Volatility Products

Instructions

The same risk measure can have a qualitatively different financial meaning, depending on whether or not it is applied to a volatility product.

The Volatility Products tab collects these products separately from their underlyings. The Delta measured on this tab represents a risk commensurate to Vega on the Equity tab.

The risk measures (Greeks) shown for volatility products are the same as those for equity products. However, it is important to understand that their financial meaning can be quite different.

Volatility indices, published daily by exchanges, allow implied volatility levels to be traded directly. Volatility products, including derivatives on these indexes and funds such as ETFs, may help traders easily gain exposure to volatility levels. Some notable volatility indices (with the underlying whose volatility is measured, in parentheses) are:

-

VIX (SPX)

-

V2TX (STOXX)

-

NKVI (N225)

-

GVZ (GLD)

-

VXXLE (XLE)

-

VXAPL (AAPL)

Documentation for the computation methodology of these measures can be found on the various exchange websites. Indexes are generally quoted in annual percentage terms, except for a small number of interest-rate related indexes which are quoted in basis point terms. For example, VIX is the annualized percentage volatility of SPX; a VIX of 1 means an SPX volatility of 0.01 or 1%. Consider a VIX call with VIX-delta equal to 0.8. It would appreciate by 0.8 x 1 = 0.8 if VIX were to increase by 1. This is equivalent to saying that the value of the VIX call will rise by 0.8 when the SPX volatility goes up by 1%, so the VIX call has an SPX-vega of 0.8. (This uses the Risk Navigator convention: we present volatility in percentage terms, and define vega as the derivative value change due to a 1% change in the underlying volatility.)

Generally, a portfolio that has VIX-delta risk can be viewed as having SPX-vega risk. The following formula provides the translation between the delta risk of the volatility index and the vega risk of the underlying it measures. The volatility index-specific scaling factor below captures the quotation convention of each index:

Vega (underlying) = Delta (derivative of volatility index) x (volatility index-specific scaling factor) x 0.01

Many ETFs have been created to allow traders to more easily gain exposure to volatility index levels. These funds hold portfolios of volatility index derivative positions with various expiries in different proportions. The index holdings can be long or short, creating directional or inverse exposure to the volatility indexes. For example, IPATH S&P 500 VIX S/T FU ETN (ticker: VXX) holds long VIX futures with unit leverage and a mean time to expiry of 30 days. Its medium-term equivalent (ticker: VXZ) also holds long VIX futures, but with a mean of 5 months to expiry. An inverse ETF (ticker: XIV) holds a short VIX futures position, while leveraged ETFs (e.g., ticker TVIX) hold futures positions with notional exposure of twice the ETF’s assets.

The relationship between the prices of these funds and the volatility indexes are not completely predictable for several reasons: composition of these funds could be opaque, tracking errors exist, and fund portfolios are dynamically constructed with periodic rebalancing and rollovers near expiration dates of derivatives.

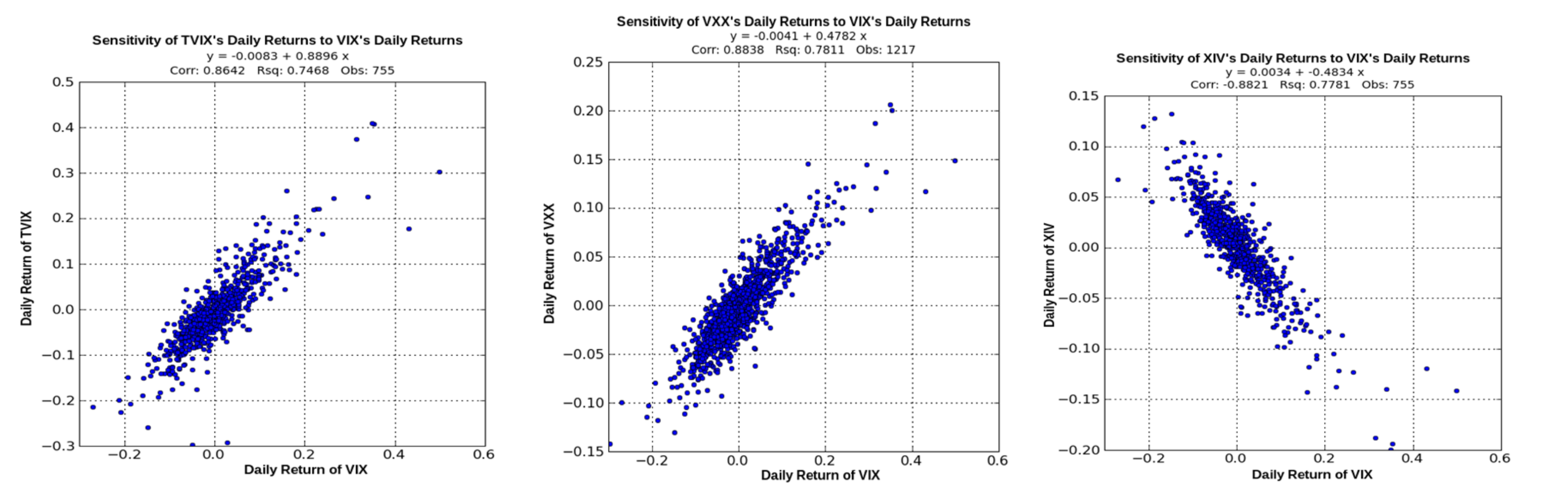

The images below show some regression results, comparing the returns on some select ETFs to returns on the VIX index, using daily closing prices since 2006. These results suggest that the daily returns of ETFs are strongly correlated with those of the volatility indexes. The slope coefficient expresses the historical sensitivity of the fund's daily return to the volatility index's daily return. These factors should be considered when choosing a product or sizing a trade.

Owning a volatility-targeting fund is equivalent to owning a portfolio whose value is sensitive to the volatility of a targeted underlying index. The fund's sensitivity to the volatility index can be translated to the Vega of the underlying as follows.

Vega (Underlying) = (Sensitivity of the fund's return to Volatility Index return) x (Current Fund price / Current Volatility Index) x (Volatility Index-specific scaling factor) x 0.01 = (Sensitivity of the fund's price movement to Volatility Index price movement) x (Volatility Index-specific scaling factor) x 0.01

While the “Sensitivity of the fund's price movement to Volatility Index price movement” was estimated from historical prices, some users may express a different view than historical data would suggest. We provide the flexibility for them to specify their own override on the “Sensitivity Editor”.

Relationship between the Equity/Commodity tabs and the Volatility Products tab in Risk Navigator:

Three portfolio value curves are displayed on the Equity/Commodity tab:

-

A) At the current volatility

-

B) If the volatility is increased by 15%

-

C) If the volatility is decreased by 15%

The portfolio value difference between A and B on the Equity/Commodity tab is equal to the portfolio value difference on the Volatility Products tab between the current level and the 15%-up level of the volatility index. A similar description applies to the portfolio value curve C.

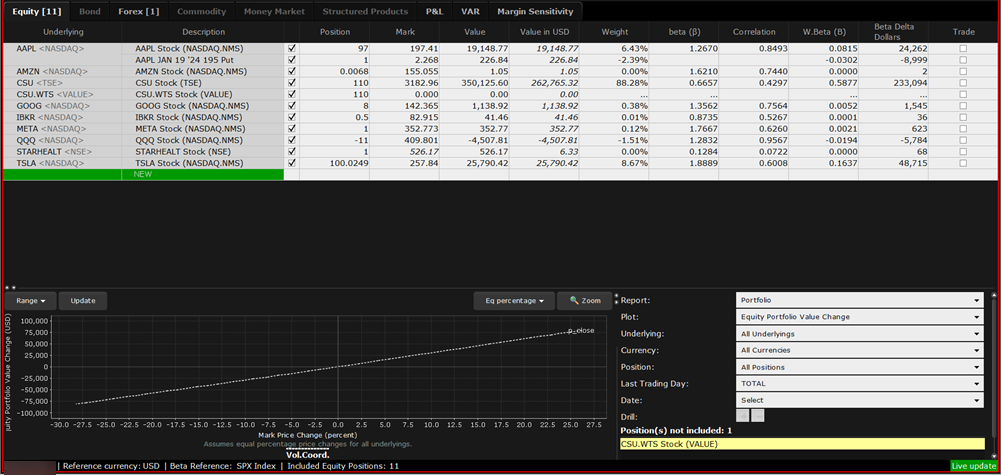

The Volatility-Coordinated P&L graph, visible on the Equity tab, is a view of the portfolio’s value change in a set of scenarios where equity and volatility both change (as detailed in the “i” tooltip on that graph). Though the portfolio value might depend on both equity and volatility changes, here the x-axis is simply the equity price change, allowing the graph to be projected onto the two-dimensional screen.

The Volatility-Coordinated P&L graph can also be viewed on the Volatility Products tab; here the graph is projected so that the x-axis is the volatility change. Since the coordinated methodology assumes that volatility increases with decreasing stock price, the “market down” scenario is now at the right (positive x) side of the graph. The information content of the graph is unchanged; it is simply being viewed from a different angle.

The volatility change displayed on the x-axis will range from -30% to +300%. These nominal volatility changes are scaled down by a factor dependent on the time to expiry or futures settlement, which parametrizes the relative stability of longer-dated options and futures.

Aggregation of Volatility Products on the Volatility Products tab

Volatility products are aggregated by the volatility indexes that they are sensitive to. For example, VXX, XIV, and VIX options are sensitive to VIX. There is a drop-down list showing all the volatility indexes that volatility products within the portfolio are sensitive to. When the user selects a particular volatility index, Risk Navigator will aggregate the price scans of only those volatility products that are sensitive to this volatility index, and ignore the rest. When the entire portfolio is sensitive to only one volatility index, that index is selected by default.

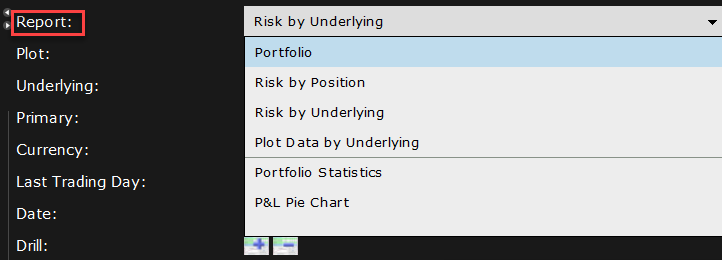

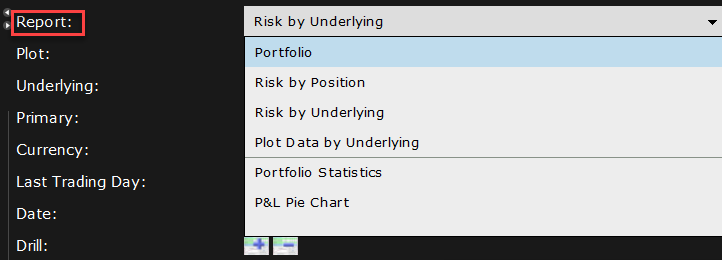

Use the Portfolio Report to view risk and exposure for all positions in your portfolio. You can view totals for specific risk measures (where applicable) in the Risk by Underlying report.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio

-

Use the Plot, Underlying, Category, Currency, and Last Trading Day fields in the Report Selector to further customize the report display.

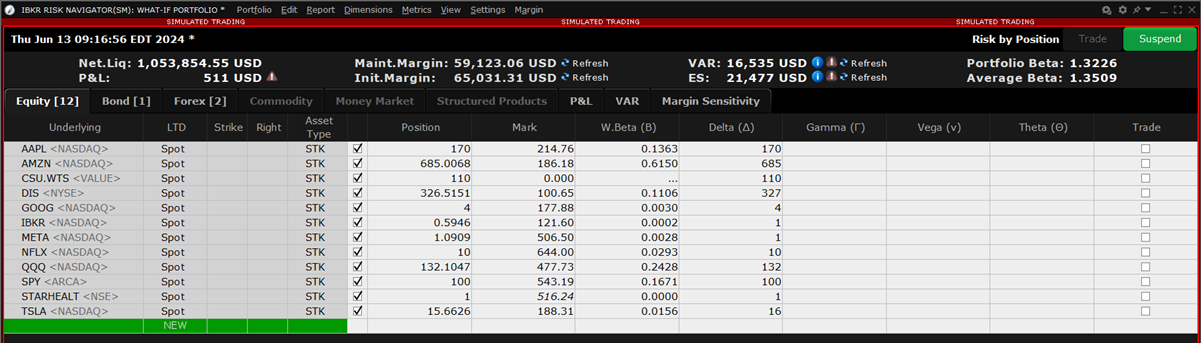

The Risk by Position report displays risk measures calculated for each position, by underlying.

To view the Risk by Position Report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Position.

-

Use the Underlying and Measure lists to define your report criteria.

If you elect to view metrics for only a single underlying, the report will not display the Underlying column as shown above.

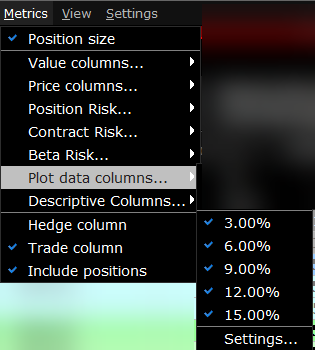

Use the Metrics menu to display available risk metrics.

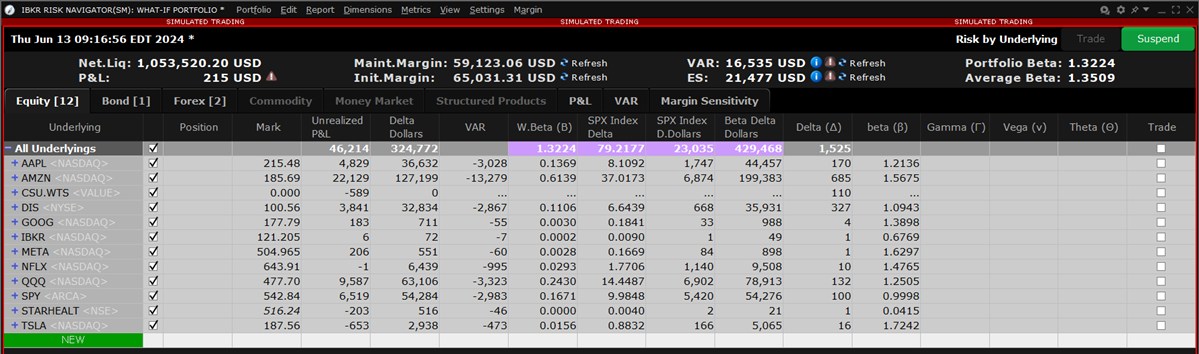

The Risk by Underlying report is designed to open by default when you open the

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Underlying.

-

Use the Underlying and Measure lists to define your report criteria.

Use the Metrics menu to display available risk metrics.

The Risk by Industry report sorts your portfolio by industry. This report displays values on all levels of detail, from individual positions to totals per industry sector.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Industry.

-

Use the Underlying and Measure lists to define your report criteria.

You can drill down several levels within an Industry category, and then drill down in the Underlying field for that category to see all underlyings in the industry, and then all derivatives of the underlying. To drill down to a deeper level of detail, click the plus "+" sign. A minus "-" sign indicates that you have drilled down to the deepest level of detail. Click the "-" sign to go up a level.

Use the Metrics menu to display available risk metrics.

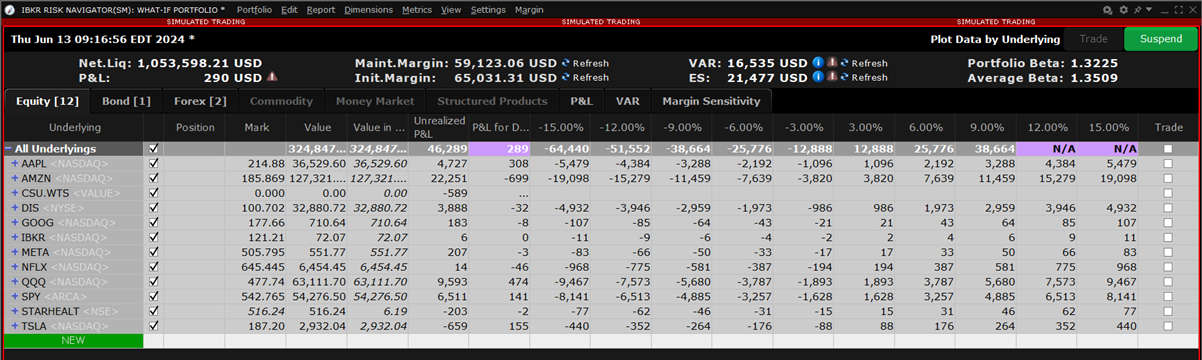

Select the Plot Data Report to view values for the symmetric data slicers in the P&L Plot. By default the slicers are spaced at +/- 3%, 6%, 9%, 12% and 15%.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Plot Data by Underlying

-

If you have the cross-hair activated in the P&L plot using the right-click menu, when you hold your mouse over a line in the plot its value is displayed. Keep in mind that the domain of the P&L plot is determined by the intersection of the valid domains for each instrument in the portfolio. This may restrict the domain of accessible values, especially for beta-weighted plots.

Change the Interval Between Plot Slicers

-

From within the plot, drag any of the blue slicer lines in an out to change the interval. Note that the corresponding negative/positive line will also adjust.

-

Using the menu, from the Metrics menu select Plot data columns and then select Settings to adjust the slicers.

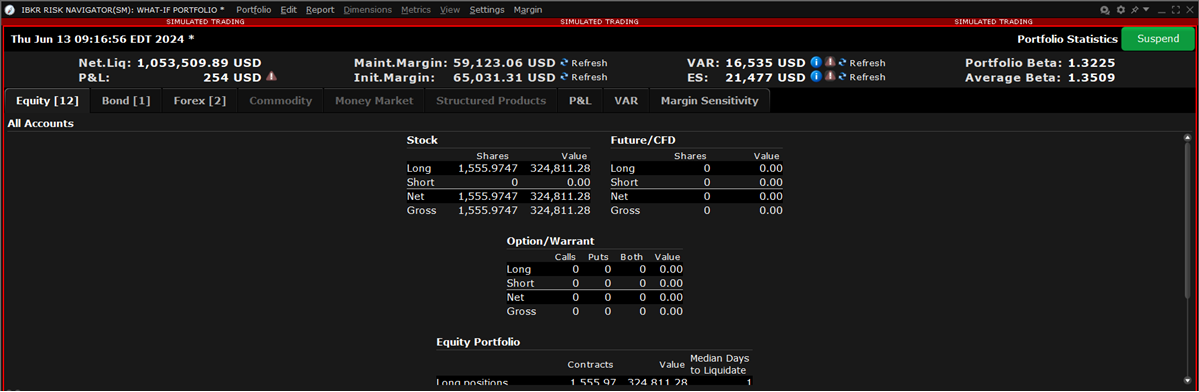

The Portfolio Statistics report shows two summary tables: one for all Stock and Futures positions, and one for all Options positions.

The Stock and Future summaries shows all long positions, all short positions, the net and gross units, and their corresponding total value.

The Option/Warrant summary shows all long calls, long puts, the sum of both calls and puts, and the total value; all short calls, short puts, the sum of both calls and puts, and the total value; the net units for calls, puts, the sum of both and the total net value; and gross units for calls, puts the sum of both, and the corresponding net value.

The Cash Balance summary shows you total in base, and all cash totals for currencies in your portfolio.

The Opaque Positions list displays positions for which risk cannot be calculated. While these positions are not included in any risk reports, the market value is included in the Portfolio Value version of the P&L graph.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio Statistics.