Create a Basket Hedge Order

Instructions

Display the Hedge metric on the Risk by Underlying and Risk by Industry reports to create a basket of delta hedge orders.

To create a basket hedge, please take the steps outlined below.

-

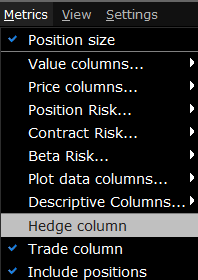

Select the Metrics menu button across the top of the Risk Navigator window.

-

Select Hedge Column.

-

If the feature is grayed out on the Metrics menu, it's not supported for that report. The Hedge checkbox functions at the aggregated level, and is only available in reports with a collapsible contract dimension, i.e. Risk by Underlying, Risk by Industry, Risk by Country, Plot Data by Underlying etc.

-

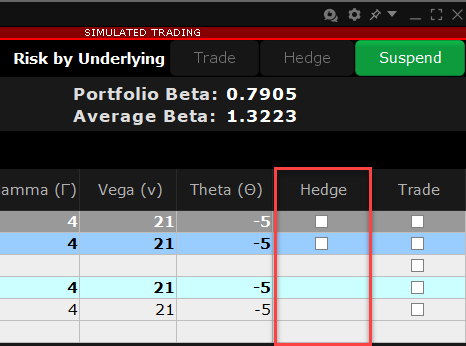

Enable the checkbox in the Hedge column of an underlying for all subportfolios whose deltas you want to hedge.

To select all subportfolios, use the checkbox in the All Underlyings top row.

-

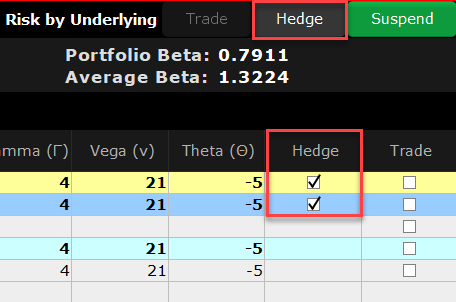

When all contracts are selected, click the Hedge button in top right corner of the report.

-

Define the hedge order attributes and click OK:

-

Pick the order type (Limit, Market or Relative).

-

If you selected the Relative order type, define the relative offset amount

-

-

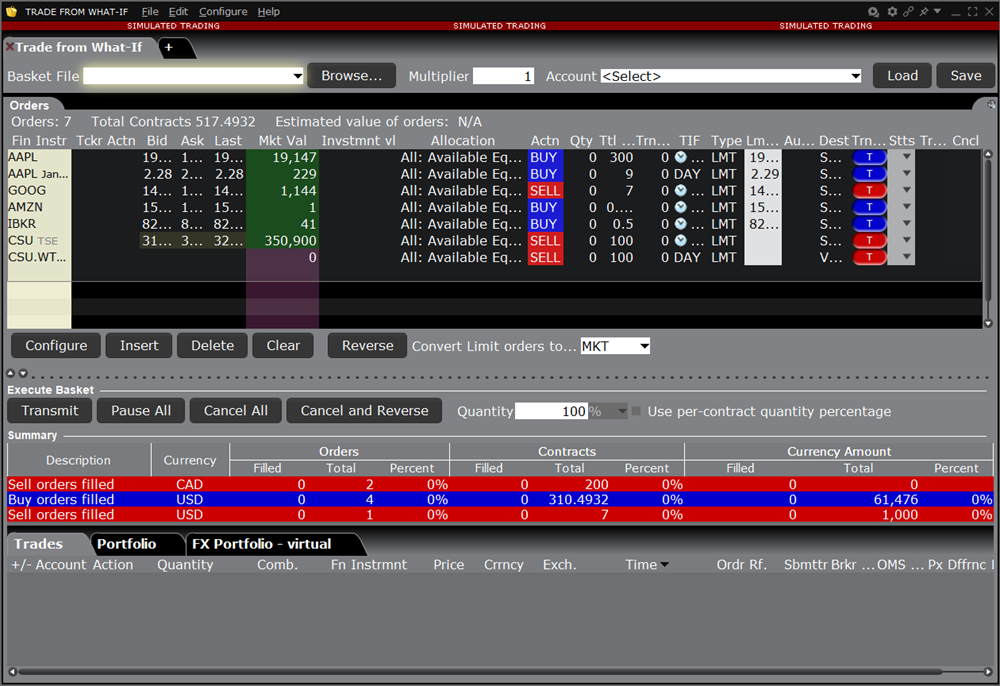

The BasketTrader opens, and the legs of the order reflect the subportfolios you selected in the Risk Navigator.

-

The Total Quantity for each leg is identical to the delta for the subportfolio, with the Action set to the opposite side; if the delta is positive, the leg becomes a SELL order. If the delta is negative, the leg becomes a BUY order.

-

You can save the basket for later use by clicking the Save button at the top right of the basket.