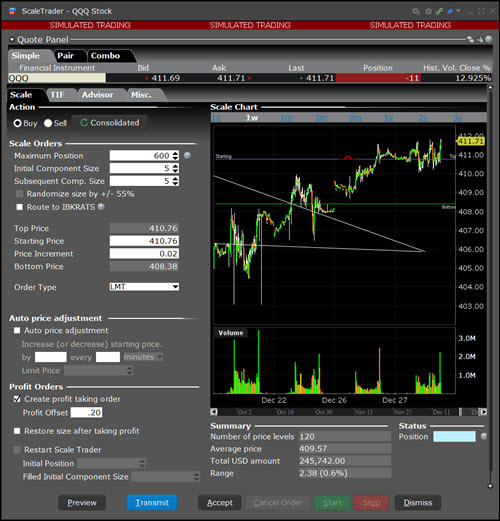

Example 2: Scale Order with Profit-Taking Orders

Instructions

Data Assumptions:

| Label | Value |

|---|---|

| NBBO | $411.69 - $411.71 |

| Action | Buy |

| Total Order Size | 600 |

| Initial/Subsequent Component Size | 5 |

| Starting Price | $410.76 |

| Price Increment | .02 |

| Order Type | Limit |

| Time in Force | GTC (this is set on the Basic tab of the order ticket) |

| Create profit taking order | Check to enable |

| Profit Offset | 0.20 |

Like example 1, this is an order to buy 600 shares scaled into 120 components of 5 shares each. In addition, we have instructed the system to submit profit-taking sell orders against each order component, with a .20 profit offset. This means the profit orders will be submitted at the last filled price level plus the .20 cent offset.

-

The first 5 share component is submitted as a buy limit order at the Starting Price of $410.76. When the component order fills two things happen. The next component of 5 shares is submitted at $410.74 (component price - price increment), and a sell order is submitted for 5 shares at $410.96 (component price + profit offset).

-

When the $410.74 price level fills, a sell order for 5 shares at $410.94 (component price + profit offset) is submitted. This pattern continues until all components have filled, or you cancel the order.

-

The order will be held if any parent component becomes unmarketable, but the profit orders can continue to work without holding up the order.