Recognia Technical Indicators

Instructions

Use technical market scanners and columns powered by Recognia Research. Recognia’s pattern recognition technology identifies technical events that have formed over days, weeks, and even months which may indicate the trends over the short-, medium- and long-term horizons. Apply technical pattern scanning with other fundamental and technical data points to find the stocks that match your specified criteria. Recognia can recognize over 60 technical events such as Head and Shoulders, Breakouts, Shooting Stars, Hammers, Gravestones, Triangles, Flags, Pennants and more.

To add Technical Indicators by Recognia columns to a Watchlist, please take the steps outlined below.

-

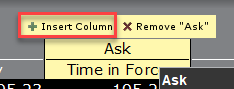

Hover your mouse over an existing column heading and click the green "+" sign to insert column.

-

From the displayed list select Technical Indicators by Recognia and select the data point columns to add.

-

Intermediate Term Event Score - Recognia's proprietary score of the event on a scale of 0 to 5. Events are assigned a score upon their confirmation - the value is assigned differently depending on the type of event. For example, for classic patterns, the value depends on how symmetrical the pattern is and how closely it matches the textbook definition. For indicator and oscillator events, the value is based on the amount of penetration.

-

Intermediate Term Event Trade Type - Potential trading opportunity type based on the event. Possible values include: Long, Short, and Undefined. This data is provided for information purposes only and is not intended as a recommendation to buy or sell securities.

-

Intermediate Term Technical Event Class - The class for the event. Technical events are placed into one of four classes:

-

Classic Patterns, such as Double Top, Flag, Head and Shoulders Top, etc.

-

Short-term Patterns, such as Shooting Star, Engulfing Line, Hammer, etc.

-

Indicator, such as double and triple moving average crossovers

- Oscillator, such MACD, RSI, Fast Stochastic, etc.

-

-

Intermediate Term Technical Event Date - The date the event formed. All dates are of the form: YYYY-MM-DD.

-

Intermediate Term Technical Event Name - The name of the Technical Event® pattern or indicator identified by Recognia.

-

Long Term Event Score - Recognia's proprietary score of the event on a scale of 0 to 5. Events are assigned a score upon their confirmation - the value is assigned differently depending on the type of event. For example, for classic patterns, the value depends on how symmetrical the pattern is and how closely it matches the textbook definition. For indicator and oscillator events, the value is based on the amount of penetration.

-

Long Term Event Trade Type - Potential trading opportunity type based on the event. Possible values are: Long, Short, and Undefined. This data is provided for information purposes only and is not intended as a recommendation to buy or sell securities.

-

Long Term Technical Event Class - The class for the event. Technical events are placed into one of four classes:

-

Classic Patterns, such as Double Top, Flag, Head and Shoulders Top, etc.

-

Short-term Patterns, such as Shooting Star, Engulfing Line, Hammer, etc.

-

Indicator, such as double and triple moving average crossovers.

- Oscillator, such MACD, RSI, Fast Stochastic, etc.

-

-

Long Term Technical Event Date - The date the event formed. All dates are of the form: YYYY-MM-DD.

-

Long Term Technical Event Name - Name of the Technical Event® pattern or indicator identified by Recognia.

-

Short Term Event Score - Recognia's proprietary score of the event on a scale of 0 to 5. Events are assigned a score upon their confirmation - the value is assigned differently depending on the type of event. For example, for classic patterns, the value depends on how symmetrical the pattern is and how closely it matches the textbook definition. For indicator and oscillator events, the value is based on the amount of penetration.

-

Short Term Event Trade Type - Potential trading opportunity type based on the event. Possible values include: Long, Short, and Undefined. This data is provided for information purposes only and is not intended as a recommendation to buy or sell securities.

-

Short Term Technical Event Class - The class for the event. Technical events are placed into one of four classes:

-

Classic Patterns such as Double top, Flag, Head and Shoulders Top, etc.

-

Short-term Patterns, such as Shooting Star, Engulfing Line, Hammer, etc.

-

Indicator, such as double and triple moving average crossovers.

-

Oscillator, such as MACD, RSI, Fast Stochastic, etc.

-

-

Short Term Technical Event Date - The date the event formed. All dates are of the form: YYYY-MM-DD.

-

Short Term Technical Event Name - Name of the Technical Event® pattern or indicator identified by Recognia.