Trade US Municipal Bonds

Instructions

US residents can trade municipal bonds in

Add Municipal Bond Market Data to your Trading Page

-

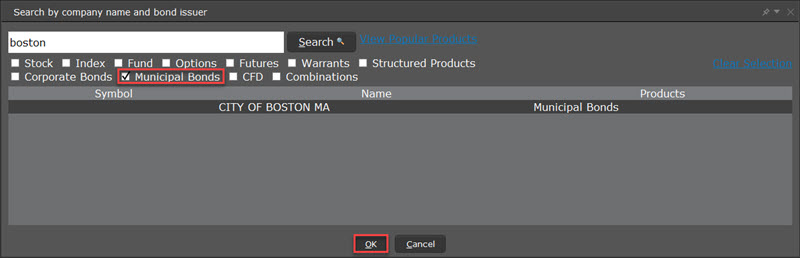

In the Underlying field, enter the municipality name, for example Boston.

-

From the list of results, uncheck all asset types except munis.

-

Select the muni bond(s) from the remaining results and click OK.

-

The muni data is added to your trading window.

Note: Add the Company Name field to your page layout to see the municipality name. The Underlying field only displays the CUSIP.

Trade Municipal Bonds

-

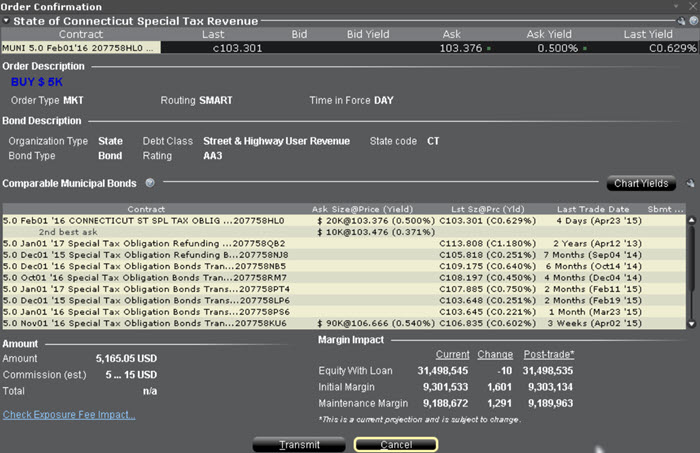

Click the Ask to create a BUY order; click the Bid to create a SELL order.

-

Click “T” to transmit the order.

-

In the Comparable Bonds screen, submit an RFQ, compare your bond to others that are comparable, and transmit your order.

Notes on Comparable Bonds

MSRB Rule G-18 requires each broker, dealer and municipal securities dealer, when executing a transaction in municipal securities for or on behalf of a client, to make a reasonable effort to obtain a price for the client that is fair and reasonable in relation to prevailing market conditions. Since

To qualify as “comparable” to your target bond for price comparison, a bond must meet all of the following criteria:

-

It must have the same organization type, bond type, debt class and rating as the target bond.

-

It must have identical watch list status as the target bond (either “none”, or “marked for upgrade” or “marked for downgrade”).

-

The difference between the target bond's coupon rate and the associated bond's rate must be 50 basis points or less.

-

The difference in maturity date between the target bond and the associated bond must be one year or less.