Trade US Corporate Bonds

Instructions

Use the US Corporate Bonds scanner to find contracts to add to your trading page.

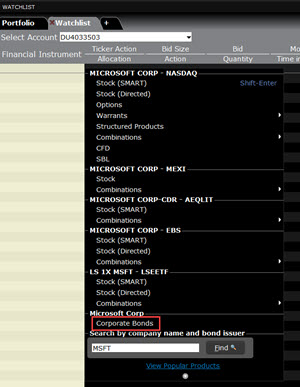

Add Corporate Bonds Market Data to your Trading Page

-

Enter an underlying symbol and hit enter, then select the Bond instrument from the selection list.

-

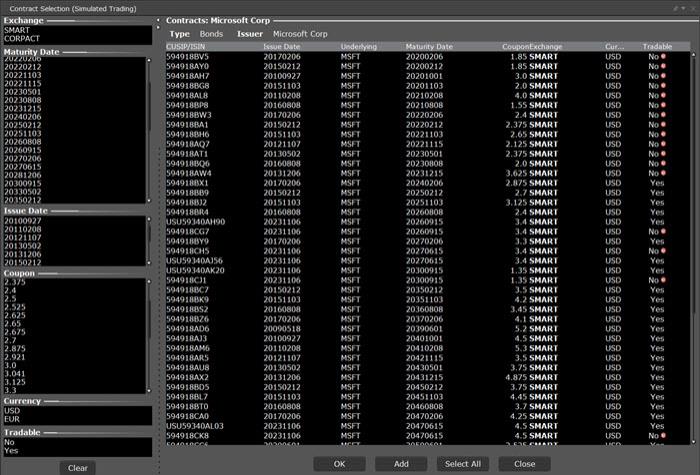

In the Contract Selection box, use the Maturity date, Issue Date and Coupon filter lists to narrow your display choices.

-

Select the contract(s) from the right pane and click OK.

-

If you want to add multiple contracts with different maturities, click Add instead of OK. This will add the selected contracts to your trading screen and then allow you to select a different maturity date and add more contracts. Click OK to close the box.

Market data for the bond is displayed on the trading page. The following information is noted in the Description field of the market data line:

-

Instrument type - For treasuries. Labeled as bond, note, or bill.

-

Coupon - the interest rate used to calculate the amount you will receive as interest payments over the course of a year.

-

Maturity date - the date on which the issuer must repay the face value of the bond.

-

CUSIP number - a nine-character ID for a specific security.

-

Bond rating - Identifies the credit rating of the issuer. A higher credit rating generally indicates a less risky investment. The bond ratings are from Moody's and S&P, respectively.

To see contract details, double-click on a market data line.

Trade Corporate Bonds

-

Click the Ask to create a BUY order; click the Bid to create a SELL order.

-

Click “T” to transmit the order.

Note: Place a non-marketable limit order that meets or exceeds the best quote and your order will be included in the market data shown to other