Aggregated Greeks in Reports

Instructions

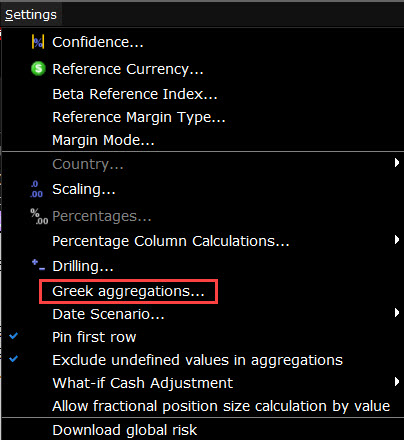

The aggregate calculations for the Delta, Gamma and Vega position Greeks can be changed from the Settings menu by choosing Greek aggregations.

To change Greek Aggregation alculations follow the steps below.

-

From the Settings menu of Risk Navigator, select Greek aggregations.

-

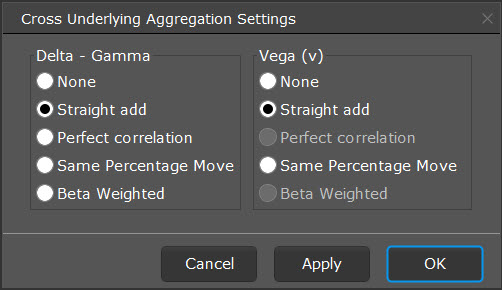

Use the radio button to choose a calculation.

Calculations use the following variables:

S_i = underlying price.

sigma_i = historical volatility of the underlying.

Delta_i = total delta denominated to the base currency.

Gamma_i = total gamma denominated to the base currency.

Vega_i = total vega denominated to the base currency.

Straight add:

Aggregated Delta = sum over i (Delta_i)

Aggregated Gamma = sum over i (Gamma_i)

Aggregated Vega = sum over i (Vega_i)

Perfect Correlation:

Aggregated Delta = sum over i (Delta_i * S_i * sigma_i)

Aggregated Gamma = 0.5 * sum over i (Gamma_i * (S_i * sigma_i)^2)

Same Percentage Move:

Aggregated Delta = sum over i (Delta_i * S_i * 0.01)

Aggregated Gamma = 0.5 * sum over i (Gamma_i * (S_i * 0.01)^2)

Aggregated Vega = sum over i (Vega_i * sigma_i)