Algorithmic Trading

Available in: Client Portal

Algos can help to balance market impact with risk to get the best price for large volume orders. To access Algos, please follow the steps outlined below.

Instructions

-

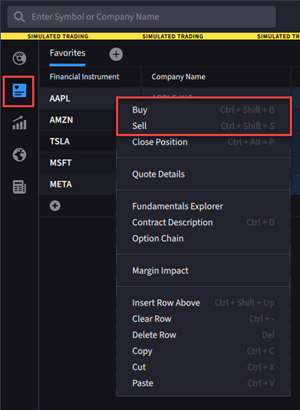

Navigate to the Watchlist menu and enter the product you are looking to trade.

-

Right-click on the product and select Buy or Sell.

-

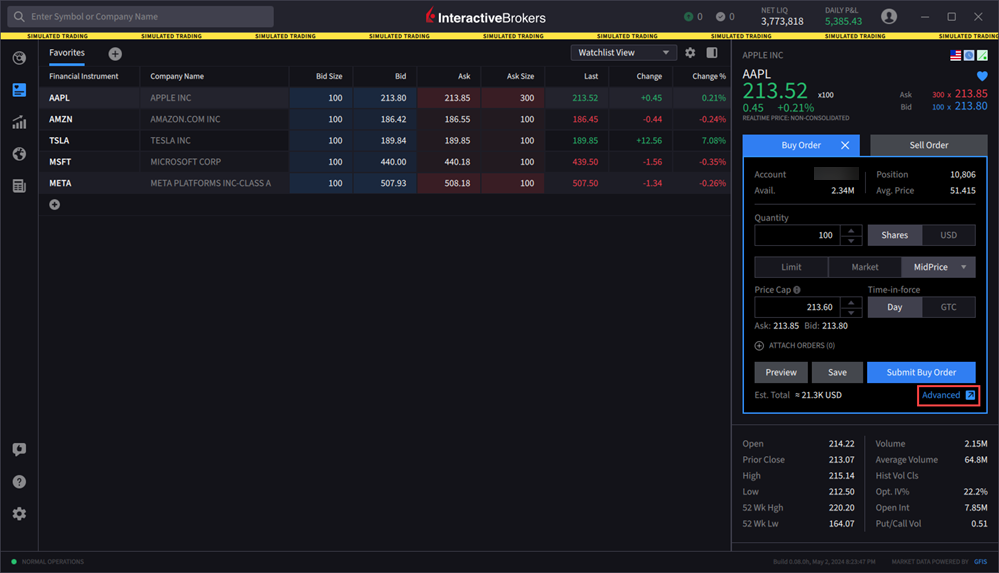

The Rapid Order Entry ticket will populate on the right-hand side of the Watchlist screen.

-

Select the Advanced button in the bottom right corner to open a Full Order Ticket window.

-

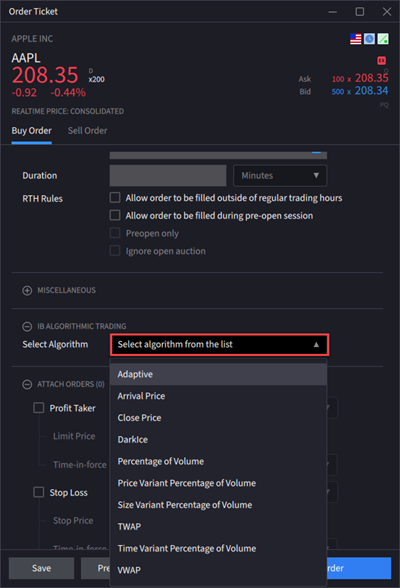

The Advanced Window will populate on your screen. Scroll down to IB Algorithmic Trading section. Select the desired Algo order type from the drop-down list.

-

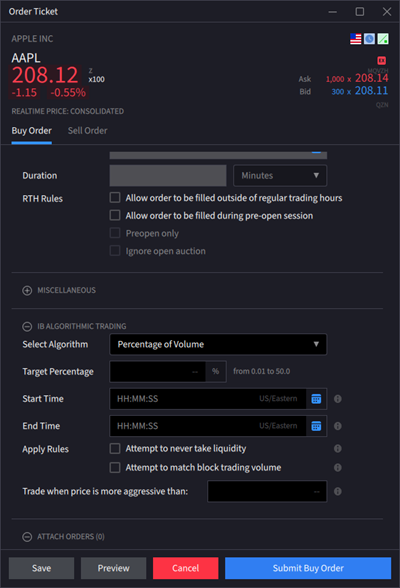

Adjust the Algo order type as desired before submitting.

-

Select Submit Buy Order or Submit Sell Order.

Our growing family of Algos includes the following IBKR Algos:

- Accumulate Distribute - Use the Accumulate Distribute algo to buy or sell large quantities in smaller, random sized increments over time, minimizing market impact. This algo supports multiple asset classes including stocks, options, futures, forex, and combination orders. For more information see the Accumulate Distribute page.

-

Adaptive Algo - This algo can be used with a limit or market order, and is designed to achieve better than average cost efficiency over basic limit and market orders by attempting to trade market and aggressive limit orders between the spread. You can specify how urgently you want the order to fill using the "priority/urgency" selector in the algo window. For more information see the Adaptive Algo page.

-

Arrival Price - This strategy is designed to achieve or outperform the bid/ask midpoint price at the time the order is submitted, taking into account the user-assigned level of market risk which defines the pace of the execution, and the user-defined target percent of volume. For more information see the Arrival Price page.

-

Close Price Strategy - The Close Price algo is designed to minimize slippage with respect to the closing price by slicing orders into smaller quantities and executing them in the continuous market just before the close. It considers the user-assigned level of market risk, the user-defined target percentage of volume, and the volatility of the stock in determining how long before the close it should start executing the trade, and the pace at which the trade should be executed. For more information see the Close Price Strategy page.

-

Dark Ice - The Dark Ice algo is similar to an iceberg or reserve order, as it allows the user to specify a display size different from the order size, which is shown in the market. Additionally, the algo randomized the display size +/- 50%, and based on the calculated probability of the price moving favorably, it decides whether to place the order at the limit price or one tick lower than the current offer for buy orders and one tick higher than the current bid for sell orders. For more information see the Dark Ice page.

-

Percentage of Volume Strategy - Allows you to participate in volume at a user-defined rate. Order quantity and volume distribution over the day is determined using the target percent of volume you entered along with continuously updated volume forecasts calculated from market data. For more information see the Percent of Volume page.

-

Price Variant Percentage of Volume Strategy - This algo allows you to participate in volume at a user-defined rate that varies over time based on the price of the security. It lets you buy more aggressively when the price is low and less aggressively as the price increases, and just the opposite for sell orders. For more information see the Variant Algo page.

-

Size Variant Percentage of Volume Strategy - This algo strategy allows your order to work more aggressively at the start and less aggressively towards the end, or vice versa. It lets you participate via volume at a user-defined rate that varies with time based on the remaining order quantity. For more information see the Variant Algo page.

-

Time Variant Percentage of Volume Strategy - This algo strategy allows your order to work more aggressively at the start and less aggressively towards the end, or vice versa. It lets you participate via volume at a user-defined rate that varies with time based on the initial and terminal participation rates that you specify. The algo will then calculate the rate of participation between the start and end times. For more information see the Variant Algo page.

-

TWAP - Designed to achieve the time-weighted average price calculated from the time the order is submitted to the close of the market. For more information see the TWAP page.

-

VWAP - Designed to achieve or outperform the VWAP price, calculated from the time you submit the order to the close of the market. For more information see the VWAP page.

-

Minimize Impact (for Options) - Designed to minimize market impact by slicing the order over time as defined by the Max Percentage value. This algo applies to Options only. For more information see the Minimize Impact page.

-

Balance Impact and Risk (for Options) - Balances the market impact of trading the option with the risk of price change over the time horizon of the order by taking into account the user-assigned level of market risk which defines the pace of the execution, and the user-defined target percent of volume. For more information see the Balance Impact and Risk page.