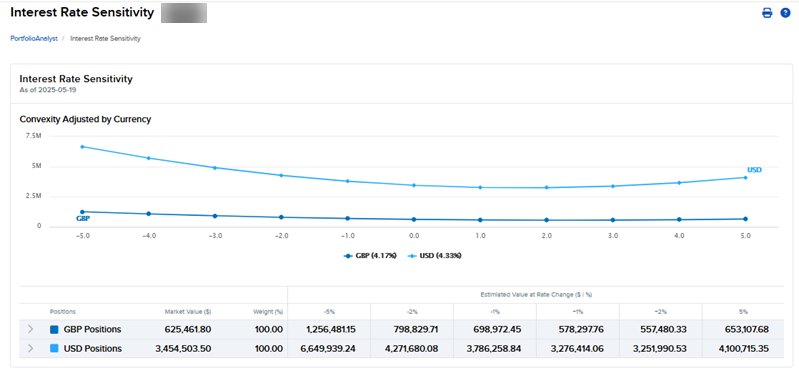

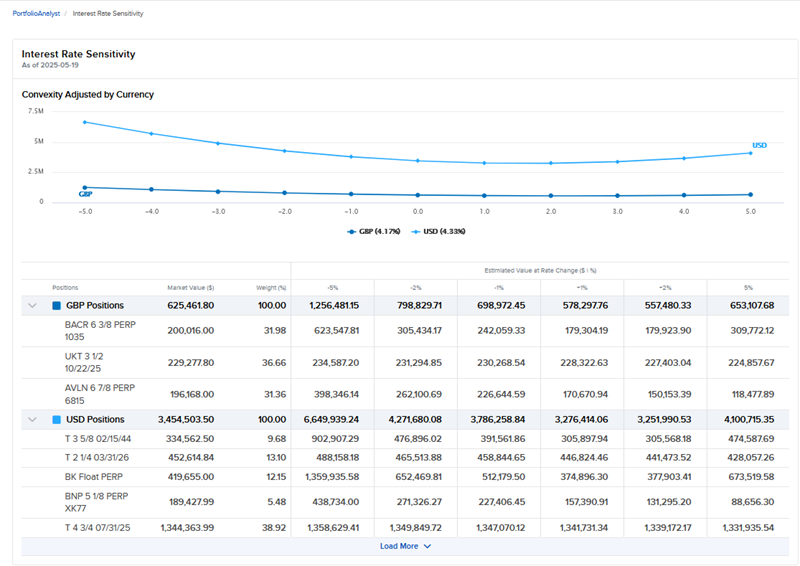

Interest Rate Sensitivity

Instructions

The Interest Rate Sensitivity widget lets you estimate how sensitive your portfolio's fixed income positions are to changes in the interest rate environment.

Interest rate sensitivity is estimated by calculating the Macaulay Duration for each fixed income holding in a portfolio. Using Macaulay Duration, we calculate the Modified Duration which is used to determine the Duration Effect from a given interest rate change. We then estimate each bond position’s Convexity by calculating the bond value given a small positive and negative interest rate change, which allows us to determine the Convexity Effect for a given interest rate change. We then calculate the total estimated bond value change for a given interest rate change by combining the Duration Effect and the Convexity Effect, demonstrating a position or portfolio’s interest rate sensitivity.

Supported Time Period(s) and Account Type(s):

-

Time Period(s): Supported for time periods ending on most recent day.

-

Account Type(s): Brokerage accounts only.

To navigate to the Interest Rate Sensitivity widget, follow the steps below.

-

Select Performance & Reports > PortfolioAnalyst > Navigate to the Interest Rate Sensitivity widget.

-

Alternatively, click Menu in the top left corner > PortfolioAnalyst > Navigate to the Interest Rate Sensitivity widget.

-

-

Select the blue arrow icon in the top right corner to view additional details.

-

A new page will populate with additional information regarding your portfolio's interest rate sensitivity.

-

Select the arrow icon to the left of the positions to populate additional details.

-

Hover your cursor over the graph to view market value of the currency.