Risk Navigator Menus

Instructions

The Risk Navigator Menus have been listed below.

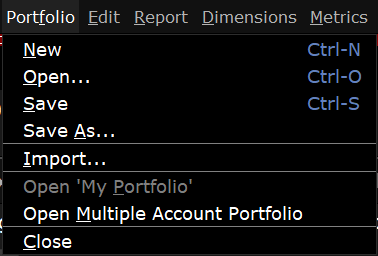

Open your portfolio or create a new hypothetical What-if portfolio.

| Field | Description |

|---|---|

| New | Create a new what-if portfolio. |

| Open | Open an existing what-if portfolio. |

| Save | Save the active portfolio. |

| Save As | Save the active portfolio in a new directory or with a different name. |

| Import | Import a .csv file as a new portfolio. |

| Open 'My Portfolio' | Only available from within a What if. This command opens your actual portfolio in the Risk Navigator. |

| Close | Closes the portfolio. |

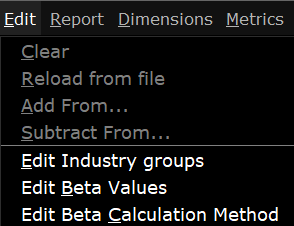

Edit a what-if portfolio, and tools for any portfolio from the Edit menu.

| Field | Description |

|---|---|

| Clear | Available from What-If Only: Complete clears all data including underlyings and positions from the what-if portfolio. |

| Reload from file | Available from What-If Only: Replaces current what-if data with position data from a selected file. |

| Add From... | Available from What-If Only: Adds all positions from a selected file. Note that if you currently have a position in the what-if and also in the file from which you are adding, the position quantity will be the sum of both positions. |

| Subtract From... |

Available from What-If Only: Subtracts the positions from the selected file from your what-if. For example, if the what if does not include aapl, but the portfolio you're using to "Subtract From" includes a long 500 position in aapl, the what-if position quantity will be: 0 - 500 = -500 (it subtracts the position quantity). If your what-if includes a long 1000 position in aapl and you subtract the long 500 position, the position quantity will be: 1000 - 500 = 500. |

| Edit Industry groups | Opens the Industry Editor. |

| Edit Beta Values | Manually edit beta values with the Manual Beta Editor. |

| Edit Beta Calculation Method | Opens the Beta Calculation Editor. |

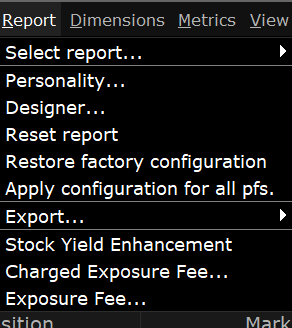

Select, configure and export Risk Navigator reports.

| Field | Description |

|---|---|

| Select report | Open a report. This is the same list that is available from the selector in the bottom right panel of the Risk Navigator. |

| Personality | Select a "trading personality" that is used to determine the fields that appear in certain reports. rader Personalities include Derivatives, Equity Hedged, and Equity Long/Short. Existing clients can choose to |

| Designer | Configure the report designs by adding and removing columns. |

| Reset report | Returns the open report layout to the default original. This action will remove any added fields, column sizing, manual entries etc. |

| Restore factory configuration | This command restores all reports to the default original layout. |

| Apply configuration for all portfolios (pfs) | Select this command to apply your changes to all reports. For example, if you add the Beta Weighting field to the open report, use this command to add the same field to all reports that support it. |

| Export | Let's you export your portfolio to and.xls or .csv file format to open in Excel. |

| Stock Yield Enhancement | Displays the Stock Yield Enhancement report within the Portal. This provides an estimate on the potential yield available to you if you loan out shares of stock that you fully own. |

| Exposure fee |

Displays the Daily Exposure Fee imposed for having a very high worst-case loss risk exposure. |

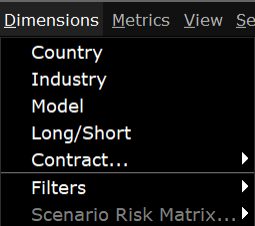

Define parameters and filters for reports.

| Field | Description |

|---|---|

| Country | Add the Country field to the report. |

| Industry | Add the Industry field to the report. |

| Contract | Modify the Contract field details by adding or removing details such as expiry, right, issuer etc. Only fields valid for the active report are displayed. |

| Filters | Filter the display by specifying the expiration style, asset type or right to show. |

| Scenario Risk Matrix | When the Measure by Price Change and Volatility Change report is displayed, specify the matrix values for columns, rows and the slicer. |

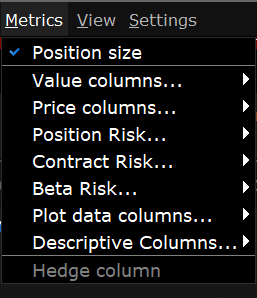

The Risk Navigator Metrics menu is context-sensitive, and allows you to select applicable metrics for each report.

Not all menu commands are available for all reports. For example, the Portfolio Analysis columns are only available in the P&L Summary.

| Metrics | Description |

|---|---|

|

Size Columns |

|

|

Select Position size to display your (signed) position in the contract. A short position is depicted by a "-" minus sign. Choose "None" to remove the Position field from your report. |

|

|

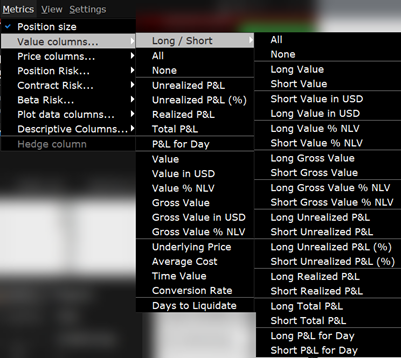

Value Columns |

|

| Long/Short | These columns provide aggregated values for all long and all short positions. |

| All | Selects all available value columns to include in the report. |

| None | De-selects all columns. |

|

Unrealized P&L (%) |

(Market value of positions) - (average cost) (Market value of positions) - (average cost) shown as a percentage. |

| Realized P&L |

(Market value of positions since close of period*) - (average cost for these positions). *Cut-off times for determining realized P&L for transactions are as follows:

|

|

The "unrealized" Average Cost P&L is shown in total, per underlying, and for each position. |

|

| P&L for Day |

(current price - prior day's closing price) x (total number of outstanding shares) + (New Position calculation for all new positions) |

|

Price |

The current market price of one unit of the contract. |

| Price Change | The difference between the last price, and the closing price on the previous trading day. |

| Price Change % | The percentage difference between the last price, and the closing price on the previous trading day. |

| Value |

Current market value of the position. Position x Multiplier x Price |

| Value % NLV |

The ratio of the current value to the total net liquidity of the portfolio. For CFDS and futures: The ratio of the Daily P&L to the total net liquidity of the portfolio. |

| Gross Value | The current gross market value of the position. |

| Gross Value % NLV/GMV | The current gross market value of the position as a percentage of the total New Liquidation Value (or Gross Market Value) of the portfolio. |

| Underlying Price | The price of the underlying (in cases where position is a derivative). |

| Average Cost | The average price you paid (cost) per unit. |

|

Time Value |

The (price) x (position). |

|

Displays the rate used to convert non-base positions into the base currency. |

|

| Currency | The currency of the position. |

|

Value at Risk (VAR) represents the minimum expected loss under normal market conditions over a specific time horizon, and based on the percent probability as defined by the confidence level. This is a theoretical value and does not represent the potential worst-case loss scenario. Note: In cases where the VAR cannot be calculated, the notation "N/A" is displayed on a violet background. |

|

| Portfolio Analysis Columns | |

| Mark-to-Market P&L Month-to-Date | Shows the profit or loss recognized in the current month for both open and closed positions. |

| Mark-to-Market P&L Month-to-Date (%) | The percent that the position's mark-to-market P&L for the current month-to-date accounts for, relative to the portfolio's total. |

| Mark-to-Market P&L Year-to-Date | Shows the profit or loss recognized in the current year for both open and closed positions. |

| Mark-to-Market P&L Year-to-Date (%) | The percent that the position's mark-to-market P&L for the current year-to-date accounts for, relative to the portfolio's total. |

| Realized P&L Month-to-Date | Realized month-to-date P&L from the previous business day + realized P&L from the current day. |

| Realized P&L Month-to-Date (%) | The percentage of the position's realized P&L month-to-date to the portfolio's total month-to-date P&L. |

| Realized P&L Year-to-Date | Realized year-to-date P&L from the previous business day + realized P&L from the current day. |

| Realized P&L Year-to-Date (%) | The percentage of the position's realized P&L year-to-date to the portfolio's total year-to-date P&L. |

| Unrealized P&L Month-to-Date | The change in unrealized P&L in the current month. |

| Unrealized P&L Month-to-Date (%) | The percentage of the change of the position's unrealized month-to-date P&L to the portfolio's total change in unrealized month-to-date P&L. |

| Unrealized P&L Year-to-Date | The change in unrealized P&L in the current year. |

| Unrealized P&L Year-to-Date (%) | The percentage of the change of the position's unrealized year-to-date P&L to the portfolio's total change in unrealized year-to-date P&L. |

|

|

|

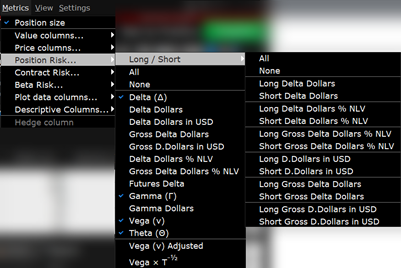

| Long/Short | These columns provide aggregated values for all long and all short positions. |

| All | Selects all available value columns to include in the report. |

| None | De-selects all columns. |

|

Delta |

This position delta captures both the direction and the magnitude of the portfolio's sensitivity to an underlying by representing the degree and direction of change in the option price, based on a change in the price of the underlying. We use a capital "D" to differentiate the |

| Delta Dollars |

Delta Dollars is calculated using the formula: delta x underlying price. |

| Delta Dollars % NLV/GMV | The ratio of the current exposure to the total Net Liquidity Value (or Gross Position Value) of the portfolio. |

|

This column is derived from raw position delta. For each futures position or futures option position with this future as direct underlying, futures delta = (delta / exp(r*T)) / futureMultiplier, where futureMultiplier is the contract multiplier of future, exp(r*T) is the scaling factor that we currently apply to raw delta; dividing by it yields the original raw delta. |

|

|

Gamma helps you assess directional risk by defining the speed at which the option's directional changes will occur, i.e. the rate of change of delta. We use a capital "G" to differentiate the |

|

| Gamma Dollars |

Gamma Dollars is calculated using the formula: 0.5 x Gamma x (Underlying Price x 1%)2 |

|

Vega represents the portfolio's sensitivity to changes in implied volatility of the underlyings, and shows the change in the price of an option relative to a change in the implied volatility of the underlying. Generally long option positions benefit from rising (and suffer from declining) implied volatilities, while short option positions experience the opposite - they benefit from declining (and suffer from rising) implied volatilities. We use a capital "V" to differentiate the |

|

|

Theta represents the portfolio's sensitivity to the passage of time by indicating the rate at which the market value of your portfolio will change with time. This metric calculation is based on the assumption that all other variables remain unchanged, including the underlying price, implied volatility and interest rate. We use a capital "T" to differentiate the |

|

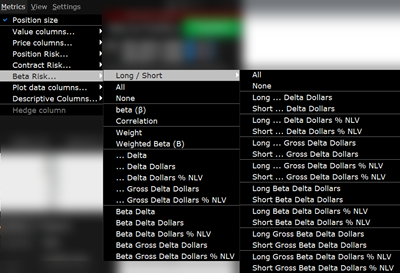

| Beta Risk Columns | |

| Contract Risk Columns | |

| All |

The "unrealized" Average Cost P&L is shown in total, per underlying, and for each position. |

| None |

The current market price of one unit of the contract. |

| Delta | Delta captures both the direction and the magnitude of the portfolio's sensitivity to an underlying by representing the degree and direction of change in the option price, based on a change in the price of the underlying. |

| Gamma | Gamma helps you assess directional risk by defining the speed at which the option's directional changes will occur, i.e. the rate of change of delta. |

| Vega | Vega represents the portfolio's sensitivity to changes in implied volatility of the underlyings, and shows the change in the price of an option relative to a change in the implied volatility of the underlying. Generally long option positions benefit from rising (and suffer from declining) implied volatilities, while short option positions experience the opposite - they benefit from declining (and suffer from rising) implied volatilities. |

| Theta | Theta represents the portfolio's sensitivity to the passage of time by indicating the rate at which the market value of your portfolio will change with time. This metric calculation is based on the assumption that all other variables remain unchanged, including the underlying price, implied volatility and interest rate. |

| Implied Volatility | The implied volatility on an option. |

| Implied Volatility Change | The absolute change in implied volatility between the current value and the value calculated using yesterday's closing price. |

| Implied Volatility Change (%) | The change in implied volatility between the current value and the value calculated using yesterday's closing price, as a percentage. |

| Historical Volatility | The last available historical volatility. |

| Historical Volatility Change | The difference between the historical volatility as of yesterday's close and the current historical volatility. |

| Historical Volatility Change (%) | The difference between the historical volatility as of yesterday's close and the current historical volatility, as a percentage. |

| Tracking Factor | Provides the related tracking factor if the contract has a related primary contract. |

| Plot data Columns | |

| All | Adds all data slicers below to the P&L Plot. |

| None | Removes all data slicers from the P&L Plot. |

| 3% | Add or remove just this pair of data lines (+3%/-3%) |

| 6% | Add or remove just this pair of data lines (+6%/-6%) |

| 9% | Add or remove just this pair of data lines (+9%/-9%) |

| 12% | Add or remove just this pair of data lines (+12%/-12%) |

| 15% | Add or remove just this pair of data lines (+15%/-15%) |

| Settings | Click to adjust slicer line values. You can also grab and drag slicer lines within the P&L plot. |

| Descriptive Columns | |

| All | Display all descriptive columns. |

| None | Hide all descriptive columns. |

| Description | Company name or short description of the contract. |

| Currency | Currency of the position. |

| Hedge | |

| Hedge Column | Check to create a hedging order for the selected position. Click the "Hedge" button at the top of the portfolio to create the hedging orders in |

| Trade Column |

For What-If only: If you want to add a what-if position to your real portfolio, check the "Trade" checkbox to tag the position for order creation. When you click the "Trade" button at the top of the What-if, an order will be created in |

| Include Positions | For What-If only: indicates that you want the position included in the risk calculations and in the P&L graph computation. |

The new risk measures added in

| Column Name | Description |

|---|---|

| Long Gross Value | The current gross market value of the position Position Size x Multiplier x Price for long positions |

| Short Gross Value | The current gross market value of the position Position Size x Multiplier x Price for short positions |

| Gross Delta Dollars |

Gross Delta Dollars is calculated using the formula: absolute value of delta x underlying price. |

| Long Gross Delta Dollars |

absolute value of delta x underlying price - for long positions |

| Short Gross Delta Dollars |

absolute value of delta x underlying price - for short positions |

| Beta Gross Delta Dollars |

contract gross beta x exposure |

| Long Gross Beta D. Dollars |

contract gross beta x exposure - for long positions |

| Short Gross Beta D. Dollars |

contract gross beta x exposure - for short positions |

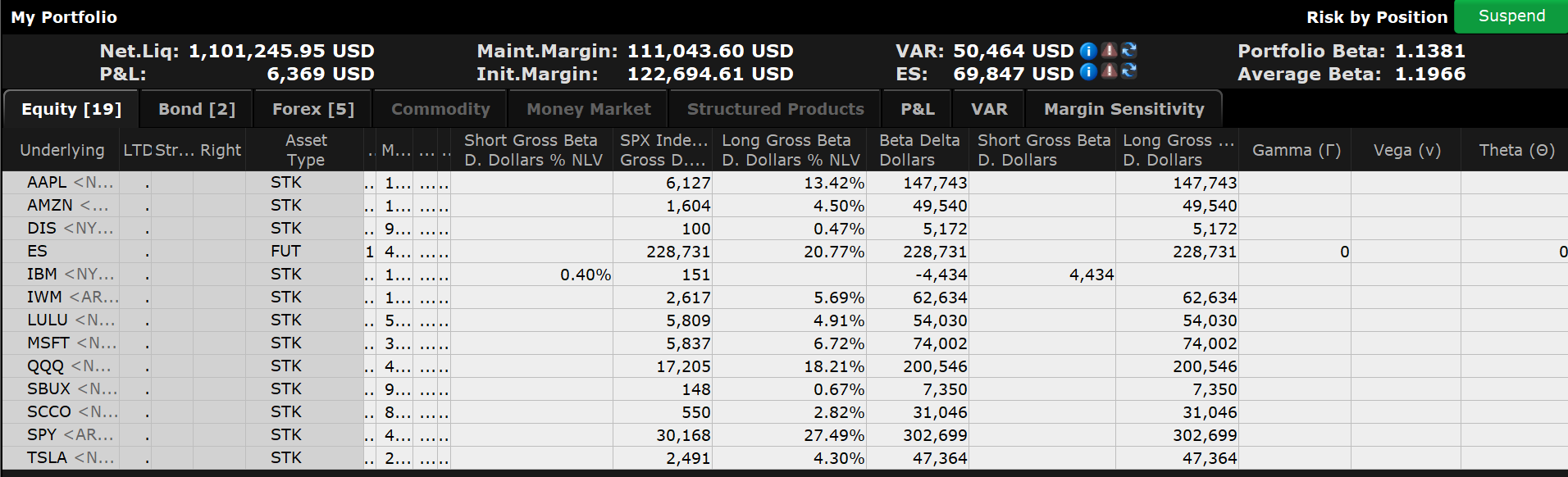

The image below shows the above columns in a Risk Navigator table:

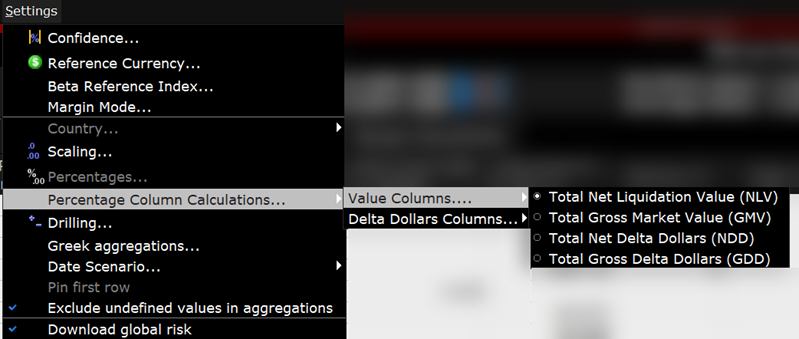

Relative measures are now divided into two groups. Percentage measures in one of the groups are relative to Value column, while others are relative to Delta Dollars. They are reflected in the "Percentage Column Calculations...' menu as shown below. This means total aggregation can now independently be changed for percentage measures belonging to a particular group.

Calculations for Value-based measures. E.g. using Total Net Liquidation Value (NLV)

| Column Name | Description |

|---|---|

| Long Gross Value % NLV | The ratio of the current gross value (daily PnL for CFD-s and Futures) - to the Total Net Liquidation Valule (NLV) of the portfolio for long positions |

| Short Gross Value % NLV | The ratio of the current gross value (daily PnL for CFD-s and Futures) - to the Total Net Liquidation Valule (NLV) of the portfolio for short positions |

Calculations for Delta Dollars based measures. E.g. using Total Gross Delta Dollars (GDD)

| Column Name | Description |

|---|---|

| Gross Delta Dollars % GDD |

The ratio of the current Gross Exposure - to the Total Gross Delta Dollars (GDD) of the portfolio |

| Long Gross D. Dollars % GDD |

The ratio of the current Gross Exposure - to the Total Gross Delta Dollars (GDD) of the portfolio for long positions |

| Short Gross D. Dollars % GDD |

The ratio of the current Gross Exposure - to the Total Gross Delta Dollars (GDD) of the portfolio for short positions |

| Beta Gross Delta Dollars % GDD |

(contract gross beta x exposure) / Total Gross Delta Dollars (GDD) |

| Long Gross Beta D. Dollars % GDD |

(contract gross beta x exposure) /Total Gross Delta Dollars (GDD) for long positions |

| Short Gross Beta D. Dollars % GDD |

(contract gross beta x exposure) / Total Gross Delta Dollars (GDD) for short positions |

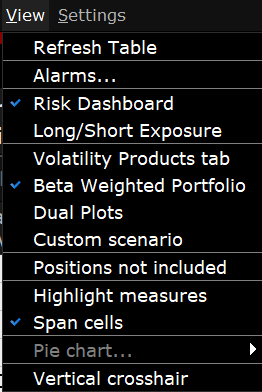

Show or hide tools and views.

| Field | Description |

|---|---|

| Refresh Table | Manually refreshes data in the report. |

| Alarms | Displays details for active Risk Navigator alarms. |

| Risk Dashboard | Display the Risk Dashboard. |

| Beta Weighted Portfolio | Displays beta weighting fields. |

| Dual Plots | Opens side-by-side P&L plots to allow you to compare Equal Percentage Move and Beta Weighted plots. |

| Custom Scenario | Opens the custom scenario. |

| Positions not included | Shows the list of unresolved positions (below the report selector in the bottom right corner of the interface). |

| Highlight measures | Check this off to highlight the measures. |

| Span cells | Check this off to span cells. |

| Pie chart | When the P&L Pie Chart is displayed, this menu command is enabled and allows you to change pie chart settings. |

| Vertical crosshair | Enables the vertical crosshair in the P&L Plot. You can also enable/disable this feature using the right-click menu from within the plot. |

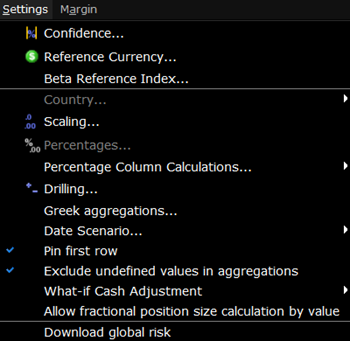

Use the Settings menu to specify global directives for the Risk Navigator.

| Field | Description |

|---|---|

| Confidence | Set the confidence level which is used in both the P&L plot and in the VaR calculations. Possible values are 95%, 99% and 99.5%. |

| Reference Currency | Defines the base currency for the portfolio. This is used in the portfolio-level aggregations and in forex decomposition on the forex tab. |

| Beta Reference Index | The index used as the benchmark for beta calculations. |

| Country |

For bonds Risk by Country report. Sort bonds by: Registration - This is the country where the bond was issued. Issuer Domicile - The domicile of the bond issuer. Parent Domicile - The domicile of the parent company of the bond issuer. U Ultimate Parent Domicile - The domicile of the ultimate parent company of the bond issuer. |

| Scaling | Define scaling settings for the presented measures. |

| Percentages | Percentage settings for the Measure by Price Change and Volatility Change report. |

| Percentage Column Calculations | Toggle the calculation for calculated fields to use Total Net Liquidation Value or Total Gross Market Value. |

| Drilling | Specifies the drilling depth, i.e. the number of levels that should be expanded when you drill down. |

| Greek Aggregations | Select cross-underlying aggregation methods for the Greek columns. |

| Date Scenario | Specific to the P&L plot. Specify whether changing the Date Scenario for Custom Scenarios is restricted to the selected underlying. |

| Pin First Row | When selected, the first row of aggregated report data will remain visible below the header row when you scroll through a table. This setting is enabled by default. |

| Exclude undefined values in aggregations | When checked, the Greek aggregation will exclude any undefined position. Positions may be undefined for many reason including missing market data, invalid prices, missing conversion rates etc. |

| Download Global Risk | This feature is mandatory when presenting the risk matrix via the Measure by Price Change and Volatility Change report. This features requires greater CPU and memory usage and should be disabled until needed. |

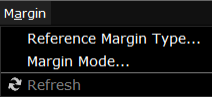

Use the Margin menu to specify a Reference Margin Type and Margin Mode for the Risk Navigator.

| Field | Description |

|---|---|

| Reference Margin Type... |

Select the Margin Type Settings:

|

| Margin Mode... | For What-If only: Click to select a new margin mode to apply, if available. |

| Refresh | Refresh the margin requirements. |