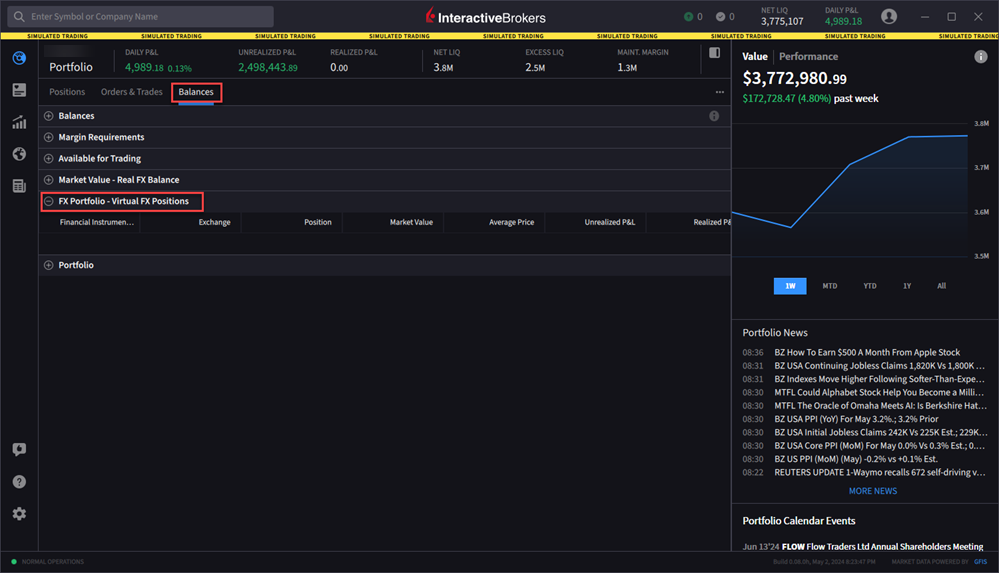

FX Portfolio - Virtual FX Position

The FX Portfolio section is designed to show activity for currency pair trades for FX traders to track average cost and run P&L on their currency trades. However the "Position" value may reflect the sum of trades executed in the FX market along with currency conversions to change non-base funds into your base currency. To view this information, please take the steps outlined below.

Instructions

-

Click the Portfolio menu

from the top left corner of your screen.

from the top left corner of your screen. -

Click the Balances tab.

-

Expand the FX Portfolio - Virtual FX Position section.

Parameter Description Contract description Symbol and description. Exchange An exchange on which the pair trades. This may not be the executing exchange for the trade. Position The sum of trades executed in the FX market for the selected currency pair. Unsettled Position Unsettled currency trades. Currency Currency used to buy/sell the FX pair. Market Value (Position) x (market price). Market Price Real-time price of the position. Average Price Average price per contract. Unrealized P&L The difference between the trade price and the market price times position, including commission.

Example: BUY 20,000 EUR.USD @ 1.54390

Trade Price = 1.54390

Market Price (current price) = 1.54385

1.54390 – 1.54385 = .00005

.00005 X 20,000 = 1

+ 2.5 commission = -3.50 Unrealized P&L

Realized P&L Realized profit & loss for the pair. Liquidate Last Last liquidation "Yes" or "No" tag. If set to "Yes" this position will be put at the end of the queue to liquidate last in the case of margin requirements. To set, use the right-click menu on the desired position.

Note: While clients have the opportunity to pre-request the order of liquidation in the event of a margin deficiency in their account, such requests are not binding on IBKR. In the event of a margin deficiency in client’s account, IBKR retains the right, in its sole discretion, to determine the assets to be liquidated, the amount of assets liquidated, as well as the order and manner of liquidation. Clients are encouraged to consult the IBKR Client Agreement and the IBKR Disclosure of Risks of Margin Trading for further information.

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.