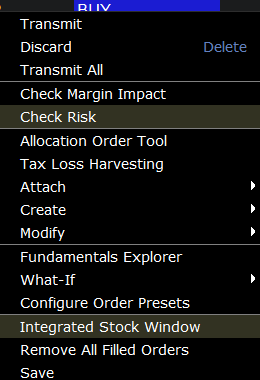

Right Click on the Order Management Line

Instructions

To see a right-click menu, select an order management line and then click the right mouse button. Select an item from a right-click menu using your mouse. The right-click menu on an Order Management line contains the following menu commands:

| Menu Command | Description |

|---|---|

| Transmit | Transmits the selected order. |

| Discard | Removes the order from the page. |

| Transmit All | Transmits all orders on the current Quote Monitor page. |

| Check Margin Impact | Opens the Preview Order box which shows the order parameters, commissions and margin impact of the order before you transmit. |

| Check Risk | Opens the Risk Navigator tool which allows you to view position risk. |

| Allocation Order Tool | Quickly open the Allocation Order Tool which allows you to manage order allocations to reduce or exit a position, increase or open a new position, or rotate positions. |

| Tax Loss Harvesting | Opens the Tax Loss Harvesting window which allows you to project, preview, and allocate trades to take advantage of potential capital losses for all or some of your invested clients. |

| Attach |

Bracket Orders - Attach a set of opposite-side orders that "bracket" the current order in an attempt to limit loss. Target Limit - Attach an opposite side limit order. Target Relative/Pegged - Attach an opposite side relative order. Stop - Attach a Stop order to the selected order. Stop Limit - Attach a Stop Limit order to the selected order. Trailing Stop - Attach a Trailing Stop order to the selected order. Trailing Stop Limit - Attach a Trailing Stop Limit order to the selected order. Adjustable Stop - Attach an adjustable stop order, which will be modified to the adjusted order type when the stop trigger is hit. Auto Combo Limit - Flips the parent combination order and submits an opposite side limit order. You must enter a limit price. For example, if you have a BUY calendar spread, the parent order looks like this: Buy 1 XYZ OPT NOV06 80.0 CALL Sell 1 XYZ OPT OCT06 80.0 CALL When you attach an auto combo limit, Sell 1 XYZ OPT NOV06 80.0 CALL Buy 1 XYZ OPT OCT06 80.0 CALL You must enter a limit price. Since the attached order is dependent on the parent order, it will not be transmitted until the parent order executes. Auto Combo Market - Flips the parent combination order and submits an opposite side market order. See above. Beta Hedge - Attach a Beta Hedge Order to the selected order. FX Order - Attach an FX Order to the selected order. Pair Trade - Attach a Pair Trade to the selected order. |

| Create |

Duplicate - Creates another order management line with the same order parameters directly below the selected line. Scale Orders - Creates a series of orders at incrementally decreasing/increasing price intervals. |

| Modify |

Order Ticket - Opens the Order Ticket window where you can modify parameters before you transmit the order. Condition - Opens the Conditional tab on the Order Ticket where you can create or modify a conditional order, which is an order that will automatically be submitted or cancelled ONLY IF specified criteria for one or more defined contracts are met. |

| Fundamentals Explorer | Opens the Fundamentals Explorer window which is designed to help you better gauge the fundamental value of an asset. |

| What if | Creates a new what-if scenario in Risk Navigator that includes the proposed order(s). |

| Configure Order Presets | Opens the Presets configuration page for the selected ticker/instrument type. Note that any changes you make to the order presets do not apply to the current existing order. |

| Integrated Stock Window | Opens the ISW. |

| Remove All Filled Orders | Removes filled orders from the page. |

| Save | Saves the order. |