Structured Products

Instructions

Structured products are partially supported in Risk Navigator, and are presented with only the position size, price and P&L without any additional calculated risk measures.

The following reports are available for structured products in your portfolio:

Use the Portfolio Report to view risk and exposure for all positions in your portfolio. You can view totals for specific risk measures (where applicable) in the Risk by Underlying report.

To view this report, please take the steps outlined below.

-

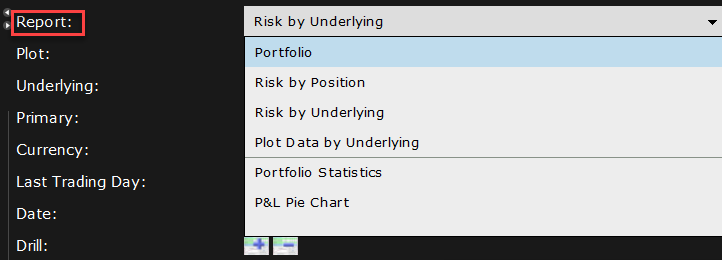

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio

-

Use the Plot, Underlying, Category, Currency, and Last Trading Day fields in the Report Selector to further customize the report display.

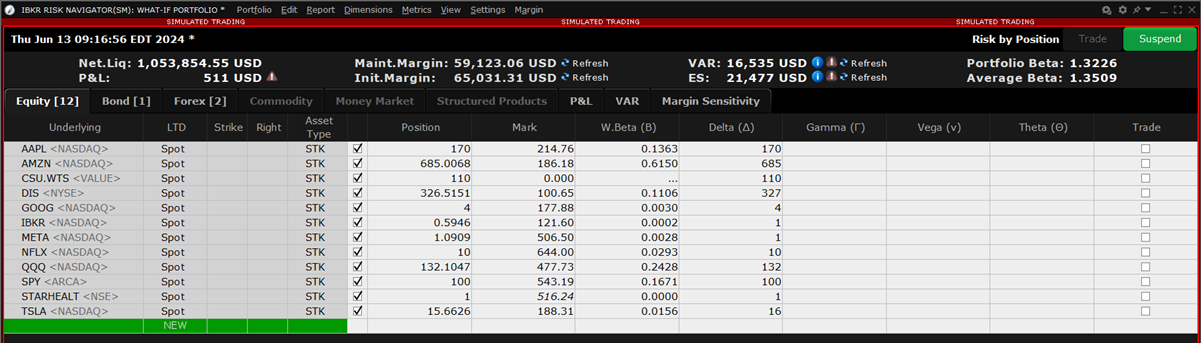

The Risk by Position report displays risk measures calculated for each position, by underlying.

To view the Risk by Position Report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Position.

-

Use the Underlying and Measure lists to define your report criteria.

If you elect to view metrics for only a single underlying, the report will not display the Underlying column as shown above.

Use the Metrics menu to display available risk metrics.

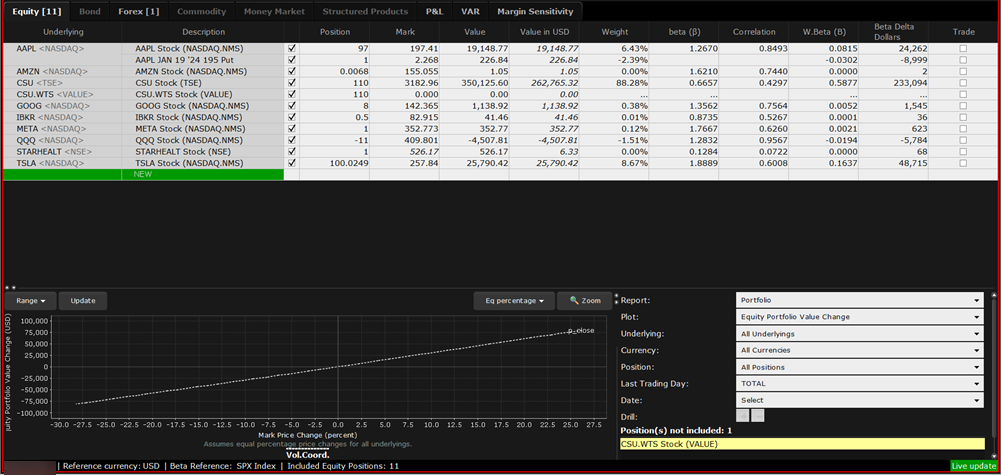

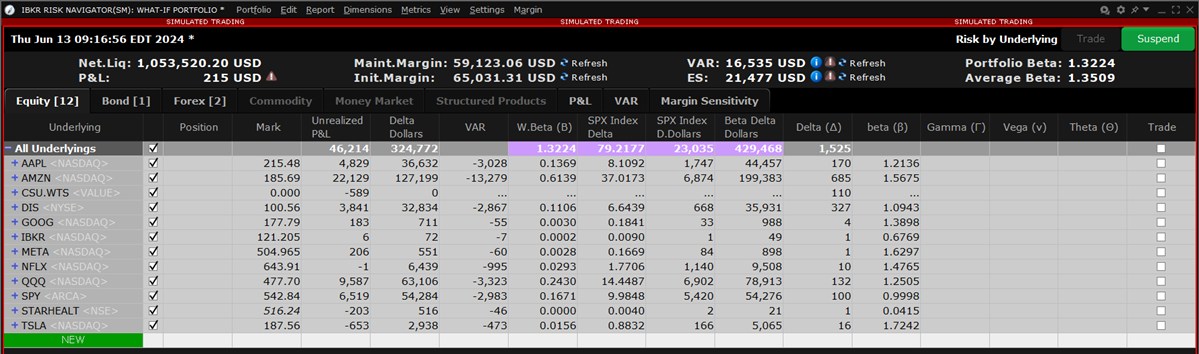

The Risk by Underlying report is designed to open by default when you open the

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Underlying.

-

Use the Underlying and Measure lists to define your report criteria.

Use the Metrics menu to display available risk metrics.

The Risk by Industry report sorts your portfolio by industry. This report displays values on all levels of detail, from individual positions to totals per industry sector.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Industry.

-

Use the Underlying and Measure lists to define your report criteria.

You can drill down several levels within an Industry category, and then drill down in the Underlying field for that category to see all underlyings in the industry, and then all derivatives of the underlying. To drill down to a deeper level of detail, click the plus "+" sign. A minus "-" sign indicates that you have drilled down to the deepest level of detail. Click the "-" sign to go up a level.

Use the Metrics menu to display available risk metrics.

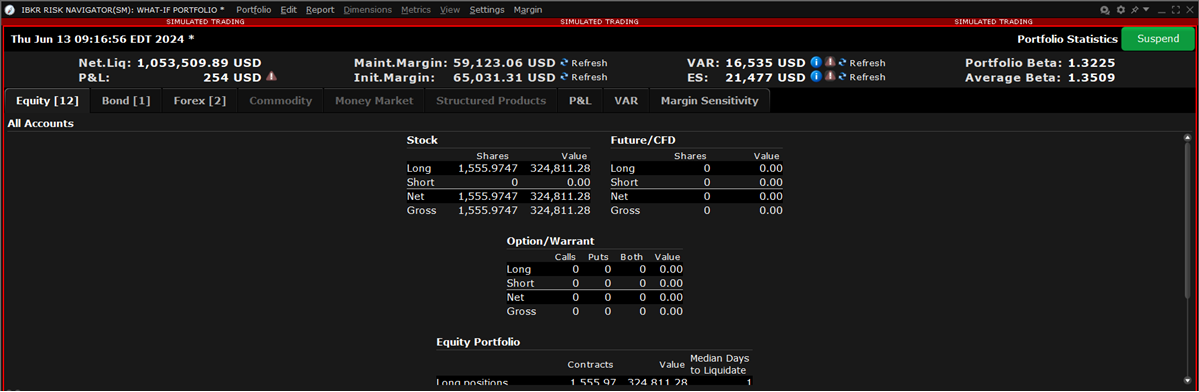

The Portfolio Statistics report shows two summary tables: one for all Stock and Futures positions, and one for all Options positions.

The Stock and Future summaries shows all long positions, all short positions, the net and gross units, and their corresponding total value.

The Option/Warrant summary shows all long calls, long puts, the sum of both calls and puts, and the total value; all short calls, short puts, the sum of both calls and puts, and the total value; the net units for calls, puts, the sum of both and the total net value; and gross units for calls, puts the sum of both, and the corresponding net value.

The Cash Balance summary shows you total in base, and all cash totals for currencies in your portfolio.

The Opaque Positions list displays positions for which risk cannot be calculated. While these positions are not included in any risk reports, the market value is included in the Portfolio Value version of the P&L graph.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio Statistics.