Money Market Tab

Instructions

The Money Market tab display ultimate underlyings categorized as Financial Index” or “Financial Notional”. The product categories of FUT and FOP are either “Fixed Income” or “Money Market.” Money Market positions are grouped by currency.

The following reports are available for Money Market products in your portfolio:

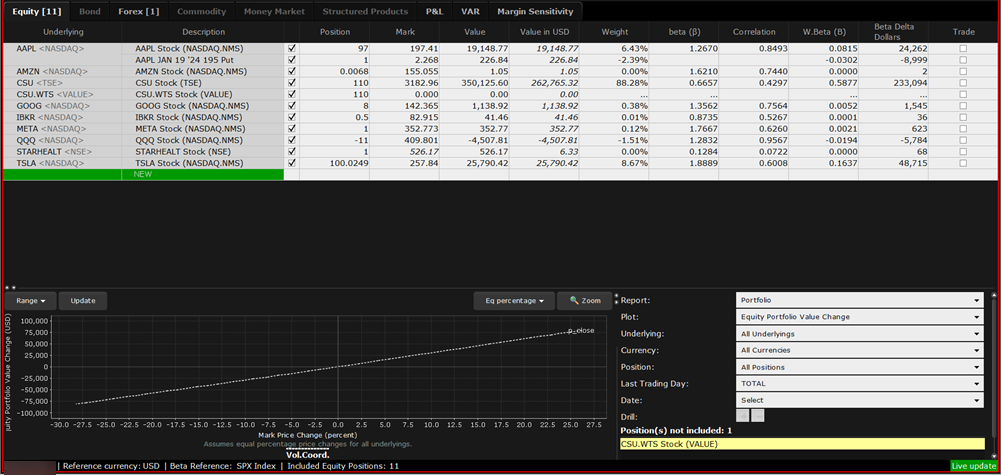

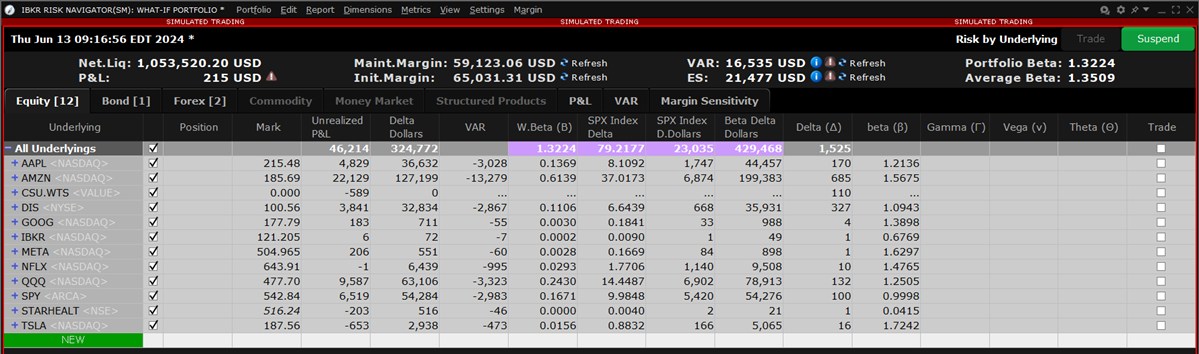

Use the Portfolio Report to view risk and exposure for all positions in your portfolio. You can view totals for specific risk measures (where applicable) in the Risk by Underlying report.

To view this report, please take the steps outlined below.

-

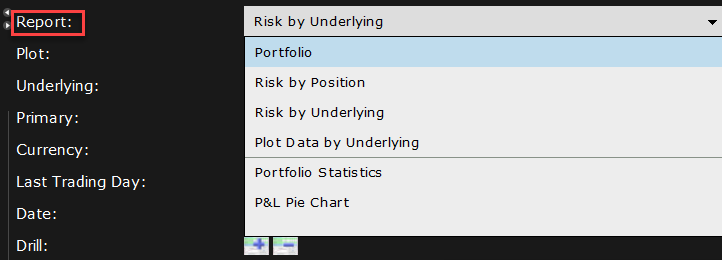

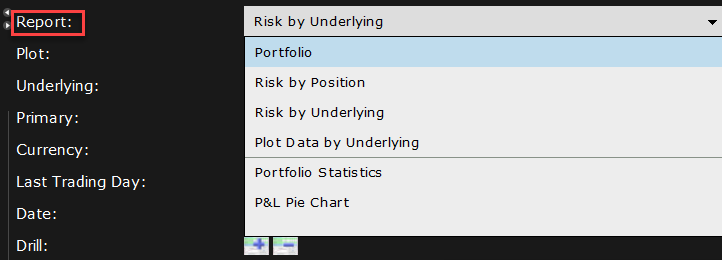

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio

-

Use the Plot, Underlying, Category, Currency, and Last Trading Day fields in the Report Selector to further customize the report display.

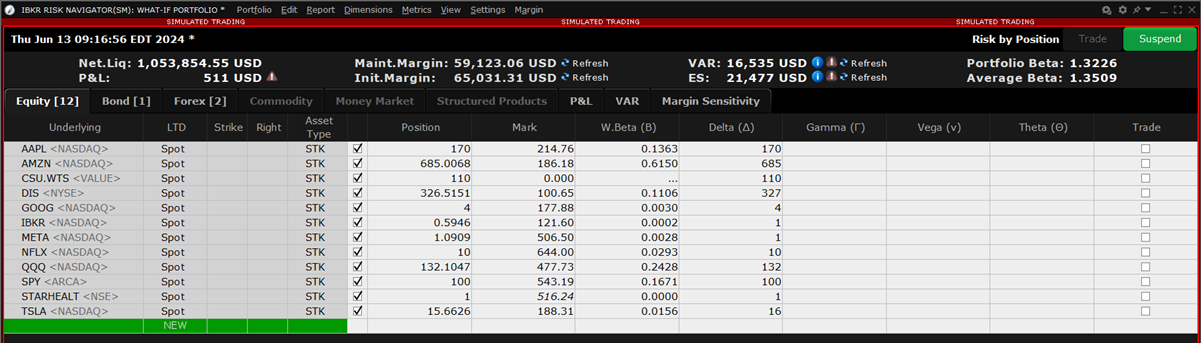

The Risk by Position report displays risk measures calculated for each position, by underlying.

To view the Risk by Position Report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Position.

-

Use the Underlying and Measure lists to define your report criteria.

If you elect to view metrics for only a single underlying, the report will not display the Underlying column as shown above.

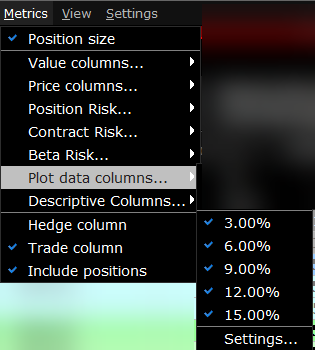

Use the Metrics menu to display available risk metrics.

The Risk by Underlying report is designed to open by default when you open the

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Underlying.

-

Use the Underlying and Measure lists to define your report criteria.

Use the Metrics menu to display available risk metrics.

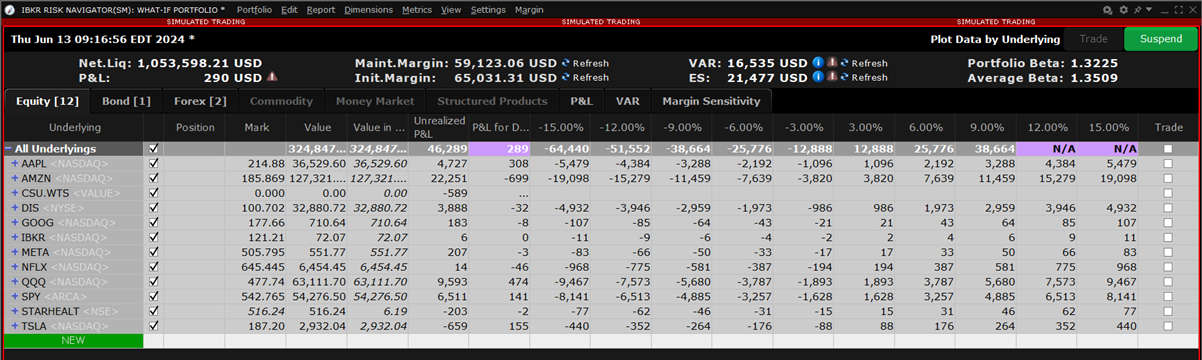

Select the Plot Data Report to view values for the symmetric data slicers in the P&L Plot. By default the slicers are spaced at +/- 3%, 6%, 9%, 12% and 15%.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Plot Data by Underlying

-

If you have the cross-hair activated in the P&L plot using the right-click menu, when you hold your mouse over a line in the plot its value is displayed. Keep in mind that the domain of the P&L plot is determined by the intersection of the valid domains for each instrument in the portfolio. This may restrict the domain of accessible values, especially for beta-weighted plots.

Change the Interval Between Plot Slicers

-

From within the plot, drag any of the blue slicer lines in an out to change the interval. Note that the corresponding negative/positive line will also adjust.

-

Using the menu, from the Metrics menu select Plot data columns and then select Settings to adjust the slicers.

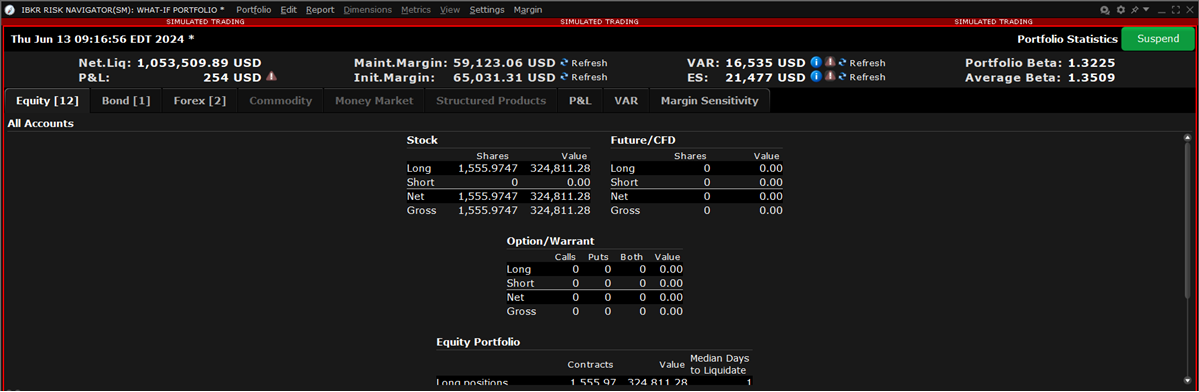

The Portfolio Statistics report shows two summary tables: one for all Stock and Futures positions, and one for all Options positions.

The Stock and Future summaries shows all long positions, all short positions, the net and gross units, and their corresponding total value.

The Option/Warrant summary shows all long calls, long puts, the sum of both calls and puts, and the total value; all short calls, short puts, the sum of both calls and puts, and the total value; the net units for calls, puts, the sum of both and the total net value; and gross units for calls, puts the sum of both, and the corresponding net value.

The Cash Balance summary shows you total in base, and all cash totals for currencies in your portfolio.

The Opaque Positions list displays positions for which risk cannot be calculated. While these positions are not included in any risk reports, the market value is included in the Portfolio Value version of the P&L graph.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio Statistics.

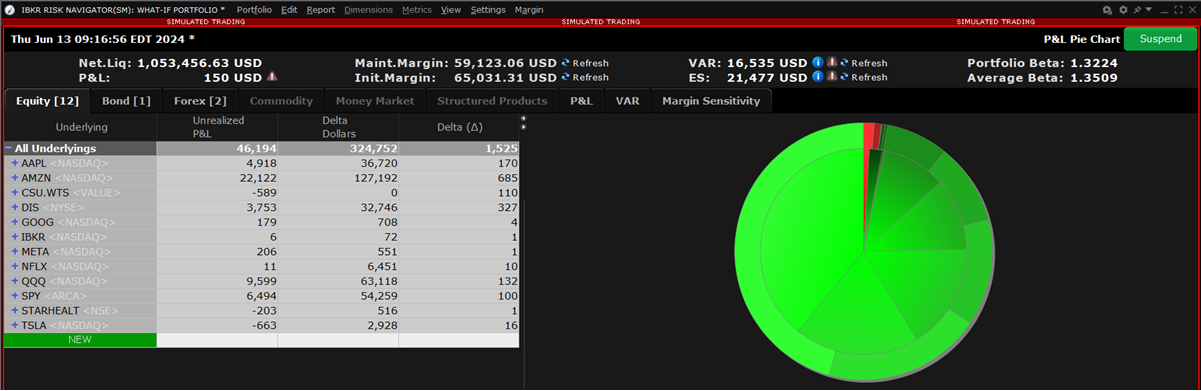

The P&L Pie Chart shows the position Delta and P&L for all positions in your portfolio relative to the total portfolio. Use default color coding to see losing positions in red, profiting positions in green and neutral positions in blue, or change the coloring to display each position using a different color.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select P&L Pie Chart.