View Tax Lots

Instructions

Use the Tax Optimizer page to manage your stock, option, bond, warrant, and single-stock future gains and losses for tax purposes. Specifically, the Tax Optimizer lets you select one of several tax lot-matching algorithms to:

- Change the default tax lot-matching method for the current or prior trading day.

- Manually match specific sales to open tax lots for the current or prior trading day.

Futures (but not Single Stock Futures) and options on futures always use FIFO.

In addition, you can view a year-to-date (YTD) summary screen, which shows your YTD short-term and long-term profit and loss, unrealized profit and loss, and total profit and loss by symbol. You can change your account default lot-matching method and today's lot-matching method from the YTD summary.

All profit and loss amounts in the Tax Optimizer are converted to the base currency of your account. However, prices are NOT converted to your base currency.

-

Click Menu in the top left corner > Trade > Orders and Trades.

-

Alternatively, click the PortfolioTab

Your recent Orders and Trades will appear on the screen.

-

-

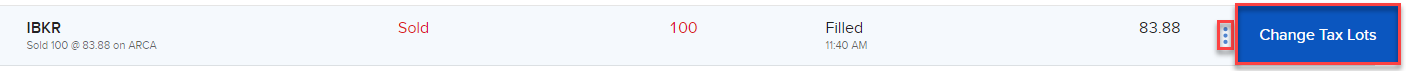

Under the Trades section, select the blue

icon to the right of the trade you are looking to change the tax lots for.

icon to the right of the trade you are looking to change the tax lots for. -

Select View Tax Lots.

-

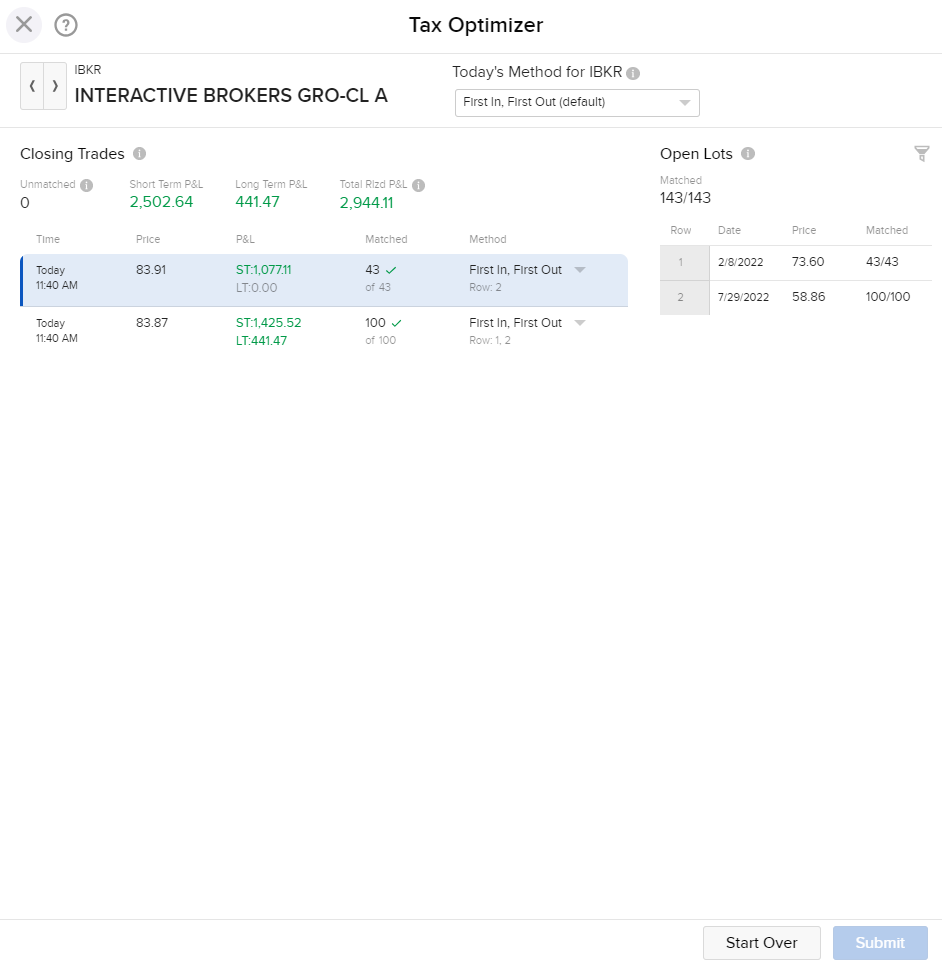

The Tax Optimizer screen will populate.

-

The Closing Trades will populate on the left hand side and the Open Lots will populate on the right hand side.

-

Select the Open Lot you would like to apply to the Closing Trade.

-

Select Submit to save these changes.

Note: If you log out of Portal while the Tax Optimizer is open, you will not be able to save your changes in the Tax Optimizer.

The Tax Basis Declaration page, available in the reporting section of Client Portal, lets you change the default tax lot-matching method for your account. This function in the Tax Optimizer replaces the same function on the Tax Basis Declaration page, so you will no longer have access to the Tax Basis Declaration page in Client Portal. You will be able to change the default tax-lot matching method on the Tax Optimizer page in Client Portal OR in the Tax Optimizer.

Most taxpayers recognize capital gain or loss for tax purposes when they close a position. If an asset is sold for less than its purchase price, then the difference is considered a capital loss. If an asset is sold for more than its purchase price, then the difference is considered a capital gain. Gain or loss is equal to proceeds minus the adjusted cost basis of the position.

Gain or Loss = Proceeds – Adjusted Cost Basis for Each Tax Lot

Gains and losses resulting from trades are based on “matching lots.” A tax lot is the record of details of a purchase. Each acquisition of a security, on a different date or at a different price, constitutes a tax lot. Tax lots are used to determine the cost basis and holding period when you dispose of securities.

When you sell a security, if you don’t sell all of the shares that you own you must match the sale to a tax lot or lots in order to determine your gain or loss as well as your holding period.

The IRS allows two basic methods for matching tax lots: First in, First out (FIFO) and Specific Identification.

-

FIFO is the default method that will be applied if you do not choose another method. Under FIFO, the sale is matched with the earliest purchased lot or lots available.

-

Specific Identification allows a trader to match sales with purchases in a different order than FIFO, as long as he or she can show that the tax lots were selected at the time of the sale. The Tax Optimizer lets you choose a method until 8:30 PM ET on the day of the trade.

The Tax Optimizer lets you use Specific Identification directly by letting you change the tax lot-matching method for a specific position, and manually select tax lots to match. You can also use Specific Identification by choosing among several available lot matching algorithms.

Once lots have been matched, the gain or loss for that lot equals the proceeds minus the adjusted cost basis for each lot.

The period from the purchase to the sale is the holding period.

-

Gains or losses from securities held for one year or less are generally short-term and are taxed at ordinary income rates.

-

Gains or losses from securities held for more than one year are long-term and may be eligible for preferred rates.

The Tax Optimizer lets you manage your trades' gains and losses for tax purposes by changing a tax lot's matching method. The system default is First In, First Out (FIFO). Choose from the following tax lot matching methods in Tax Optimizer:

First In, First Out (FIFO)

The default method for matching tax lots. Sales are paired with the earliest purchases sequentially. FIFO assumes that assets remaining in inventory are matched to the most recently purchased or produced assets. FIFO is always used for futures, options on futures and cryptocurrencies.

Last In, First Out (LIFO)

Each sale is paired with the most recent possible purchase. LIFO assumes that an entity sells, uses or disposes of its newest inventory first.

Highest Cost

Seeks to maximize losses while minimizing gains. This method first looks at all possible ways to match a closing trade to an open lot. Sales are paired based on the following rules:

-

It looks at all possible options for matching a closing trade to an open lot.

-

If any possible matches would result in a loss, the method chooses the match that results in the largest possible loss.

-

If no possible match would result in a loss, the method chooses the match that results in the smallest possible gain.

Maximize Long Term Gain (MLG)

-

Maximize Long-Term Gain per share

-

If no Long Term gain, maximize Short Term gain per share

-

If no Long Term or Short Term gain, realize and minimize Short Term loss per share

-

If no Short Term loss, realize and minimize Long Term loss per share

Maximize Long Term Loss (MLL)

-

Maximize Long-Term Loss per share

-

If no Long Term loss, maximize Short Term loss per share

-

If no Long Term or Short Term loss, realize and minimize Short Term gain per share

-

If no Short Term gain, realize and minimize Long Term gain per share

Maximize Short Term Gain (MSG)

-

Maximize Short-Term Gain per share

-

If no Short Term gain, maximize Long Term gain per share

-

If no Short Term or Long Term gain, realize and minimize Long Term loss per share

-

If no Long Term loss, realize and minimize Short Term loss per share

Maximize Short Term Loss (MSL)

-

Maximize Short-Term Loss per share

-

If no Short Term loss, maximize Long Term loss per share

-

If no Short Term or Long Term loss, realize and minimize Long Term gain per share

-

If no Long Term gain, realize and minimize Short Term gain per share

Specific Lot

Lets you see all of your tax lots and closing trades, then manually match lots to trades. The Specific Lot method is available in Method for All and per transaction, but it cannot be set as the Default Match Method.

This topic presents an example of a group of trades and what the gain and loss would be under each of the following seven lot-matching methods:

|

Basic Scenario A customer makes the following purchases:

The same customer makes the following sales:

|

Under the FIFO lot-matching method:

-

Sale 1 is matched with Lot 1 for a long-term gain of $15.

-

Sale 2 is matched with Lot 2 for a long-term loss of $5.

-

Sale 3 is matched with Lot 3 for a short-term loss of $15.

The customer therefore has a net long-term gain of $10, a net short-term loss of $15, and a basis of $20 and holding period starting July 15, 2025 for the remaining open lot.

Under the LIFO lot-matching method:

-

Sale 1 is matched with Lot 4 for a short-term gain of $5.

-

Sale 2 is matched with Lot 3 for a short-term gain of $5.

-

Sale 3 is matched with Lot 2 for a long-term loss of $25.

Customer has a net long-term loss of $25, a net short-term gain of $10, and a basis of $10 and holding period starting January 15, 2025 for the remaining open lot.

Under the Maximize LT Gain lot-matching method:

-

There are four possible matches for Sale 1:

-

Lot 1 would result in a long-term gain of $15

-

Lot 2 would result in a long-term loss of $15

-

Lot 3 would result in a short-term loss of $5

-

Lot 4 would result in a short-term gain of $5

The only possible long-term gain for Sale 1 is Lot 1, so Sale 1 would be matched with lot 1 for a long-term gain of $15.

-

There are three possible matches for Sale 2:

-

Lot 2 would result in a long-term loss of $5.

-

Lot 3 would result in a short-term gain of $5.

-

Lot 4 would result in a short-term gain of $15.

None of the possible matches results in a long-term gain. The second priority for the Maximize LT Gain matching method is to maximize short-term gain.

Sale 2 would be matched with Lot 4 for a short-term gain of $15.

-

There are two possible matches for Sale 3:

-

Lot 2 would result in a long-term loss of $25.

-

Lot 3 would result in a short-term loss of $15.

None of the possible matches results in a long-term gain and none of the possible matches results in a short-term gain, so the matching method chooses based on its third priority, minimize short-term loss.

Sale 3 is matched with Lot 3 for a short-term loss of $15.

Customer has a net long-term gain of $15, no net short-term gain or loss, and a basis of $40 and holding period beginning on March 15, 2025 for the remaining open lot.

Under the Maximize LT Loss lot-matching method:

-

There are four possible matches for Sale 1:

-

Lot 1 would result in a long-term gain of $15.

-

Lot 2 would result in a long-term loss of $15.

-

Lot 3 would result in a short-term loss of $5.

-

Lot 4 would result in a short-term gain of $5.

The only possible long-term loss for Sale 1 is Lot 2, so Sale 1 is matched with Lot 2 for a long-term loss of $15.

-

There are three possible matches for Sale 2:

-

Lot 1 would result in a long-term gain of $25.

-

Lot 3 would result in a short-term gain of $5.

-

Lot 4 would result in a short-term gain of $15.

None of the possible matches results in a long-term loss. The second priority for the Maximize LT Loss matching method is to maximize short-term loss. None of the possible matches results in a short-term loss.

The third priority for the Maximize LT Loss macro is to minimize short-term gain.

Sale 2 is matched with Lot 3 for a short-term gain of $5.

-

There are two possible matches for Sale 3:

-

Lot 1 would result in a long-term gain of $5.

-

Lot 4 would result in a short-term loss of $5.

None of the possible matches results in a long-term loss. The second priority for Maximize LT Loss is maximize short-term loss.

Sale 3 is matched with Lot 3 for a short-term loss of $15.

Customer has a net long-term loss of $15, no net short-term gain or loss and a basis of $10 and holding period starting January 15, 2025 for the remaining open lot.

Under the Maximize ST Gain lot-matching method:

-

There are four possible matches for Sale 1:

-

Lot 1 would result in a long-term gain of $15.

-

Lot 2 would result in a long-term loss of $15.

-

Lot 3 would result in a short-term loss of $5.

-

Lot 4 would result in a short-term gain of $5.

The only possible short-term gain for Sale 1 is Lot 4, so Sale 1 would be matched with lot 4 for a short-term gain of $5.

-

There are three possible matches for Sale 2:

-

Lot 1 would result in a long-term gain of $25.

-

Lot 2 would result in a long-term loss of $5.

-

Lot 3 would result in a short-term gain of $5.

The only possible short-term gain for Sale 1 is Lot 3, so Sale 2 is matched with Lot 3 for a short-term gain of $5.

-

There are two possible matches for Sale 3:

-

Lot 1 would result in a long-term gain of $5.

-

Lot 2 would result in a long-term loss of $25.

None of the possible matches results in a short-term gain. The second priority for the Maximize ST Gain matching method is to maximize long-term gain.

Sale 3 is matched with Lot 1 for a long-term gain of $5.

Customer has a net long-term gain of $5, a net short-term gain of $10, and a basis of $40 and holding period beginning on March 15, 2025 for the remaining open lot.

Under the Maximize ST Loss lot-matching method:

-

There are four possible matches for Sale 1:

-

Lot 1 would result in a long-term gain of $15.

-

Lot 2 would result in a long-term loss of $15.

-

Lot 3 would result in a short-term loss of $5.

-

Lot 4 would result in a short-term gain of $5.

The only possible short-term loss for Sale 1 is Lot 3, so Sale 1 is matched with Lot 3 for a short-term loss of $5.

-

There are three possible matches for Sale 2:

-

Lot 1 would result in a long-term gain of $25.

-

Lot 2 would result in a long-term loss of $5.

-

Lot 4 would result in a short-term gain of $15.

None of the possible matches results in a short-term loss. The second priority for the Maximize ST Loss matching method is to maximize long-term loss.

Sale 2 is matched with Lot 2 for a long-term loss of $5.

-

There are two possible matches for Sale 3:

-

Lot 1 would result in a long-term gain of $5.

-

Lot 4 would result in a short-term loss of $5.

Sale 3 is matched with Lot 4 for a short-term loss of $5.

Customer has a net long-term loss of $5, net short-term loss of $10 and a basis of $10 and holding period starting January 15, 2025 for the remaining open lot.

| Basic Scenario

A customer makes the following purchases:

On December 15, 2025, the same customer makes the following sales and selects Highest Cost as the lot-matching method for ABC:

|

There are three possible matches for Sale 1:

-

Lot 1, which would result in a $300 (long-term) gain.

-

Lot 2, which would result in a $100 (short-term) loss.

-

Lot 3, which would result in a $500 (short-term) loss.

Sale 1 is matched with Lot 3, because that match results in the largest possible loss.

There are two possible matches for Sale 2:

-

Lot 1, which would result in a $300 (long-term) gain.

-

Lot 2, which would result in a $100 (short-term) gain.

Sale 1 is matched with Lot 2, because that match results in the smallest possible gain.

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.