Account Inheritance

Instructions

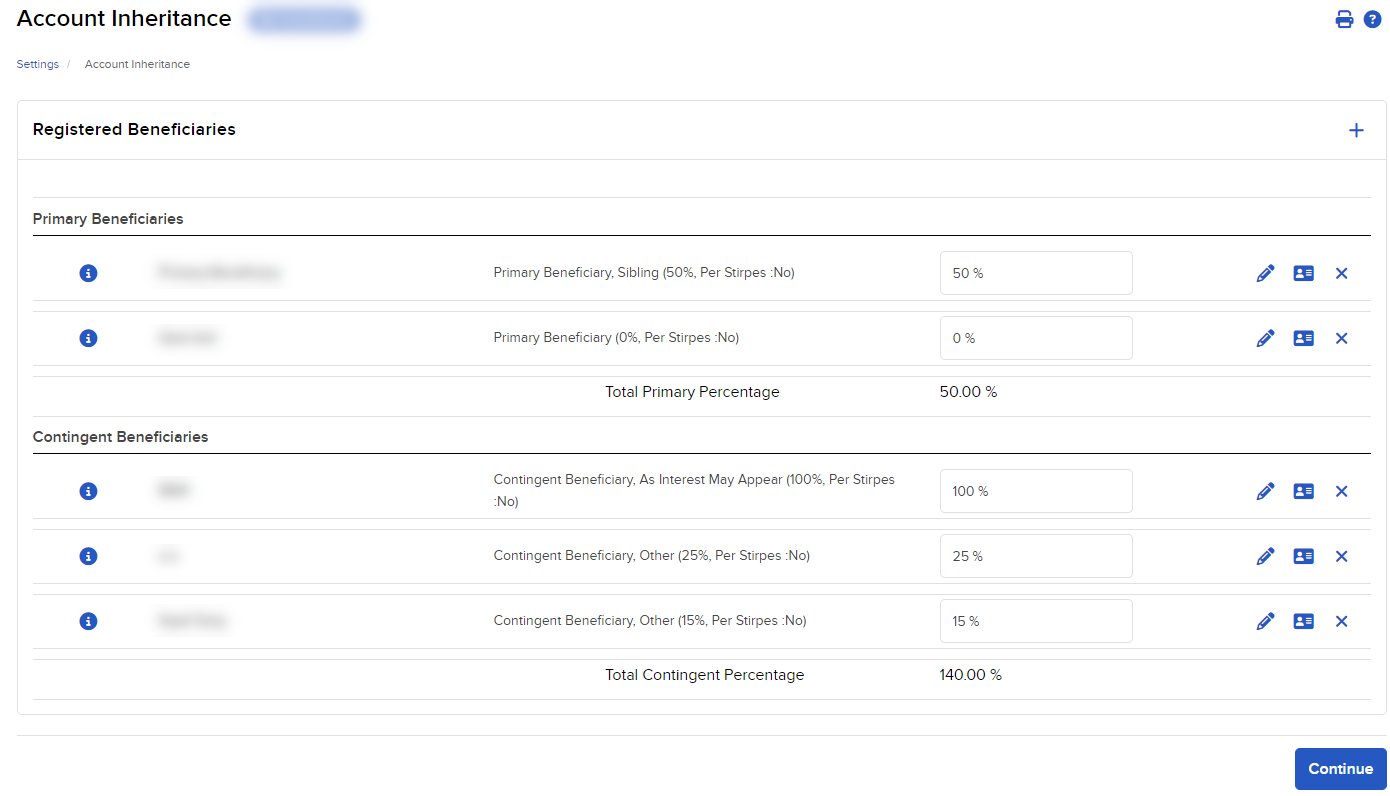

In the Client Portal, use the Account Inheritance page to register one or more beneficiaries to whom you want to directly pass your account assets upon your death without having to go through probate. Upon death of the account holder, in order to receive their inherited assets, any named beneficiaries will have to submit a certified copy of the death certificate, signed identification document (driver's license or passport), and a Non-Probated Estate Action Form with instructions for delivery of the assets.

The following rules apply to beneficiary registration:

-

Your beneficiary (or beneficiaries) can be a natural person or other entity, such as a trust, corporation or guardianship. Minors can be beneficiaries only if a custodian, trustee, or guardian is named for the minor.

-

You must designate at least one and up to six Primary beneficiaries, and can designate one or more optional contingent or Secondary beneficiaries. When you register a beneficiary, you select the percent ownership of your assets to that beneficiary. The percent ownership among all Primary beneficiaries must equal 100%. The percent ownership of all Secondary beneficiaries, if you choose to include them in your beneficiary registration, must also equal 100%.

- If you are married and reside in a community property state, you must obtain your spouse’s consent if you are not naming your spouse as the sole primary beneficiary. You and your spouse should consult a legal and tax professional.

- For individual accounts, when you complete the beneficiary registration, the title of your account will be amended to include your Transfer on Death Beneficiary (for example, “John Doe, TOD Mary Smith”).

-

For individual accounts, at the completion of the online registration process, you will be prompted to complete a Transfer On Death Agreement and send it to us. Be sure to send us a new signed Agreement anytime you change or remove TOD beneficiaries.

Some US states do not allow beneficiary registration or may have specific restrictions. You and your spouse should consult a legal and tax professional.

Register a Beneficiary

-

Click the User menu (head and shoulders icon in the top right corner) > Settings > Account Configuration > Account Inheritance.

-

Click the plus "+" icon to add a Beneficiary and click Continue.

-

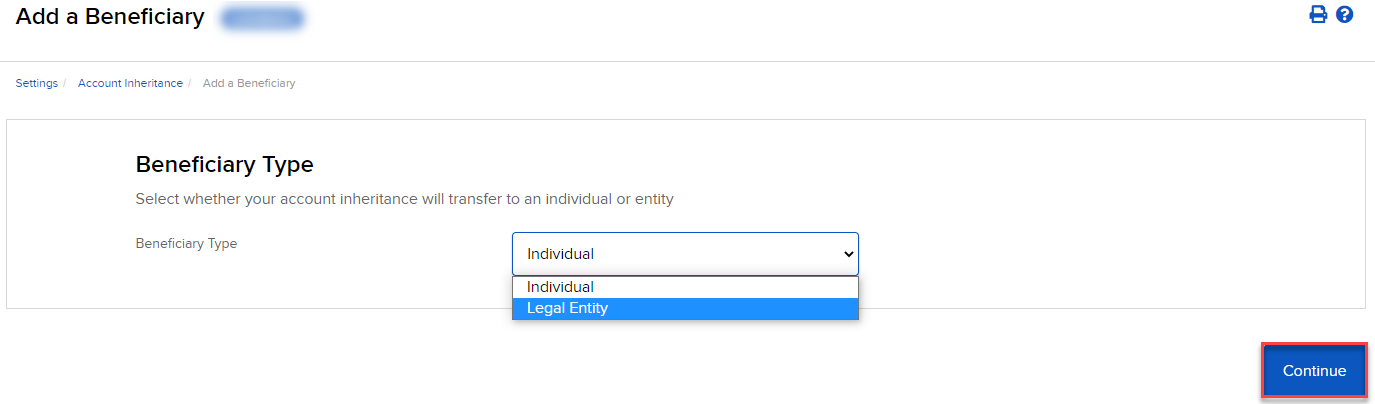

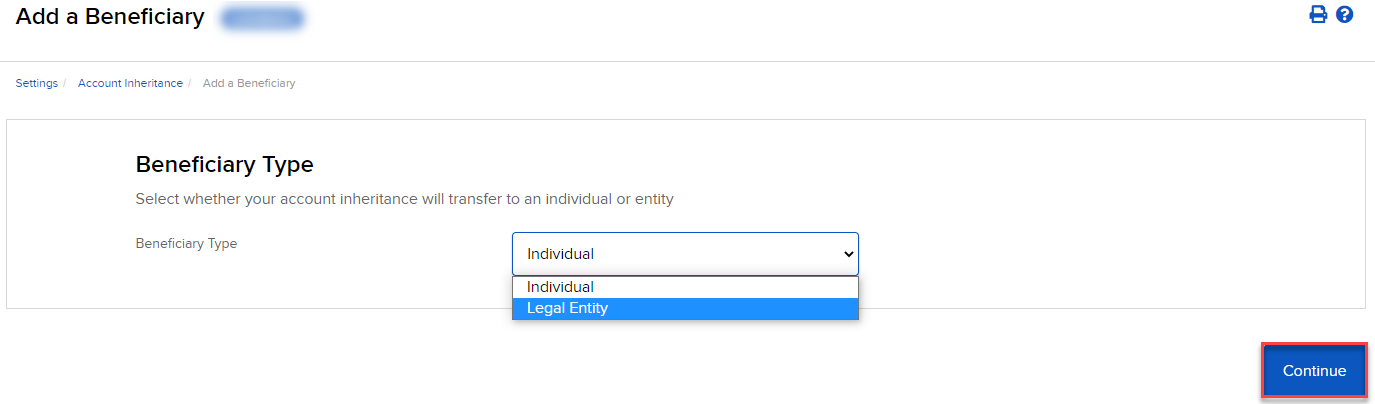

Select the beneficiary type (Individual or Legal Entity) and click Continue.

-

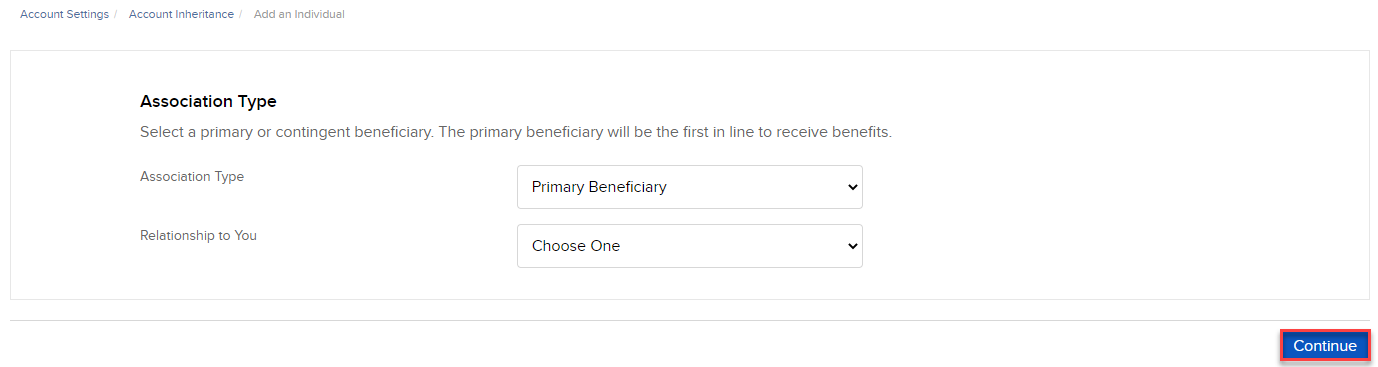

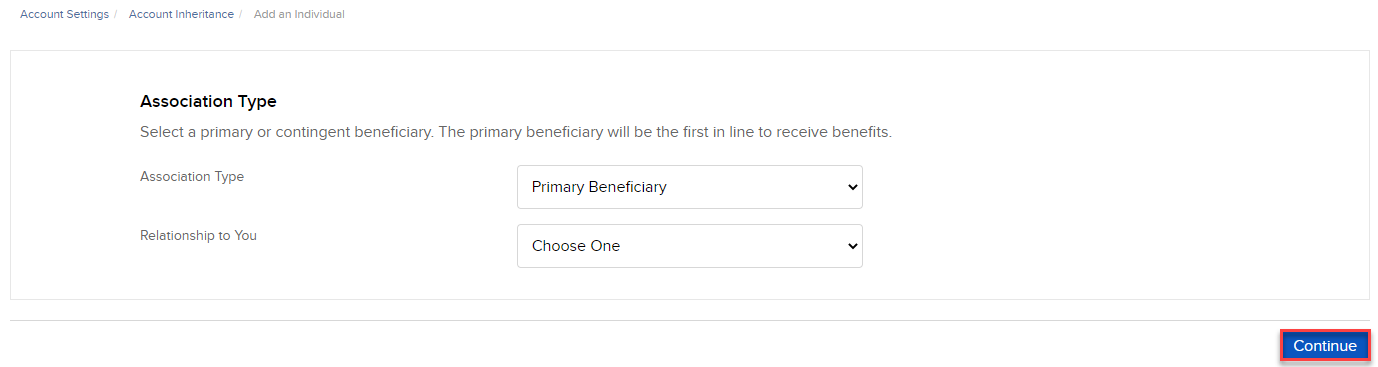

Select the association type (Primary Beneficiary or Contingent Beneficiary). Then select their relationship to you (Brother, Daughter, Father, Husband, Mother, Other, Sister, Son, or Wife) and click Continue.

-

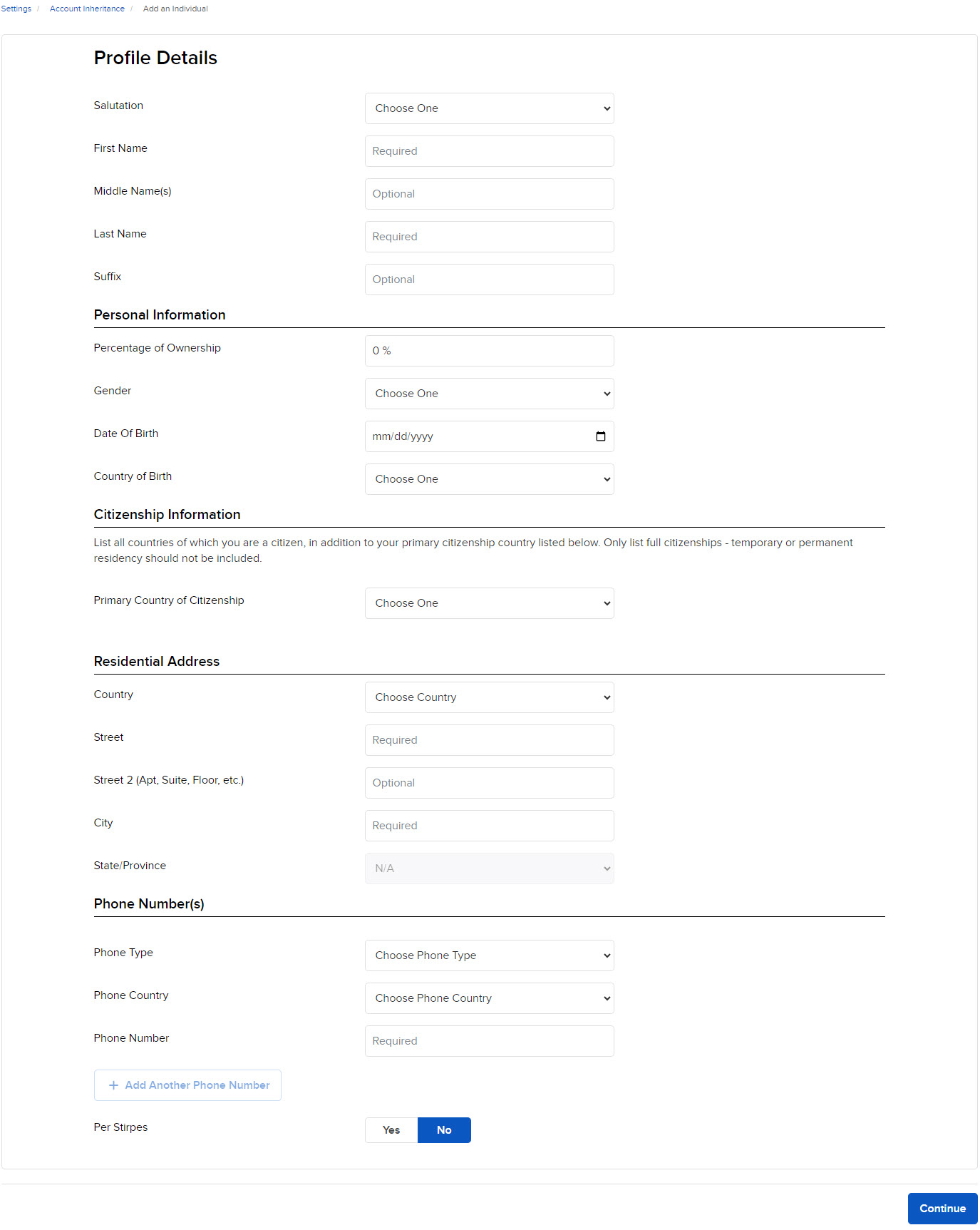

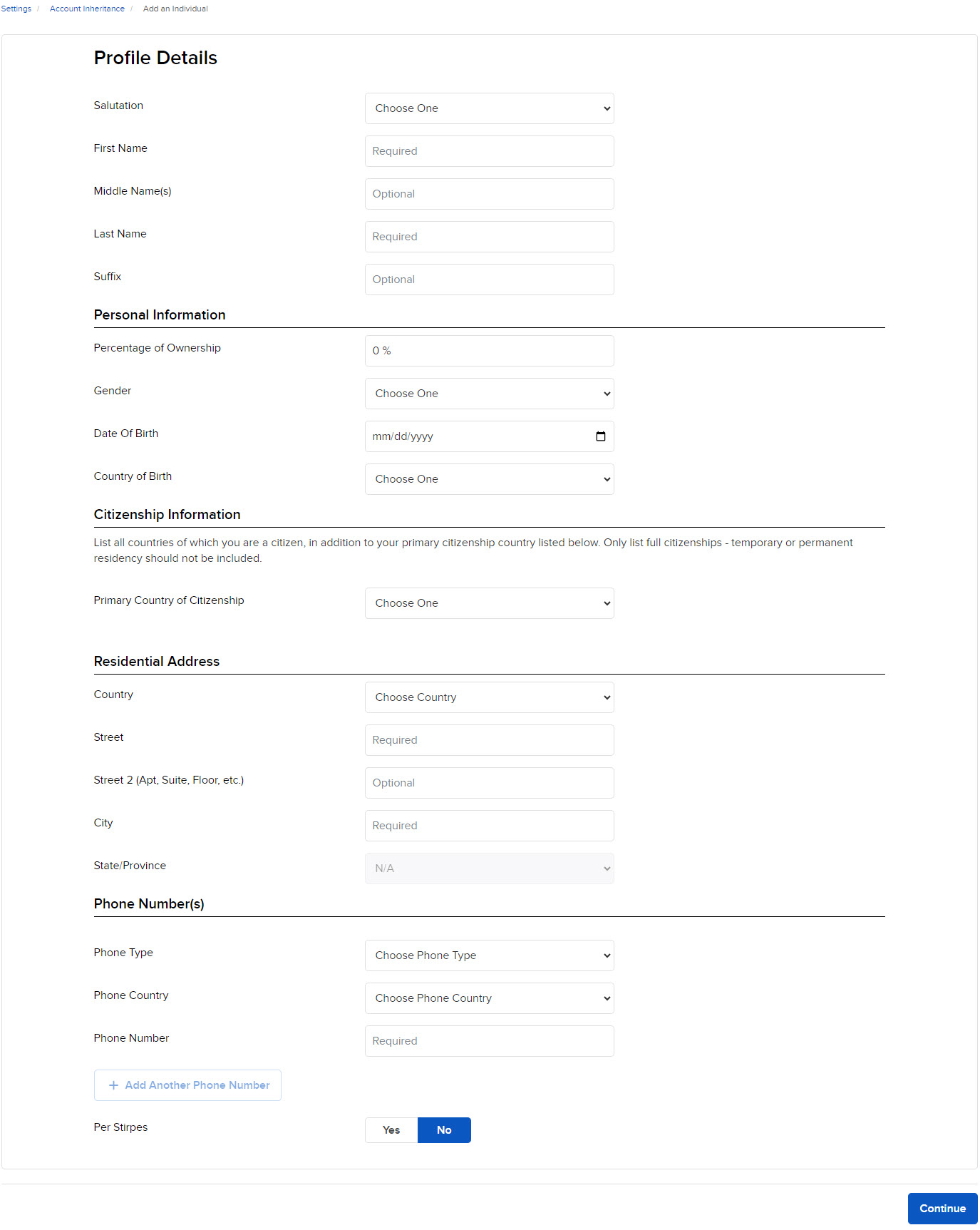

Enter information about the beneficiary in the fields on the next page:

-

If you are registering only one beneficiary, enter 100 in the Percent of Ownership field to assign all of your assets to that person or entity. If you plan on registering additional beneficiaries, enter the appropriate percent amount of ownership for this beneficiary. The percent of ownership for all beneficiaries must equal 100.

-

You must designate at least one and up to six Primary beneficiaries, and can designate one or more optional contingent or Secondary beneficiaries.

-

When you are finished, click Continue. Click OK to return to the Account Inheritance page.

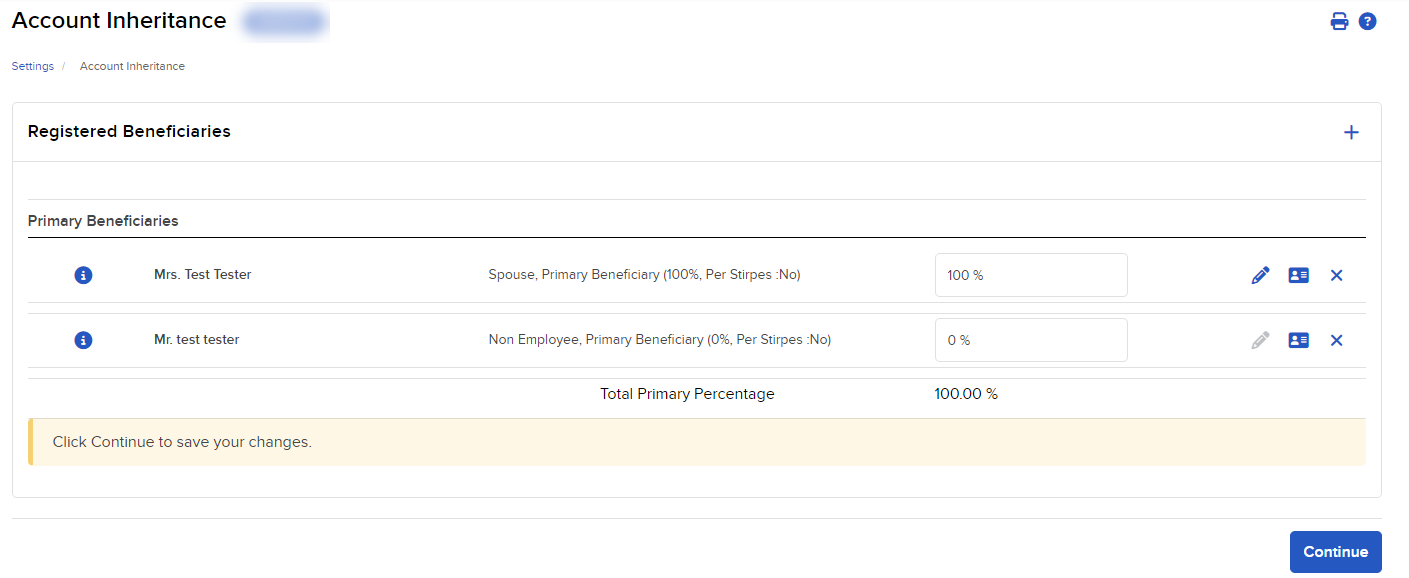

The beneficiary whose information you just entered is displayed on the Account Inheritance page.

To configure an eligible beneficiary with Per Stirpes, click the card icon.

-

Click Continue. Verify all of the information on display is correct and click Continue again.

-

You will receive an email containing a confirmation number that must be entered to confirm your beneficiary registration. Once you have entered the confirmation number, click Continue.

If you are a non-U.S resident, you will be required to provide a copy of the national identification document that shows the identification number that you have provided. The document must include person's photograph and date of birth.

-

Click the User menu (head and shoulders icon in the top right corner) > Settings > Account Configuration > Account Inheritance.

- Click Add a Beneficiary and click Continue.

- Select the beneficiary type (Individual or Legal Entity) and click Continue.

-

Select the association type (Primary Beneficiary or Contingent Beneficiary). Then select their relationship to you (Brother, Daughter, Father, Husband, Mother, Other, Sister, Son, or Wife) and click Continue.

-

Enter information about the beneficiary in the fields on the next page:

- If you are registering only one beneficiary, enter 100 in the Percent of Ownership field to assign all of your assets to that person or entity. If you plan on registering additional beneficiaries, enter the appropriate percent amount of ownership for this beneficiary. The percent of ownership for all beneficiaries must equal 100.

- You must designate at least one and

up to six Primary beneficiaries, and can designate one or more

optional contingent or Secondary beneficiaries.

If you are a non-U.S resident, you will be required to provide a copy of the national identification document that shows the identification number that you have provided. The document must include person's photograph and date of birth. - When you are finished, click Continue. Click OK to return to the Account Inheritance page.

The beneficiary whose information you just entered is displayed on the Account Inheritance page.

-

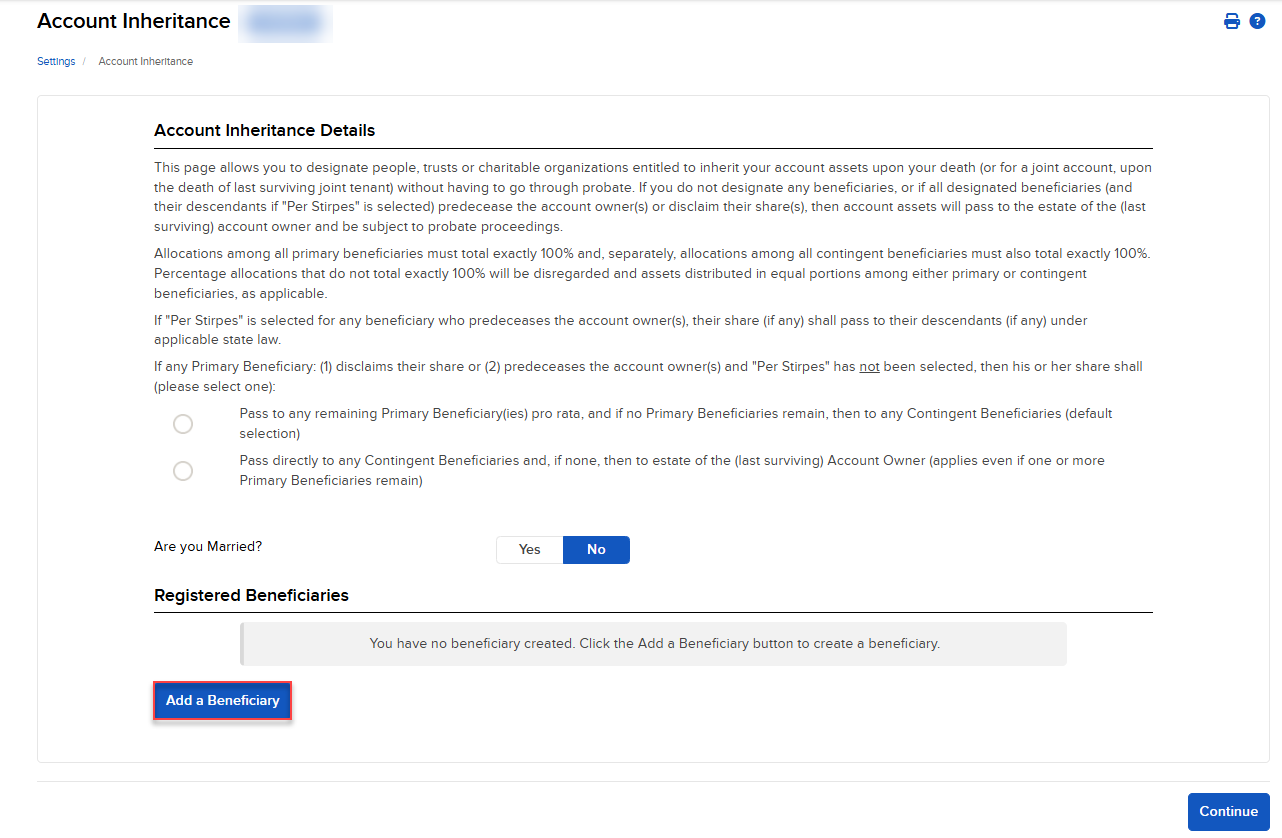

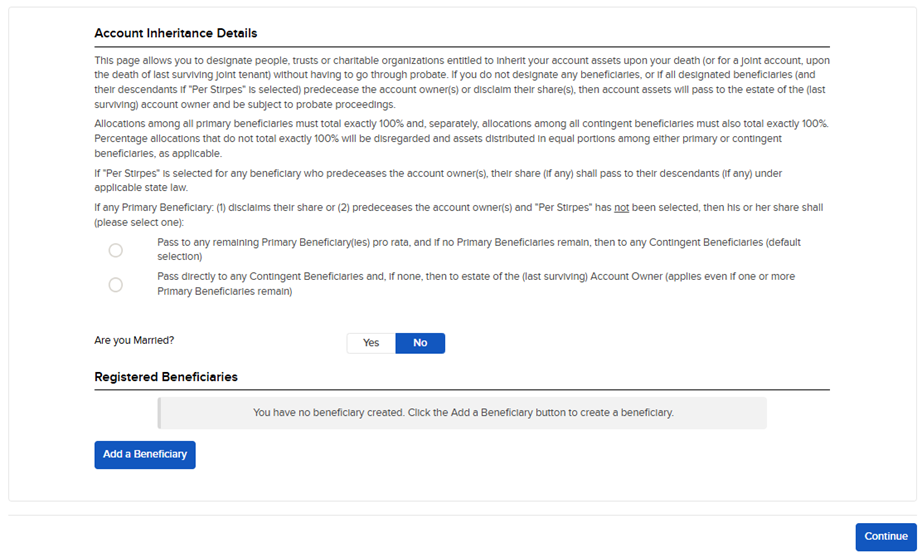

From the Account Inheritance Details section, specify what to do if any primary beneficiary predeceases the account owner by selecting one of the radio buttons on the TOD Beneficiaries page:

-

Pass to any remaining Primary Beneficiary(ies) pro rata, and if no Primary Beneficiaries remain, then to any Contingent Beneficiaries (default selection)

-

Pass directly to any Contingent Beneficiaries and, if none, then to estate of the (last surviving) Account Owner (applies even if one or more Primary Beneficiaries remain)

-

- Click Continue. Verify all of the information on display is correct and click Continue again.

-

You will receive an email containing a confirmation number that must be entered to confirm your beneficiary registration. Once you have entered the confirmation number, click Continue.

-

Click the Transfer on Death Agreement link. A pre-populated form displays. Read the agreement carefully, then print the form, sign it and send it to us.

When we approve your request, your beneficiary registration will be complete.

You are also required to send us a new signed Transfer on Death Agreement anytime you modify or remove TOD beneficiaries. To do this, see Removing or Modifying a Beneficiary.

Supported TOD Joint Types:

-

Joint Tenants with Rights of Survivorship

-

Tenants by Entirety

Additional Resources

Learn About the Client Portal Interface at IBKR Campus