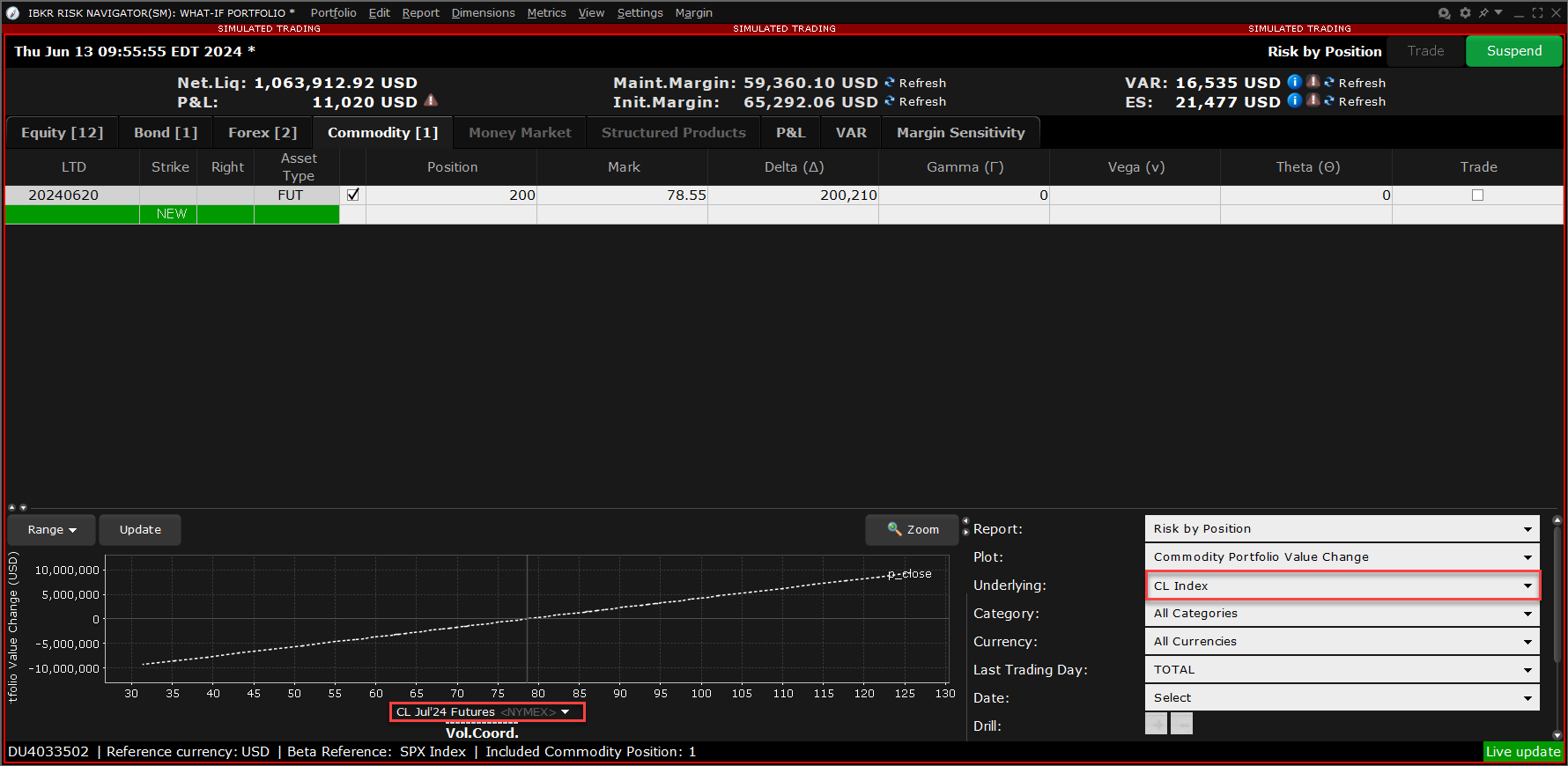

Portfolio Relative P&L Graph

Instructions

The Portfolio Relative P&L graph illustrates how the total value of your portfolio for a specific asset class (or a subset of your portfolio) will change, based on a percent change in the price(s) of the underlying(s). Available settings may change based on the asset class displayed.

-

Change the range for the underlying price change shown on the horizontal axis. The default value is +/- 30%

-

Change plot aggregation when Beta Weighted Portfolio is enabled (from View menu)

-

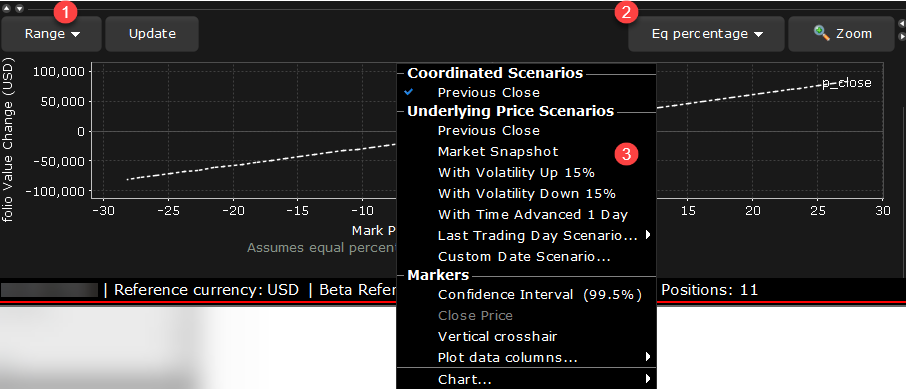

Use the right-click menu to create date scenarios, add or remove time and volume variables, enable the vertical crosshair and set data column slicers.

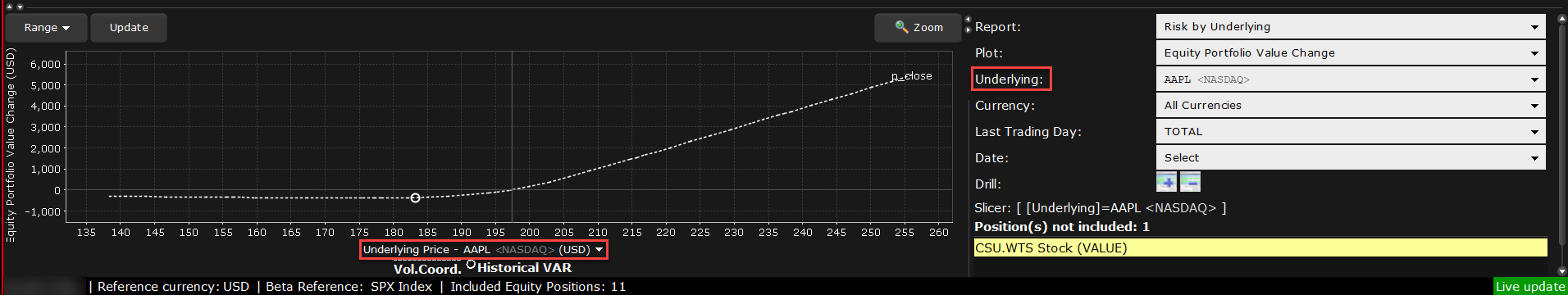

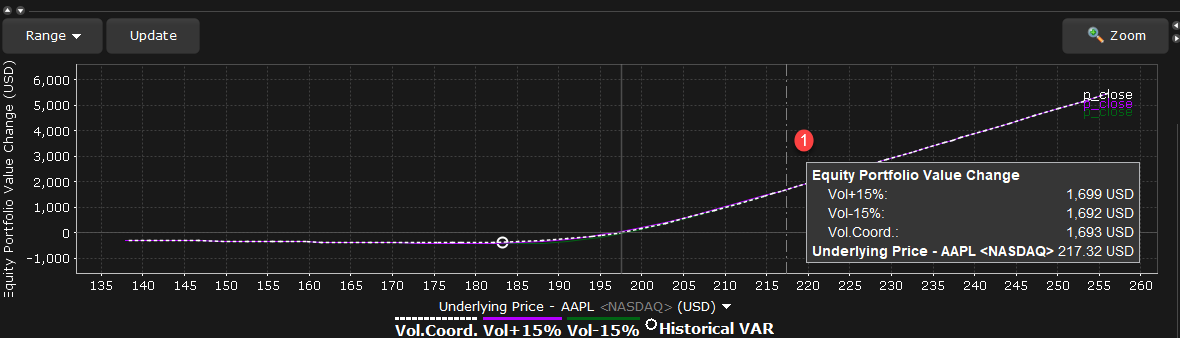

The image below shows the portfolio relative P&L for an equity portfolio, based on the value All Underlyings selected from the Underlying list in the Report Selector.

For a single underlying, you can toggle between showing the absolute price or showing the underlying price change as a percent. Click the price label below the horizontal price axis to select a display type.

Note that for leveraged ETFs, the Risk Navigator moves them by their target performance ratio in the aggregated P&L graph. For example, for an index and its triple inverse ETF, to the +10% P&L it adds the index P&L at 10% to the ETF P&L at -30%. When either one is plotted individually, it shows their own P&L, but it shows the index on a +/-30% range and the ETF on a +/-90% range.

Beta analysis in

The Confidence Interval, shown within the yellow vertical lines, illustrates the worst-case loss over a one-day period with a default 99.5% confidence level. Use the Confidence sub-command on the Settings menu to toggle between 95%, 99% and 99.5% confidence levels. Turn the Confidence Level brackets on or off using the Confidence Interval command on the right-click menu.

For portfolios containing options or volatility products (like VIX or its derivatives), vol-coordinated price changes show the effect of a change in market price level and a corresponding simultaneous change in volatility level. In scenarios where stock prices are down X%, vols are assumed to simultaneously increase by up to (10*X)% for short-dated options, decaying gradually to (2*X)% for options with longer expiries. Conversely, in scenarios with stock prices up X%, vols are assumed to be down X% for short-dated options, decaying to (X/5)% for longer expiries.

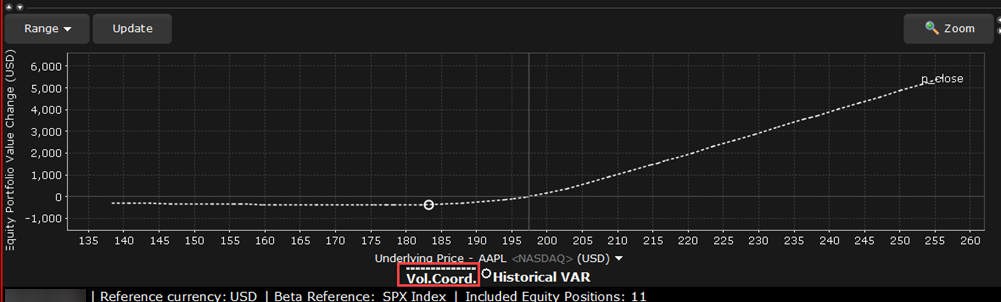

Curves generated using these coordinated volatility changes will be marked "Vol.Coord.", and will be displayed together with a tool tip detailing the scenarios used.

Use the Vol-up by 15%*, Vol-down by 15%* and reduced time to expiry by 1 day checkboxes in the right-click menu to view the plot under different scenarios to help you visualize the volatility and time risk in your option positions. While you can elect to display the base P&L using both the previous day’s closing price and the most recent dynamic price, the volatility and time variables are always based on the previous close.

*The Vol Up and Vol Down commands increase/decrease projected volatility in relative percent change. Relative percent change is calculated by multiplying the current implied volatility by 15%, and adding/subtracting this value to/from the current implied volatility. For example, if the current implied volatility of an option is 10%, a 15% relative increase would result in an implied volatility of 11.5%, calculated as follows: 10 + (10 * 0.15) = 11.5% . If the current implied volatility of an option is 42.45%, a 15% relative decrease would result in an implied volatility of 36.082%, calculated as follows: 42.45 - (42.45 * 0.15) = 36.082%.

-

Activate the Vertical Crosshair from the right-click menu to get mouse-over help at any price-change percentage point.

When the Vertical Crosshair is activated on the P&L graph using the right-click menu, you will get mouse-over help at any price-change percentage point.

For Bonds, the P&L plot is based on the interest rate change.

In cases where the index price is invalid for futures/futures options, the graph provides a drop-down selector with available expirations to use for the reference price. Ensure that the "Underlying" field in the report selector has only one contract selected.