Equity Tab

Instructions

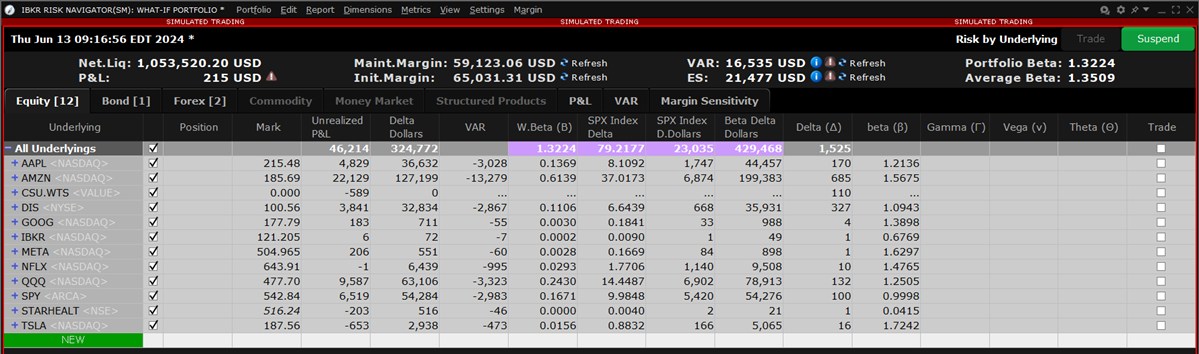

All non-bond positions that cannot be clearly categorized into the other tabs are put into the equity tab. The following reports are available for products on the Equity tab:

Use the Portfolio report to view risk and exposure for all positions in your portfolio. You can view totals for specific risk measures (where applicable) in the Risk by Underlying report.

To open the Portfolio Report please take the steps outlined below.

-

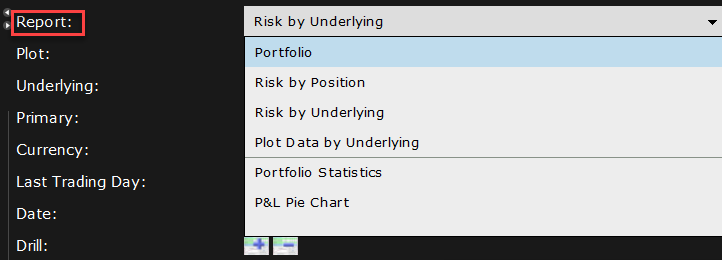

From the Report menu, choose Select Report and then select Portfolio.

-

Alternatively, use the Report Selector below the reports and in the Report drop down select Portfolio.

-

-

Use the Plot, Underlying, Category, Currency, and Last Trading Day fields in the Report Selector to further customize the report display.

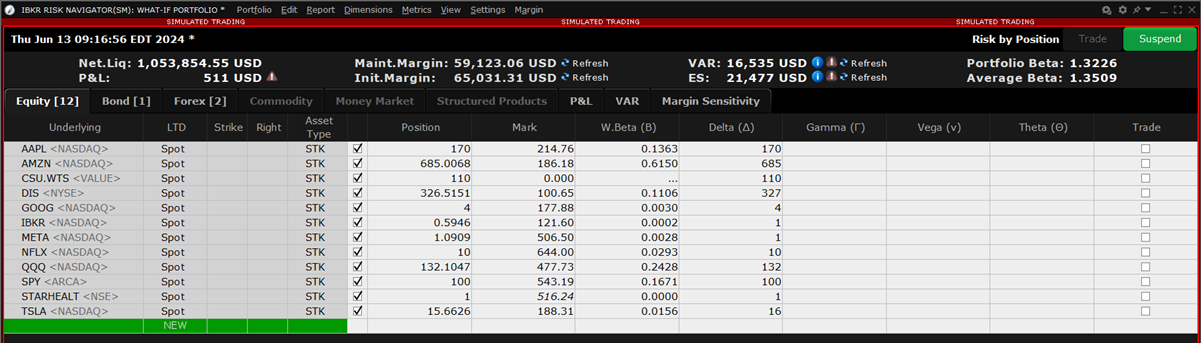

The Risk by Position report displays risk measures calculated for each position, by underlying.

To view the Risk by Position Report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Position.

-

Use the Underlying and Measure lists to define your report criteria.

If you elect to view metrics for only a single underlying, the report will not display the Underlying column as shown above.

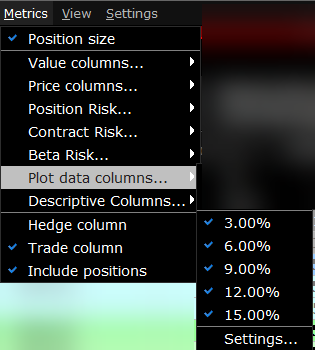

Use the Metrics menu to display available risk metrics.

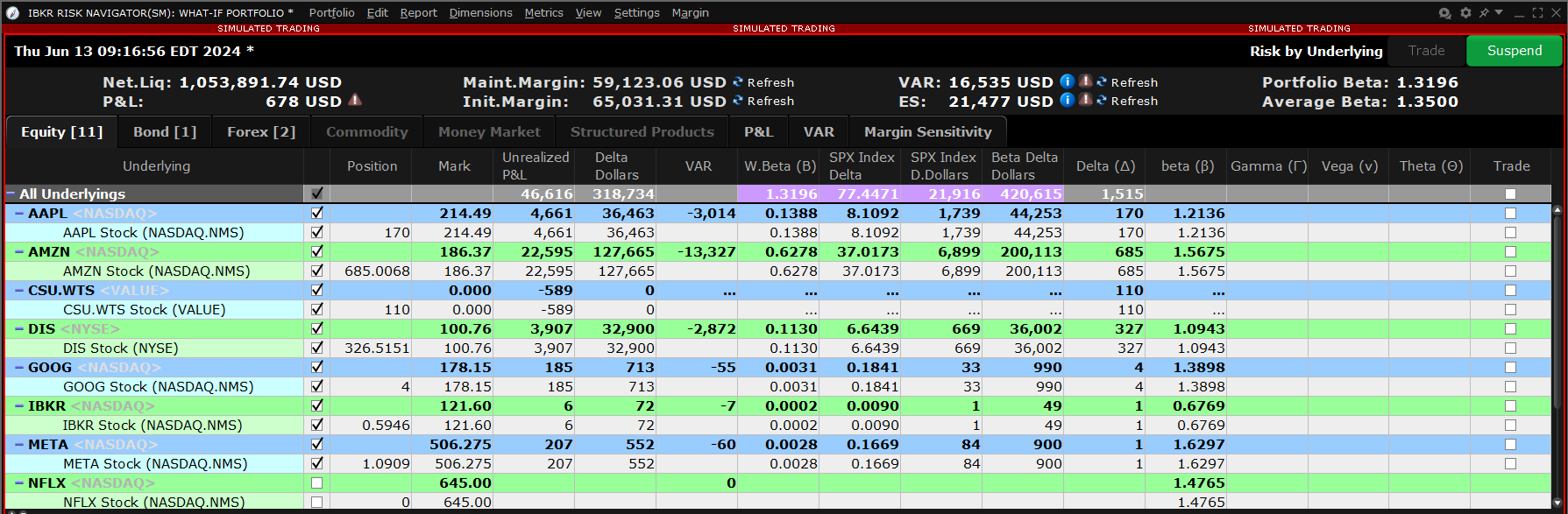

The Risk by Underlying report is designed to open by default when you open the

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Underlying.

-

Use the Underlying and Measure lists to define your report criteria.

Use the Metrics menu to display available risk metrics.

The Risk by Industry report sorts your portfolio by industry. This report displays values on all levels of detail, from individual positions to totals per industry sector.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Industry.

-

Use the Underlying and Measure lists to define your report criteria.

You can drill down several levels within an Industry category, and then drill down in the Underlying field for that category to see all underlyings in the industry, and then all derivatives of the underlying. To drill down to a deeper level of detail, click the plus "+" sign. A minus "-" sign indicates that you have drilled down to the deepest level of detail. Click the "-" sign to go up a level.

Use the Metrics menu to display available risk metrics.

The Risk by Country report sorts positions by country-related attributes that you specify from the Risk Navigator Settings menu.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Risk by Country.

-

From the Settings menu, specify the Country sort criteria:

-

Registration - This is the country where the bond was issued.

-

Issuer Domicile - The domicile of the bond issuer.

-

Parent Domicile - The domicile of the parent company of the bond issuer.

-

Ultimate Parent Domicile - The domicile of the ultimate parent company of the bond issuer.

-

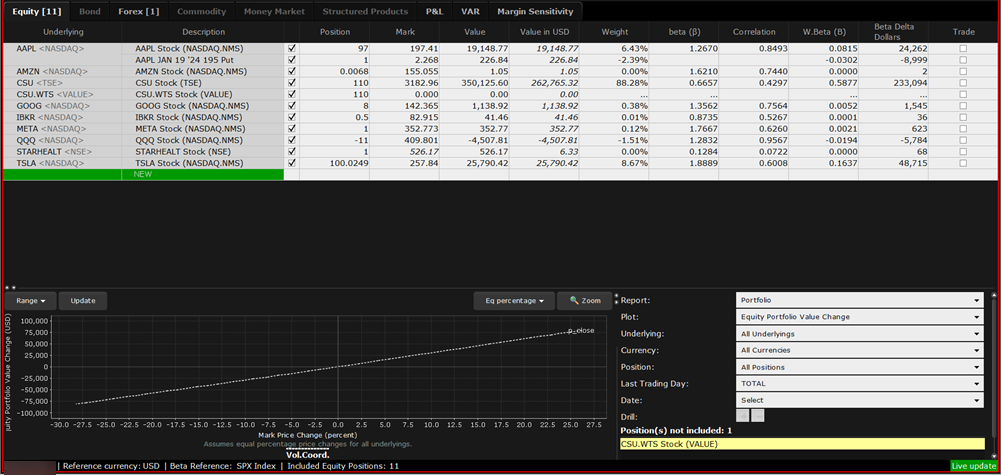

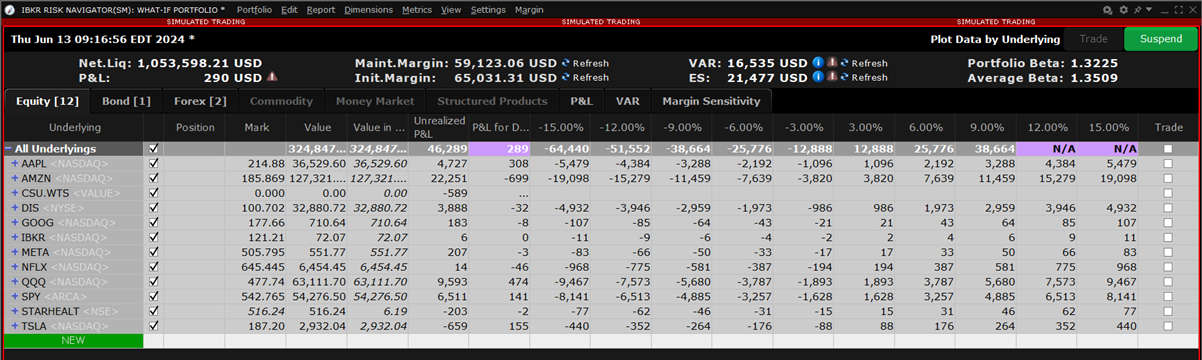

Select the Plot Data Report to view values for the symmetric data slicers in the P&L Plot. By default the slicers are spaced at +/- 3%, 6%, 9%, 12% and 15%.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Plot Data by Underlying

-

If you have the cross-hair activated in the P&L plot using the right-click menu, when you hold your mouse over a line in the plot its value is displayed. Keep in mind that the domain of the P&L plot is determined by the intersection of the valid domains for each instrument in the portfolio. This may restrict the domain of accessible values, especially for beta-weighted plots.

Change the Interval Between Plot Slicers

-

From within the plot, drag any of the blue slicer lines in an out to change the interval. Note that the corresponding negative/positive line will also adjust.

-

Using the menu, from the Metrics menu select Plot data columns and then select Settings to adjust the slicers.

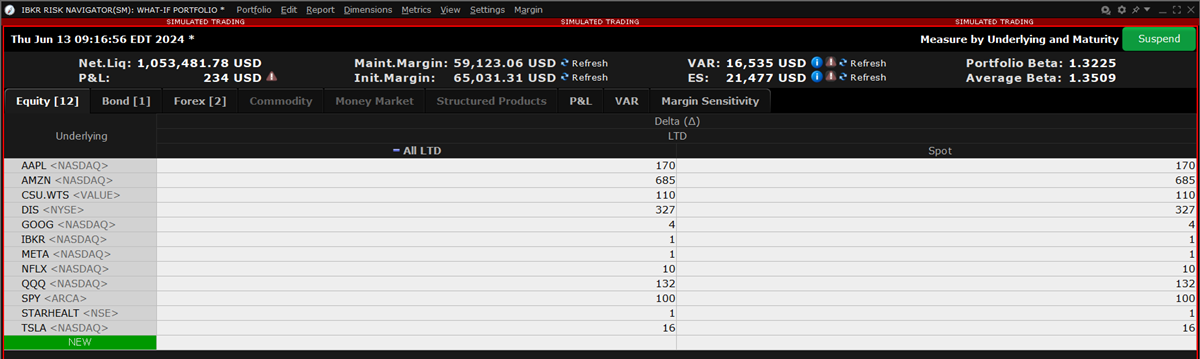

The Measure by Underlying and Maturity matrix displays risk by measure for all underlyings, sorted by Last Trading Day. The measure, which you selected in the Measure dropdown of the Report Selector, is displayed along the top of the matrix. The Last Trading Day fields display the sum of all positions (measures) for the given underlying/LTD.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Measure by Underlying and Maturity.

-

Use the Metrics menu to display available risk metrics.

This report uses the Risk FactorySM system to calculate the theoretical price and a set of risk measures for each position in your portfolio in each of the market outcome scenarios noted in the bulleted list below, and measures the market outcome for the relative portfolio Delta, Gamma, Vega, and Theta.

You must "Download global risk" from the Settings menu to populate this report.

All other reports in the Risk Navigator use real-time data in their calculations, but values in this report are calculated using the underlying and derivative prices on the close of the previous business day, at multiple positive, negative, and zero percent change scenarios in the underlying price, volatility and interest rate.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Measure by Price Change and Volatility Change.

-

From the Settings menu, select Download global risk.

-

Use the Dimensions > Scenario Risk Matrix menu to change the row and column values to view different scenarios.

You can apply market scenarios to other

Scenarios for each value are:

-

Underlying price scenarios: -30%, -20%, -10%, unchanged, +10%, +20%, +30%

-

Volatility scenarios: -30%, -15%, unchanged, +15%, +30%

-

Interest rate scenarios: -100 bp, -50 bp, unchanged, +50 bp, +100 bp

The scenarios advance the time parameter to the close of the next business day, and the values in the table reflect the scenarios applied to the measure you picked in the Report Selector. Although 175 market outcome scenarios (7x5x5) are calculated for each contract, you can only view a flat slice of these values at one time, due to the limitations imposed by our 2-dimensional display capabilities.

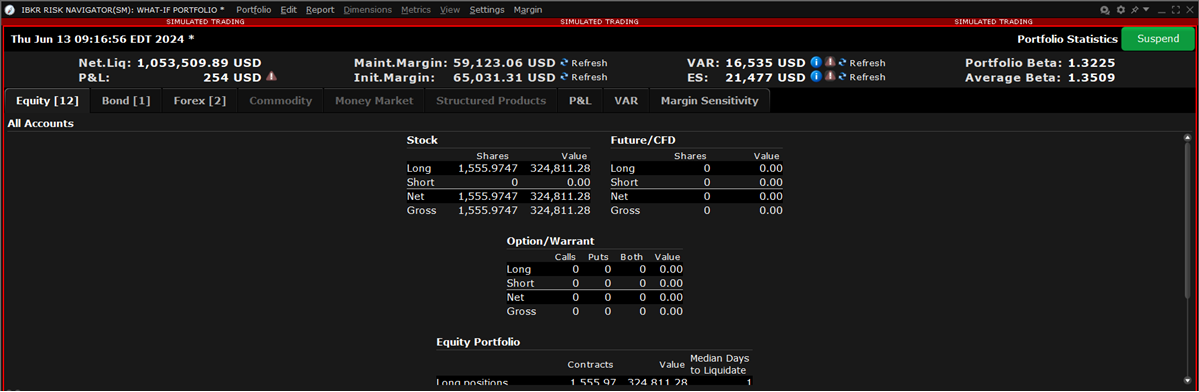

The Portfolio Statistics report shows two summary tables: one for all Stock and Futures positions, and one for all Options positions.

The Stock and Future summaries shows all long positions, all short positions, the net and gross units, and their corresponding total value.

The Option/Warrant summary shows all long calls, long puts, the sum of both calls and puts, and the total value; all short calls, short puts, the sum of both calls and puts, and the total value; the net units for calls, puts, the sum of both and the total net value; and gross units for calls, puts the sum of both, and the corresponding net value.

The Cash Balance summary shows you total in base, and all cash totals for currencies in your portfolio.

The Opaque Positions list displays positions for which risk cannot be calculated. While these positions are not included in any risk reports, the market value is included in the Portfolio Value version of the P&L graph.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Portfolio Statistics.

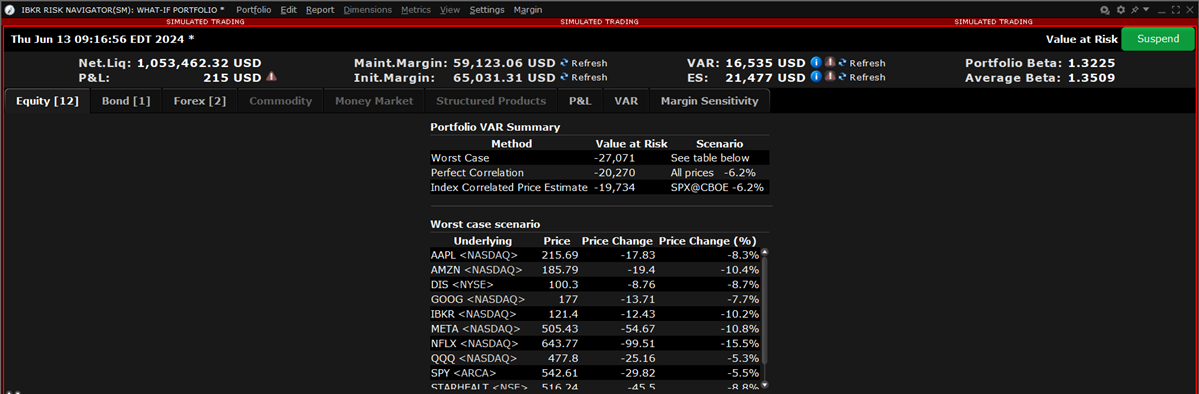

The Value at Risk report shows the greatest loss that a portfolio will sustain over a one-day period, with either 95%, or 99.5% confidence. VAR is calculated using three different methods, each with different assumptions about correlations of the underlying assets in the portfolio. This report is only available in the Equity tab and is calculated in real-time using the P&L plot data. To see VAR for you entire portfolio, use the VAR tab.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select Value at Risk Report.

-

Worst Case -Calculates the worst case price movement between the selected confidence interval for each underlying independently. Note that the VAR column in the Risk by Underlying report contains the same values.

-

Perfect Correlation - Assumes each underlying in your portfolio moves perfectly correlated with the S&P 500, and calculates the worst case price movement between the confidence interval of SPX.

-

Index Correlated Price Estimate - Assigns a correlation (Beta) to each underlying in your portfolio to the S&P 500 (used as a reference index), and then looks for the worst loss within its adjusted confidence level.

-

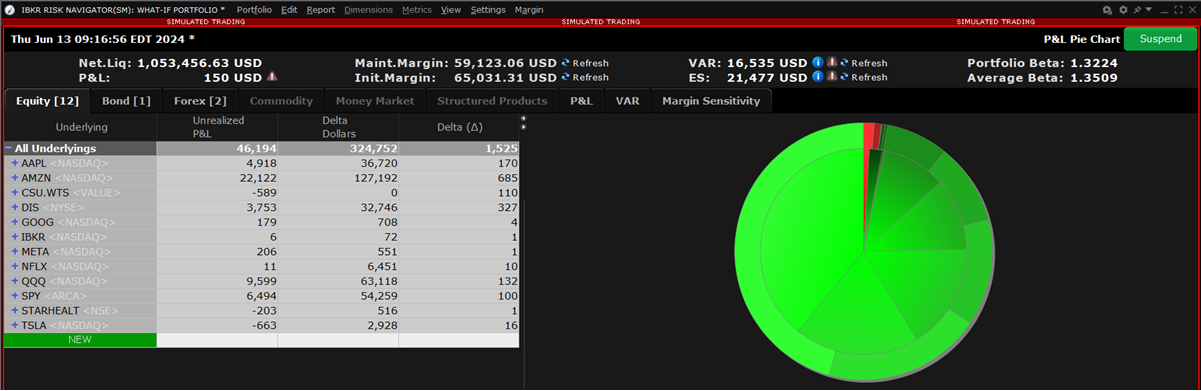

The P&L Pie Chart shows the position Delta and P&L for all positions in your portfolio relative to the total portfolio. Use default color coding to see losing positions in red, profiting positions in green and neutral positions in blue, or change the coloring to display each position using a different color.

To view this report, please take the steps outlined below.

-

In the Report Viewer panel (bottom right corner), select the Report drop-down menu.

-

Select P&L Pie Chart.