IMPACT Dashboard

Instructions

Information on the IMPACT Dashboard have been listed below.

The IMPACT Dashboard makes responsible investing easy by helping you evaluate the business values of companies in your portfolio to invest in those whose principles most closely align with yours.

To see how well a company's philosophy aligns with your values before you invest, use the IMPACT widget in the Fundamentals Explorer and the IMPACT Effect column in your Watchlist.

To Use the IMPACT Dashboard

-

Open the dashboard from your Portfolio by clicking the IMPACT button.

-

Move through the Welcome screens to get started.

-

Select the values that are important to you. You can identify a value as "Important" or "Very Important." Values tagged as Very Important carry more weight in the Portfolio Grade calculation, and companies whose values who have a low alignment with your selections will score a lower grade.

-

Click Next when finished.

-

Choose the practices to which you're opposed. Companies that engage in these practices will be flagged.

-

Click Done to see your Portfolio IMPACT Grade.

Find out more in the IMPACT Tools: Responsible Investing white paper.

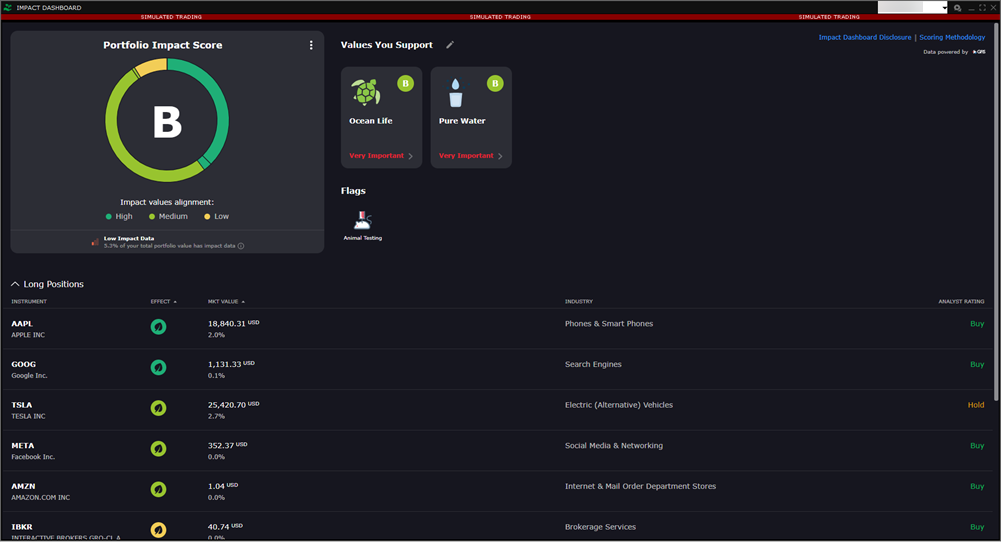

Once you have defined the values that are important to you and identified the practices to which you're opposed, we calculate an IMPACT score for your portfolio, plus individual grades for the Values You Support.

Your portfolio IMPACT Score Depends On:

The number of values you choose

-

The more values you select, the more diluted the contributing scores for each value become. To make your score more meaningful, we recommend limiting the number of values you select and applying the "Very Important" tag sparingly.

How your portfolio is weighted

-

Your Portfolio IMPACT Score is weighted based on percentages of your holdings that have data. If one holding with IMPACT data makes up a large percentage of your total holdings, the value scores for that holding will have a big effect on your overall portfolio score.

What percent of your portfolio has IMPACT data

-

At this point in time, not all companies supply the kind of responsible investing data needed to calculate IMPACT. Beneath the doughnut chart we show you the percentage of your portfolio that has data. This number is based on your total portfolio value. For example, if you have 100 positions in your portfolio, and 10 of these have data and these 10 positions account for 90% of your portfolio value, the message will tell you that 90% of your portfolio has data.

-

You can see that your portfolio grade will change if you modify the selected values including which are tagged as Important and Very Important. Also note that the practices you want to avoid are not used in the IMPACT score calculation. We flag companies in your portfolio that engage in these practices, but do not use this information to calculate your portfolio score.

Find out more about how the IMPACT grade is calculated in the IMPACT Tools: Responsible Investing white paper.

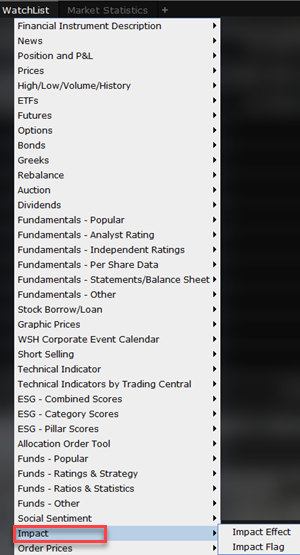

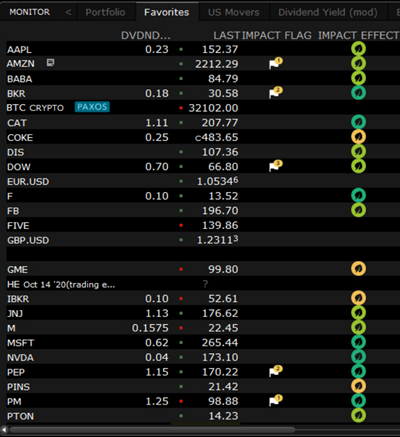

Add IMPACT columns to your Watchlists to see how potential investments align with your principles and values.

To Add IMPACT Columns to a Watchlist

-

Hold your mouse cursor over a Watchlist until the "Insert/Remove" menu displays.

-

Select Insert Column.

-

Scroll down to the IMPACT category and select a column to add. Available columns include:

-

IMPACT Effect which displays impact leaves in different colors to show how well an asset aligns with your values.

-

Dark Green: High alignment

-

Lime Green: Medium alignment

-

Yellow Green: Low alignment

-

-

IMPACT Flag which flags any company that engages in a practice to which you are opposed. Hold your mouse over a flag to see which practices are flagged for a company.

-

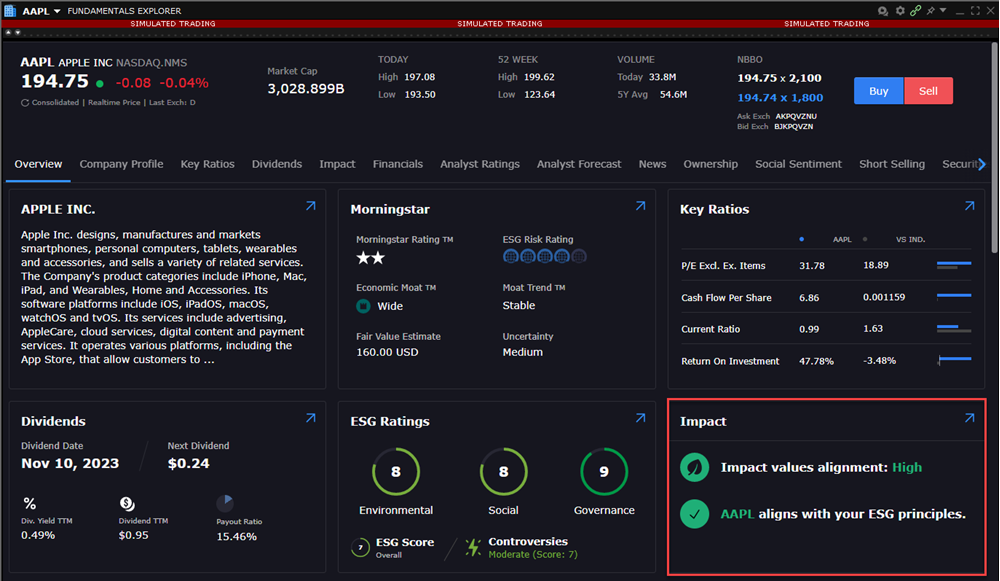

Use the IMPACT widget in Fundamentals Explorer to see how potential investments may fit in with your responsible investing goals.

To Open Fundamentals Explorer

-

Right-click an asset, then click the Fundamentals Explorer icon in the top right corner of the pop-up window.

-

The IMPACT widget shows you an overview of how well the selected asset aligns with your both your IMPACT values and your ESG principles. You can use this information for assets in which you are considering investing to decide whether or not they are in line with your values.