Risk Dashboard

Instructions

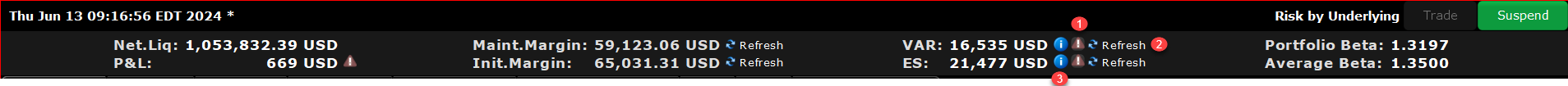

The Risk Dashboard is pinned along the top of the product tabsets, and is available for what-if as well as active portfolios. The values are calculated on demand for what-if portfolios.

To hide or display the Dashboard please take the steps outlined below.

-

From the View menu, select Risk Dashboard.

The dashboard provides at-a-glance account information including:

-

Warning Icon: Click to see a list of positions excluded from the VAR and Expected Shortfall calculations.

-

Refresh Icon: Click to refresh calculations. The icon only displays if there has been a change in the portfolio that is not currently reflected in the VAR and Expected Shortfall calculations.

-

Information Icon: Hover your curser to see details.

| Dashboard Field | Description |

|---|---|

| Net Liquidation |

The total Net Liquidation value for the account. This value is taken from the Total Net Liquidation Value field in the Account Information window. |

| P&L |

The total daily P&L for the entire portfolio. This value is taken from the "All Contracts" level of the Risk Navigator P&L tab in the P&L for the Day field. |

| Maintenance Margin |

Total current maintenance margin. Use this to see margin for a hypothetical what-if portfolio as well as for your current portfolio. This value is taken from the Margin Requirements section in the Account Information window. |

| Initial Margin |

Total initial margin requirements. Use this to see margin for a hypothetical what-if portfolio as well as for your current portfolio. This value is taken from the Margin Requirements section in the Account Information window. |

| VAR | Shows the Value at Risk for the entire portfolio. VAR is a measure of the largest anticipated loss over a specified time period and confidence level, where the confidence level provides the probability that the VAR measure will not be exceeded. |

| Expected Shortfall (ES) | Expected Shortfall (average value at risk) is the expected return of the portfolio in the worst case; the average of all losses which are greater or equal than VaR. |

| Average Beta | The sum of the raw beta (the beta on the underlying) beta across the entire portfolio divided by the number of positions. |

| Portfolio Beta | The sum of the weighted beta for all positions. This sum is also reflected in the top total row of the Weighted Beta column. |