Client Portal 2023 Release Notes

Redesigned Order Ticket with Advisor Allocations

We’ve redesigned the Client Portal Order Ticket to use a horizontal instead of a vertical layout which adapts better to different screen sizes. The new layout also helps users avoid having to scroll up and down to find fields as they create an order. The vertical orientation is still available from the “Quick” order ticket that displays on the right side of the Client Portal interface.

Changes to the Order Ticket are also available in the Advisor Portal, along with support for Advisor Allocations. Advisors can now choose an existing Allocation Group from the Account/Group drop down. The default Allocation Method for the selected group is displayed in the order line and can be modified on a per-order basis as needed. Coming Soon: The ability to create new Allocation Groups in Client Portal.

NOTE: These updates are being released to clients gradually over the next few weeks.

Support for Trailing Orders

Client Portal now supports Trailing Stop and Trailing Stop Limit orders.

Bug Fixes

-

Previously the value shown in the “Buying Power” field was being cut off. This has been fixed to show the full value.

-

We’ve added a Total Amount field to the Trades section of the Orders & Trades screen which shows the transaction total minus fees.

-

The privacy toggle has been added back to Quote Details page.

-

For users with multiple accounts, sometimes the “Deposit” button was linking to an incorrect account.

-

When the Order Ticket is populated with a symbol and user opens Quote Details for a different ticker, the Symbol Search field was incorrectly showing the ticker from the Order Ticket.

-

The Overnight contract was incorrectly being removed from a Watchlist if the user removed an instrument using the same symbol that was not overnight.

-

Volume indicator has been disabled for those security types that do not support it, including Forex, commodities, and bonds.

-

Issues with the "Convert Currency" feature have been fixed.

-

Forex CFD contracts were not being returned using the Search feature. This has been fixed.

-

Advisors: The Manual Order Time (MOT) field is missing on the Order Ticket for some accounts. This has been fixed.

-

You can now select Event Contracts from the type-ahead list of asset types when searching for an instrument. Previously Event Contracts could only be searched by the exact CONID.

-

Bug Fixes:

-

Overnight TIF selection now works.

-

The Order Ticket for Cryptocurrencies now correctly shows Buying Power as the current balance in the client’s crypto segment.

-

The Bid and Ask prices shown for the stock symbol within the Option Chain tool was not auto-refreshing.

-

When in Wide Layout mode, the first time a chart was loaded it was getting stuck.

-

Tax Lots in Fractions was not working correctly.

-

News & Research Update

A completely re-imagined News & Research interface has been released to Client Portal and will soon be available across all IBKR trading platforms. This new interface allows you to create custom feed views of the news you want to read, in the layout style that you prefer.

-

Custom views let you browse magazine-style, or view headlines for focused skimming. To toggle between views, use the Layout icon on the far right.

-

Use Advanced Search to find news by Provider, Importance, Source, Asset Class, Article Length (read time), type of media, language, date published and more!

-

Use Browse criteria to filter news by asset class and topic preference.

-

Tabbed filters in Portfolio and Watchlist feeds that let you see just the types of news format you prefer, like traditional breaking news, institutional research, or opinions and commentary.

To access this new layout, from the Research menu select News & Research. This new presentation is easy to navigate and provides a clean, modern interface.

Capture Market Opportunities Any Time with Overnight Trading

Now you can react to market-moving news when it's convenient for you using the Overnight trading feature. Overnight Trading Hours are from 8:00 pm ET to 3:50 am ET, with the first session beginning on Sunday at 8:00 pm ET and the last session ending on Friday at 3:50 am ET and trades executed between 8:00 pm and 12:00 am will carry a trade date of the following trade day.

All clients with U.S. Stock trading permission will have access to US Overnight Trading. Note that this feature cannot be used in conjunction with Outside RTH or with the Price Management algo, and is currently only available for Limit orders.

To use this feature, in the Order Ticket select Overnight from the Time in Force list.

Orbisa Securities Lending Analytics Dashboard

Now get access to the same valuable short/securities lending data for US equities historically available only to banks, broker-dealers and institutional investors. The Orbisa Securities Lending Analytics Dashboard in Fundamentals Explorer gives you professional-level access to key metrics and data to see when borrowing demand is increasing or decreasing so you're better able to gauge in which direction market sentiment is trending. Orbisa data includes 189,000 unique securities over more than 50 global markets.

With the Orbisa Securities Lending Analytics Dashboard you can*:

-

View up to eight trend metrics including:

-

Utilization: The total quantity of the security on loan divided by the total inventory of the security. Expressed as percentage.

-

Lender Depth: A scale to indicate the number of lenders with an outstanding borrow in the name. 1: 0-5 lenders, 2: 6-10 lenders, 3: 11 or more lenders.

-

Average Duration: The volume weighted average duration of all open loans in the security based on Trade Date, expressed in calendar days.

-

Borrow Depth: A scale to indicate the number of lenders with an outstanding borrow in the name. 1: 0-5 lenders, 2: 6-10 lenders, 3: 11 or more lenders.

-

Days to Cover: For equity securities, the number of shares on loan in a security for the business date divided by the 30 day trading average in the cash market.

-

On Loan Quantity: Total quantity of the security on loan.

-

On Loan Value: Total value (USD) of the security on loan.

-

Short Interest Indicator: For equity securities, the number of shares on loan divided by the total number of shares in the public float, expressed as a percentage. For fixed income securities, the size on loan divided by the issuance size, expressed as a percentage.

-

-

Use the "Compare" chart to compare short-selling data of two companies.

-

Compare trends across multiple companies side by side using custom date ranges going back as far as 12 months.

*Some listed features require a subscription. Subscribe to Orbisa Premium in-app and get a 30-day Free Trial!

To use the Orbisa dashboard, from the Research menu select Fundamentals Explorer, then choose the Securities Lending tab.

The Orbisa dashboard is available in Desktop TWS, Client Portal, IBKR Mobile, and in the soon-to-be-released IBKR Desktop.

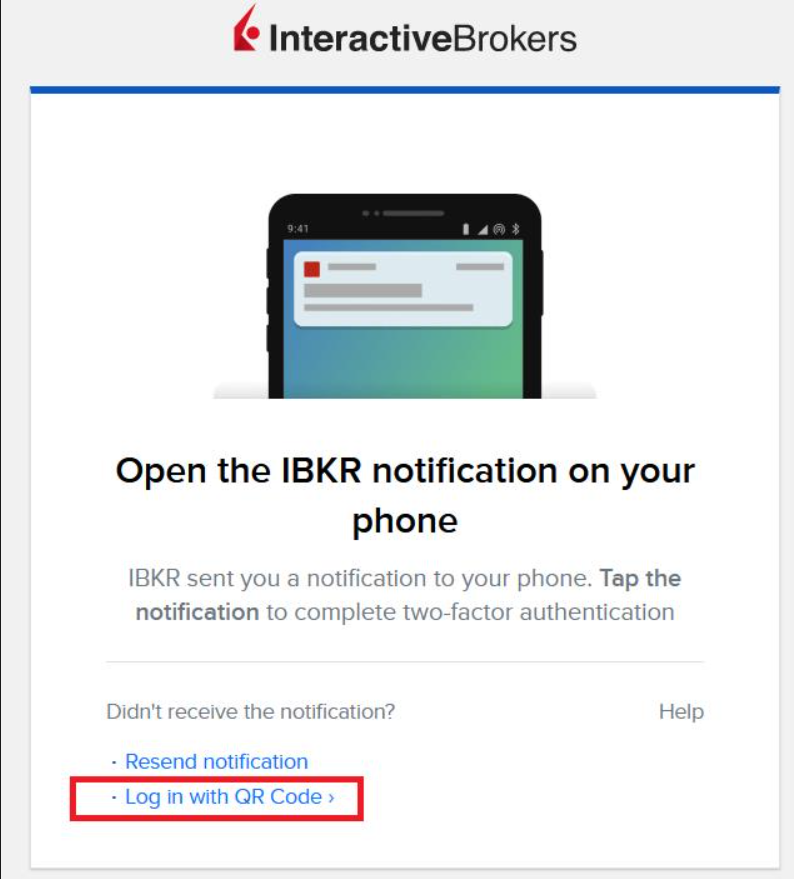

QR Code Login Support

Users who use two-factor authentication via IB Key can now log in using a QR code in cases where the IB Key notification is not received. To use, click "Log in with QR Code" directly below the "Resend notification" link in Client Portal.

Capture the displayed QR code with your device camera then tap the link to connect to IBKR. Follow instructions to provide the required security element (Face ID, Fingerprint, passcode) for your device to complete authentication.

Set Default Account in Order Entry

Click Default Account in the Order Ticket account selector, then click the star icon next to the account to set as the default.

Fixes

-

Issues experienced when submitting currency conversion via the Convert Currency tab have been fixed.

-

The IB FYI "Unexercised Option Loss Prevention Reminder" was unintentionally disabled. This has been fixed.

-

Cost Basis display on the Portfolio page has been fixed.

-

Articles listed under "For You" were only opening for English language. This has been fixed.

-

Improved FX CFD symbol search to simplify trading in Order Ticket.

-

Indicator added for AM Expiring Options in Quote Details header, and on Exercise/Lapse screen

-

New Feature Announcement Badge.

-

Contract search updated to add a link to PRIIPS for relevant contracts only.

-

Improvements to New Features Pool to enhance feedback.

-

Improved discoverability of US Overnight Trading Session during the overnight market in other regions.

-

CP WEB API: Market Data support added for combo contract IDs.

-

Glint Bond support for trading is now available.

- We now suppoort fractional FX Conversion trades .

-

Bond charts yield and price display have been improved.

-

Advisor Portal’s Consolidated Navigation is now the default which has replaced the Legacy Navigation.

-

Morningstar

-

Included the appropriate Morningstar widget in the URL when entering fundamentals explorer.

-

Overall improvement of Tax Optimizer navigation.

-

-

CP WEB API: Added new sections for the /reuters/sections API.

- Customer Web API Release 234 version – Improvement release

- CP WEB API: New endpoints for signatures-and-owners returning list of account’s signatories and owners