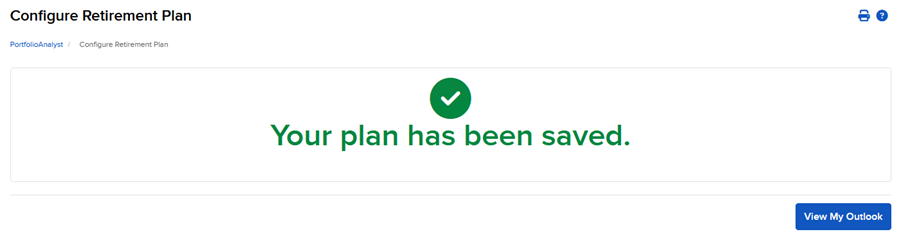

You will receive a confirmation page advising that the client's plan has been saved.

-

Select View My Outlook to view this client's retirement planner.

-

Select the Pencil icon to the right of the fields you would like to edit.

-

To navigate back to the list of client retirement plans, select the PortfolioAnalyst breadcrumb in the top left corner.

-

The list of client retirement plans will populate. Select the search bar in the top right corner to search for a client retirement plan.

-

The Retirement Plan icons are listed below

-

Click the arrow run icon to view a retirement plan

-

Click the pencil icon to edit a retirement plan

-

Click the x icon to delete a retirement plan.

-

Within the Retirement Planner tool, we make various assumptions to assist with projecting the users Retirement Outlook.

General

-

Inflation - The inflation rate will remain constant throughout the retirement plan.

-

Monthly Expenses - To estimate the users expenses during retirement, we use the current monthly expenses providing and adjust them for inflation accordingly until the end of the retirement plan.

-

Compounding - Although we display a yearly frequency, we use monthly compounding throughout the length of the retirement plan.

-

Interest Rate - The interest rate provided when including a Bank type account will remain constant throughout the retirement plan.

-

Weighted Return - The weighted return takes into consideration each accounts individual expected return along with the account size. This figure will show the combined assumed return for all accounts which are included in the retirement plan.

-

Annual Appreciation - The appreciation rate provided when including a Other Asset type account will remain constant throughout the retirement plan.

-

Starting Value - The total value of all Brokerage, Bank, and Other Asset Accounts plus any Other Asset sales or loan proceeds.

-

Ending Value - The ending value is the total ending value of all Brokerage, Bank, and Other Asset Accounts plus any Other Asset sales or loan proceeds.

Not Retired

-

Total Compensation - The compensation provided by the user will grow annually in January at the provided annual compensation growth rate. Compensation will go to zero once retired.

-

Compensation Growth Rate - This rate determine how the users total compensation will grow each year before retirement.

-

Contributions - Contributions stop once retirement starts

-

Percent Contribution - Percent contributions are added monthly to the respective account as a percentage of total monthly compensation (total compensation / 12).

-

Amount Contribution - Amount contributions are made once annually in January

-

Retired

-

Additional Monthly Retirement Income - Additional monthly retirement income grows annual by the expected inflation rate.

-

Taxable - The net income to be used to cover expenses is calculated by taxable income amount - (taxable income amount * effective tax rate).

-

Non-Taxable - No taxes are withdrawal from non taxable income.

-

Non distribution income will be applied first to cover expenses before any distribution income or sale/loan proceeds.

-

-

Market Return - Market return for Brokerage accounts in retirement is equal to inflation.

-

Distributions - Distributions occur only during retirement and only up to the amount needed to cover expenses.

-

Account Priority - Withdrawals are taken first from taxable accounts, then tax differed accounts, then non-taxable accounts, then Other Asset Accounts, then Other asset Last Resort.

-

Taxes - If an account has configured such that distributions are taxable, the total net distribution is calculated by distribution amount - (distribution amount * effective tax rate).

-

-

Other Asset Sale - If selected, an other asset will be sold to cover expenses when all other higher priority accounts have been withdrawn to zero and additional income is needed to cover the total expenses. The sale proceeds will then be used to cover expenses when available. NOTE - Taxes are not deducted from the sale proceeds when selling a Real Estate or Other Asset account type.

-

Other Asset Loan - If selected, a loan against an other asset will take place to cover expenses when all other higher priority accounts have been withdrawn to zero and additional income is needed to cover the total expenses. The loan proceeds will then be used to cover expenses when available.